Will XRP, Solana, Litecoin, Dogecoin, and Cardano ETFs Recede Traders Out in the Wintry?

Crypto markets bear long been outlined by “alt-seasons”, where tokens outside of alternate giants bitcoin and ether outperform the market as investors roll their good points into elevated beta resources. Prior alt-seasons happened for the length of the DeFi summer season in 2020, the COVID rally in 2021, and even the memecoin craze from final One year.

Since the re-election of Donald Trump there has been some other alt-season—this time in the create of tokens being packaged into pickle ETFs. The resources contain XRP, the native token of the eponymous $155 billion XRP Ledger blockchain, $9.3 billion HBAR (Hedera Hashgraph), $29 billion ADA (Cardano), $9.3 billion LTC (Litecoin), $39.2 billion DOGE (Dogecoin), $7.6 billion DOT (Polkadot), and $90.5 billion SOL (Solana).

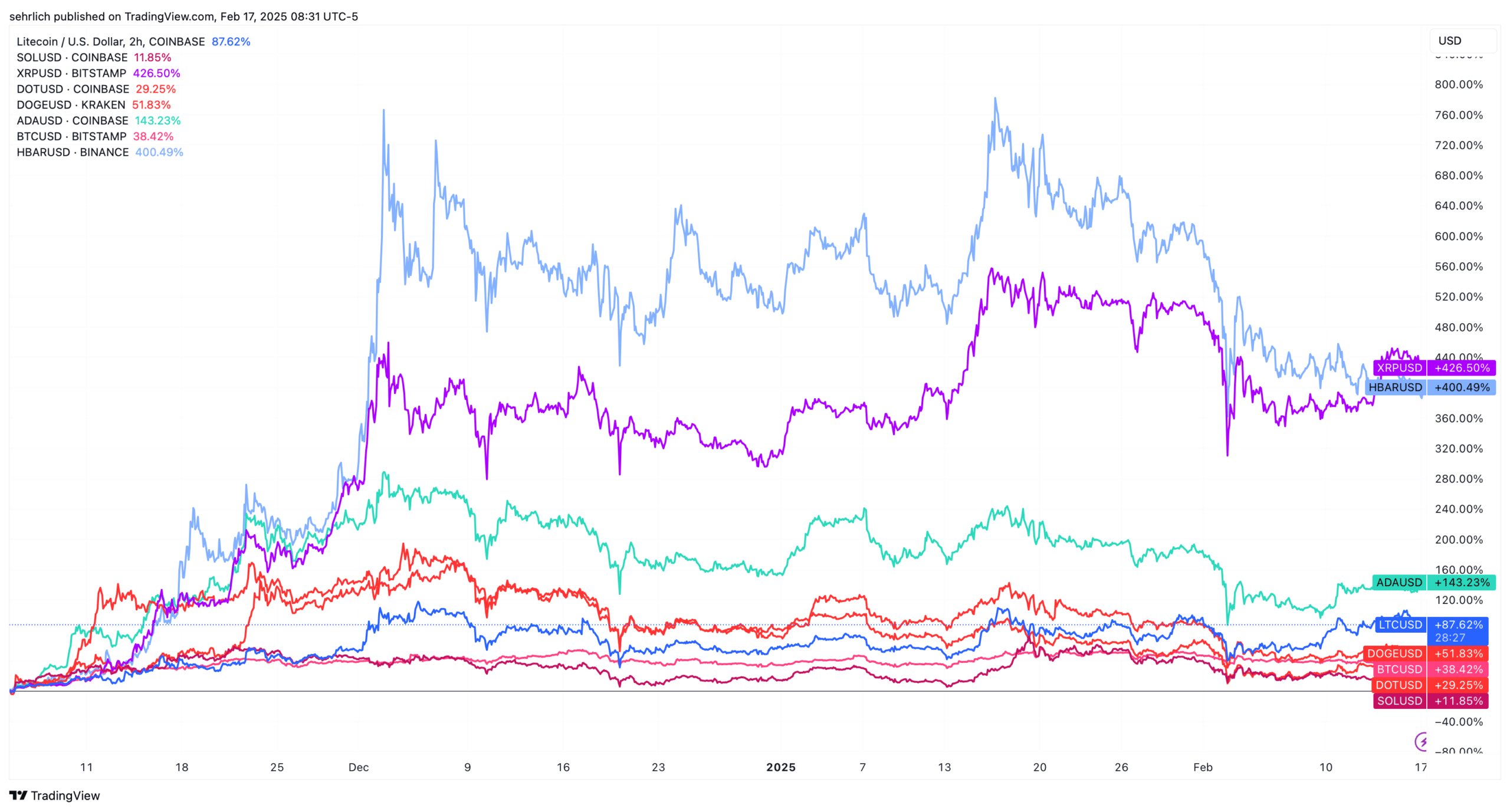

Every of those tokens has seen expansive good points since the election. XRP and HBAR lead the model with 426% and 400% jumps respectively on the support of newly filed ETF applications. XRP’s tag has also been helped because of growing expectations for a short decision of its ongoing lawsuit by the SEC, advise overtures by Ripple Labs CEO Brad Garlinghouse to the White Residence, and Ripple’s efforts to secure XRP incorporated in any capability national strategic crypto stockpile or reserve.

