Yikes. Investment Products of This Digital Asset Had ‘File Outflows’

June 29, 2021 / Unchained On each day foundation / Laura Shin

On each day foundation Bits ✍️✍️✍️

-

Ark Make investments is filing for a bitcoin ETF.

-

Ethereum funding products hit $50M in outflows throughout the final week — the largest on file.

-

Bitcoin’s hashrate dropped to 94 exa (or quintillion) hashes per 2d, a quantity no longer viewed since Could well merely 2020.

-

Compound Labs has launched an institutional DeFi product dubbed Compound Treasury.

-

Mexican monetary authorities create no longer have in ideas crypto resources currency below fresh regulations.

-

Tidal, a music streaming service, is drawn to exploring NFTs as a brand fresh advance to compensate artists.

-

Polygon stablecoin SafeDollar used to be hit by an exploit and dropped to zero.

-

Crypto.com (disclosure: a fresh sponsor of my reveals) and Circle launched a partnership that will give extra than 10M customers get hang of admission to to funds settled in USDC.

- Crypto investments in India grew 19,900% throughout the final year.

What Attain You Meme?

What’s Poppin’?

Part 1: The US Has CBDC FOMO

In a speech, the day before this day titled “Parachute Pants and Central Bank Money,” Randal K. Quarles, the Federal Reserve’s vice chair for supervision, acknowledged that the fever pitch for a US-issued CBDC has change into outright FOMO.

Quarles aspects to The us’s “susceptibility to boosterism and effort of lacking out” as a persona trait that has “as soon as in a while ended in a mass suspension of our serious pondering and to as soon as in a while impetuous, deluded crazes or fads,” love parachute pants.

Beyond the parachute pants illustration, Quarles emphasized three aspects:

- The US greenback price design is working correct ravishing. Mr. Quarles is skeptical that a CBDC is well-known for a nation where the “overall public already transacts mostly in digital dollars.” (He’s speaking referring to the kind that after in a while grab 5 days to switch between banks.) Moreover, he would now not assume referring to the Fed has the correct authority to utter “CBDC units with out regulations” being extra fleshed out.

- The advantages of increasing a CBDC are unclear when international CBDCs or other crypto resources are but to uncover competitive to the greenback. Quarles is no longer worried a few international CBDC or stablecoin overtaking the greenback because the arena’s dominant currency. He acknowledged, “It looks unlikely, nonetheless, that the greenback’s attach as a global reserve currency, or the greenback’s role because the dominant currency in world monetary transactions, will likely be threatened by a international CBDC.”

He additionally effectively-known that the US must always calm no longer effort stablecoins, positing that a “US greenback stablecoin may possibly possibly presumably give a steal to the role of the greenback within the global economic system.” On “Bitcoin and its ilk,” Quarles argued that such resources would “dwell a volatile and speculative funding fairly than a innovative methodology of price, and they’re attributable to this reality highly unlikely to electrify the role of the U.S. greenback or require a response with a CBDC.”

- A skill CBDC may possibly possibly presumably also merely pose appreciable effort to the Fed and US alike. Quarles says it can presumably “be costly and sophisticated to administer,” because the Fed would, in essence, must always act as a retail monetary institution to the final public. He additionally touched on the keen balance between increasing a CBDC that may possibly possibly presumably respect a particular person’s privacy while additionally minimizing the trouble of cash laundering.

Be taught the elephantine speech here.

Part 2: Coinbase Desires to Checklist Every Token (That Meets Its Requirements)

Coinbase CEO Brian Armstrong took to Twitter to show masks how Coinbase handles fresh asset listings on its platform.

His tweet came almost right now after the change added Polkadot, Shiba Inu, and Dogecoin within one month.

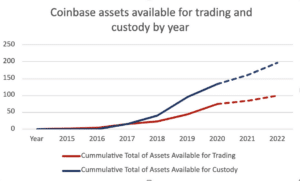

Essentially based totally on Decrypt, Coinbase has aggressively picked up the streak of its asset offerings. For context, the change added 21 fresh resources in 2020. Halfway thru 2021, the company has already added 29 fresh tokens. Coinbase’s custody division has additionally expanded, asserting give a steal to for 74 extra tokens — extra than doubling the desire of resources accessible to custody on the platform in correct six months.

Supply Decrypt

Armstrong’s Tweet thread made it determined that Coinbase is “asset agnostic” and believes in a free market with particular person desire. He additionally effectively-known that a Coinbase record is no longer an endorsement of a token. As an different, it’s correct the acknowledgment that a token hit the change’s minimal record requirements.

“Attain your possess overview and utter correct judgment,” Armstrong warned.

Instant Reads

- Congressman Tom Emmer on why Congress must always fight overregulation of blockchain and crypto innovation:

- Ben Lilly’s funding thesis for crypto is in conserving with one chart… U.S. 30 year bond yields:

- Alex Gladstein on how Bitcoin may possibly possibly presumably presumably be weak to fight monetary colonialism:

On The Pod…

Ethereum’s EIP-1559 Will Resolve Some Complications But Immense Ones Will Remain

Taylor Monahan, CEO of MyCrypto, and Tim Beiko, Ethereum Foundation core-dev facilitator, discuss about the upcoming toughen to the Ethereum community, EIP 1559. Show masks highlights:

-

why Tim believes EIP 1559 is well-known

-

what narrative is driving EIP 1559

-

what problems the community toughen will resolve

-

how Ethereum transactions/fees work

-

whether gasoline prices are correlated with ETH/USD

-

the 3 main protocol changes that EIP 1559 proposes

-

why Taylor, because the CEO of a pockets provider, is cautious of EIP 1559

-

how EIP 1559 will affect Ethereum’s block size

-

what changes pockets suppliers are concerned with attributable to EIP 1559

-

whether ‘Shadowy Swan’ occasions will likely be roughly likely after the community toughen

-

how EIP 1559 will affect miners

-

whether Tim or Taylor believes that miners may possibly possibly presumably fork Ethereum to shut EIP 1559

-

how EIP 1559 will change the remark of miner extractable imprint (MEV)

-

how Taylor and Tim feel referring to the Ethereum as sound money narrative in light of EIP 1559

-

when EIP 1559 will dash are living

Book Substitute

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Immense Cryptocurrency Craze, is now accessible for pre-expose now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-expose it this day!

You may also aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com