The two Main Causes Why Bitcoin Dumped From $71,000 to Beneath $62,000: CryptoQuant

Since Friday, BTC has passed thru a dramatic 13% swing from simply below $71,000 to easily below $62,000, and is now buying and selling around $63,700, info from CoinGecko reveals. In step with a chronicle published on Tuesday from South Korean-essentially based entirely blockchain analytics firm CryptoQuant, the tumble used to be no longer precipitated by a single, remoted incident nonetheless by concurrent events from varied actors.

Right here are the 2 fundamental causes for BTC’s most up-to-date tumble, constant with CryptoQuant:

1. Bitcoin perpetual traders took earnings.

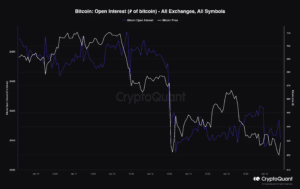

Merchants within the perpetual futures market booked earnings amid rising warfare and tensions within the Heart East as Iran attacked Israel over the weekend. CryptoQuant pointed to the lower in BTC’s open interest, which refers to the complete choice of active lengthy and short positions currently held by customers on derivative exchanges, as evidence of this pass.

Entire open interest stood around 252,000 bitcoins on April 12 and slid 12.5% to as low as 220,500 bitcoins the subsequent day, earlier than settling around 224,000 bitcoins at presstime, “implying that traders closed their lengthy Bitcoin positions to lift earnings,” the chronicle talked about.

Be taught More: Bitcoin’s Fourth Halving Is Factual Around the Nook. Is It Calm a Correct Time to Aquire?

No longer most practical possible did the amount of promote orders in perpetual futures markets dominate aquire orders, nonetheless the funding rates on derivative exchanges also changed into destructive for the first time since Jan. 2024, per CryptoQuant. While a obvious funding price is a signal that traders are piquant to pay to admire lengthy positions, a destructive funding price implies traders’ dedication to open short positions, bets for a lower BTC ticket.

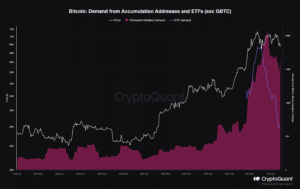

2. BTC quiz amongst the largest holders has slowed.

The draw to function bitcoin by addresses for space BTC exchange-traded funds, wallets that preserve between 1,000 and 10,000 bitcoins, and eternal holders has also slowed critically.

For addresses retaining between 1,000 and 10,000 BTC, in any other case identified as “whales,” the month-over-month development of their BTC balance has slowed from a file-high of 11% in mid-March to below 8% at press time.

Equally, gathering addresses, which most practical possible internet and don’t employ, and ETF wallets agree with also “slowed down very a lot” their depart of buying BTC. For instance, gathering addresses currently agree with an acquisition depart of 161,000 bitcoins every month, a 21% tumble from roughly 204,000 bitcoins a month within the course of the heart of March.

Be taught More: How Noteworthy Cash Could presumably well Pour into Hong Kong’s Original Bitcoin, Ether ETFs?

The most up-to-date promote-off – whereas a signal that the market used to be overheated – has placed traders’ unrealized earnings at zero, which is “on the complete a bottom in bull markets,” smartly-known CryptoQuant analysts of their chronicle.

“From a lengthy-term cyclical standpoint Bitcoin is peaceable in a bull market part,” they concluded.

Source credit : unchainedcrypto.com