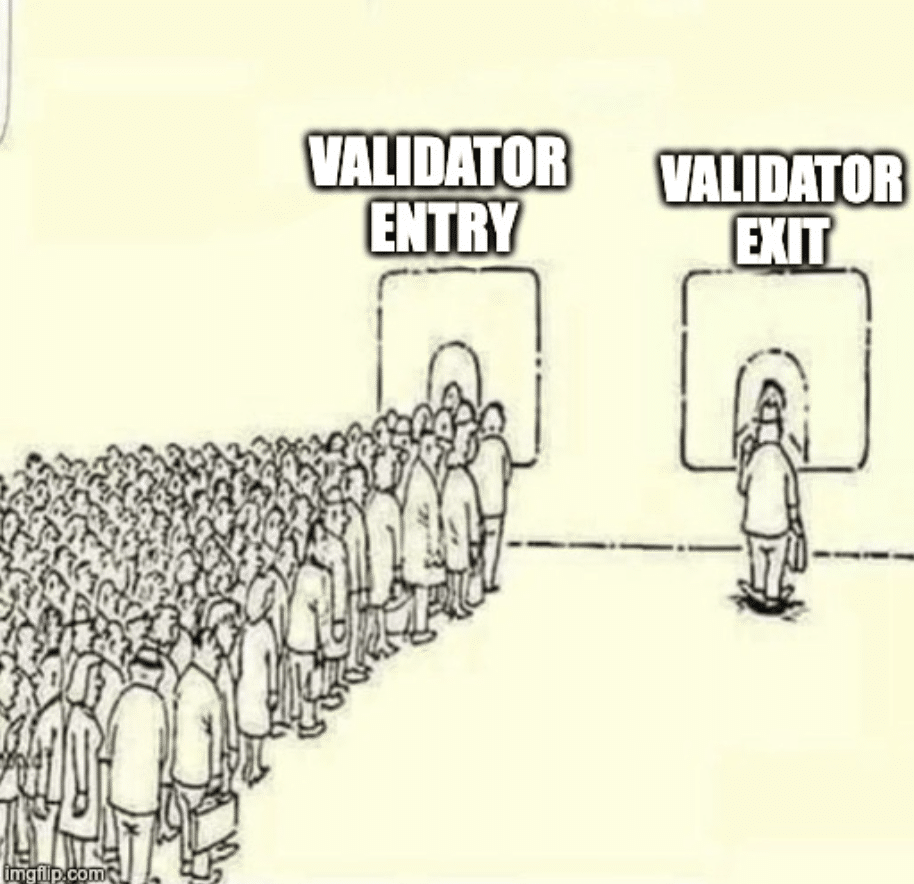

Ethereum’s Queue for New Validators Is 51 Times Longer Than Its Exit Queue

The queue for validators to delivery securing the Ethereum community is vastly longer than the road for validators to relinquish their responsibilities of confirming blocks, a imprint of pastime in restaking, the be conscious of re-utilizing ether (ETH) already securing the awful layer of Ethereum in extra ways. The more validators that are securing the Ethereum blockchain, the more ETH is in the marketplace to be restaked.

The enter queue is 51 times bigger than the exit queue at press time, per files equipped by blockchain explorer beaconcha.in. Nearly 8,300 validators each and every with 32 ETH are currently ready in line to delivery staking, whereas 161 validators strive to exit.

The validator queue is a mechanism aimed at stabilizing Ethereum’s proof-of-stake consensus. If validators didn’t have confidence to wait, an mountainous and unexpected influx of ETH might per chance per chance either enter or exit, causing an abrupt exchange in the safety scheme for the second-greatest blockchain by market capitalization.

The need of validators ready to enter the community is at its highest imprint for the reason that delivery of October. At press time, the necessity of packed with life validators – these currently securing the Ethereum blockchain and no longer ready in the queue – exceeds 943,000.

“The validator queue began to invent bigger on the initiating of Feb, whereas the ETH staking yield is peaceable below 4%. This [increase] coincides with EigenLayer’s staking cap elevate on 2/5,” wrote Kelly Ye, portfolio supervisor at Decentral Park Capital, in a Telegram message to Unchained.

ARVE Error: src mismatch

provider: youtube

url: https://www.youtube.com/see?v=PxsVKw7SdAs&t=7s

src in org: https://www.youtube-nocookie.com/embed/PxsVKw7SdAs?delivery=7&characteristic=oembed

src in mod: https://www.youtube-nocookie.com/embed/PxsVKw7SdAs?delivery=7

src gen org: https://www.youtube-nocookie.com/embed/PxsVKw7SdAs

Extra ETH Available to Be Restaked

With 32 ETH each and every, the roughly 8,300 validators will raise in about $746.3 million in entire to derive Ethereum. In consequence, this also blueprint that more ETH is in the marketplace to be restaked.

Eigen Layer, the protocol effectively-known for its restaking blueprint that extends Ethereum’s security to extra applications and networks, has been a celebrated destination for crypto denizens’ liquid staking tokens (LST).

Folks were in a position to deposit their LSTs into EigenLayer, nonetheless the group placed caps on each and every LST pool. The group has temporarily lifted caps on the necessity of LSTs folk can deposit into the protocol several times. Basically the most up-to-date cap elevate occurred on Feb. 5, which saw the price locked in EigenLayer’s clear contracts bigger than triple from $2.156 billion to merely about $7.034 billion in 10 days, files from DefiLlama shows.

As the necessity of validators entering the inhabitants outpaces these leaving, the rewards per validator will continue to shrink. Ethereum staking APR started at above 5% in June 2023 and has since lowered 129 foundation points to merely about 3.8% at press time, per files equipped by beaconcha.in.

On the replacement hand, Decentral’s Ye eminent that “we demand ETH staking pastime to continue to grow because the staking theme continues to grow. ETH currently has about 32.5% staked, which is peaceable decrease than other principal [proof-of-stake] chains.”

The price of ETH, the native cryptocurrency for Ethereum, has increased 3.2% in the previous 24 hours and 17.5% one day of the last seven days to commerce at $2,851, files from CoinGecko shows.

Source credit : unchainedcrypto.com