Nonetheless alt-seasons invent no longer final forever, and except for some extra timely public statements from key figures late these projects—Cardano founder Charles Hoskinson has also been making public pleas to the administration—there may perchance be moderately minute rationale late all these tokens seeing this kind of big surge. Despite these good points, the tokens are peaceable down an moderate of 60.7% from their all-time highs for the length of COVID. Even as you rob out Solana, whose token surged on the support of a large quantity of direct from the memecoin craze final One year and whose development appears sustainable, the tokens are peaceable down an moderate of 65%. The long-term model for them also can peaceable be down.

Some alternate insiders imagine investors are having a take a look at up on previous fundamentals when evaluating these ETFs. “I judge that long-term investors in projects take care of XRP, to me, aren’t so unparalleled justifying on the novel time that the valuation is appropriate,” says Ryan Rasmussen at Bitwise Asset Management, whose firm has utilized to list funds tracking XRP, Solana, and Dogecoin. “I judge what they’re doing is expressing a imaginative and prescient that blockchain technology will seemingly be disruptive to many different markets. And so it’s no longer so unparalleled the cashflow or income that they generate on the novel time justify the novel valuation.”

One other point for retail shoppers to rob into consideration: institutional investors are no longer going to realize support alongside for the go, no longer much less than lovely now. Speaking about the retail-heavy circulation that accompanied pickle bitcoin and ether products final One year as a precedent for these upcoming products Rasmussen acknowledged, “That did surprise us due to the retail investors had been ready to secure admission to bitcoin by centralized exchanges take care of Coinbase, Gemini, Kraken, etc., for years. I judge the reason is due to the oldschool funding corporations or wealth management corporations prefer to struggle by long due diligence and review processes for new products.”

These are going to be tricky sells for oldschool brokerages, who are peaceable looking out to wrap their heads across the bitcoin and ether products that bear introduced in $121 billion and $8.7 billion respectively, even after they open the due diligence. “I would no longer even remotely even take a look at up on at just a number of the different ones from an funding viewpoint,” acknowledged an funding guide at a Wall Road financial institution on the condition of anonymity. “I loathe to make exhaust of the note scam, but they’re factual scams. You’re procuring for something hoping that there’s somebody else that you’re going to sell to at a elevated tag.”

“Presumably Solana and XRP also can garner some resources, most important phases,” says Bloomberg Intelligence ETF Research Analyst James Seyffart. “Nonetheless for potentially the most half, the passion in all the pieces else factual doesn’t seem to be as precise.”

Listed below are some key info about every of the functionality ETFs.

XRP: No ‘There’ There

The XRP Ledger is one in all the arena’s oldest blockchains, having launched in 2012. At the origin pitched as a competitor to the Swiss banking collective SWIFT, the backbone of the world interbank fee community, it has struggled to create an label. This capacity that Ripple Labs has made a different of pivots. The final One year has seen the firm launch stablecoin and varied tokenization offerings. It has also incorporated NFTs, is at the side of tidy contracts to its original payments-centered platform, and has a decentralized alternate.

In the case of commercial efficiency, the community greatest earned $1.15 million greenbacks in bills final One year. Its 2023 whole became $583,000. By comparability, Ethereum earned $1.99 billion in bills and Bitcoin came in 2d with $922 million. Actually, the XRP Ledger became one in all 20 Billion-Buck Crypto Zombies named final One year by Forbes.

Nonetheless that is no longer the correct number that must topic for capability ETF shoppers.

XRP’s rapid tag breeze since the election created a windfall for Ripple Labs. In response to its Q4 2024 XRP Markets File, the firm now has 4.485 billion in XRP price $12.2 billion that it may perchance well sell on the novel time. Extra staggering, it has 38.9 billion items arriving the upcoming years from a pre-deliberate escrow price $106.7 billion. This treasury may perchance also be belief to be a large sell wall that will also can peaceable be overcome in direct to proceed transferring the tag upward.

Outlook: The SEC no longer too long in the past acknowledged an ETF application filed by Grayscale and the New York Stock Alternate to alternate a pickle XRP ETF. This most important step will consequence in the begin of a extreme 240-day length on the cease of which the SEC will must give a final decision on whether or now to no longer let the product open procuring and selling. Nonetheless, the SEC’s suit in opposition to Ripple Labs may perchance also can peaceable be concluded ahead of the product can open procuring and selling.

Solana: From FTX Casualty to Phoenix

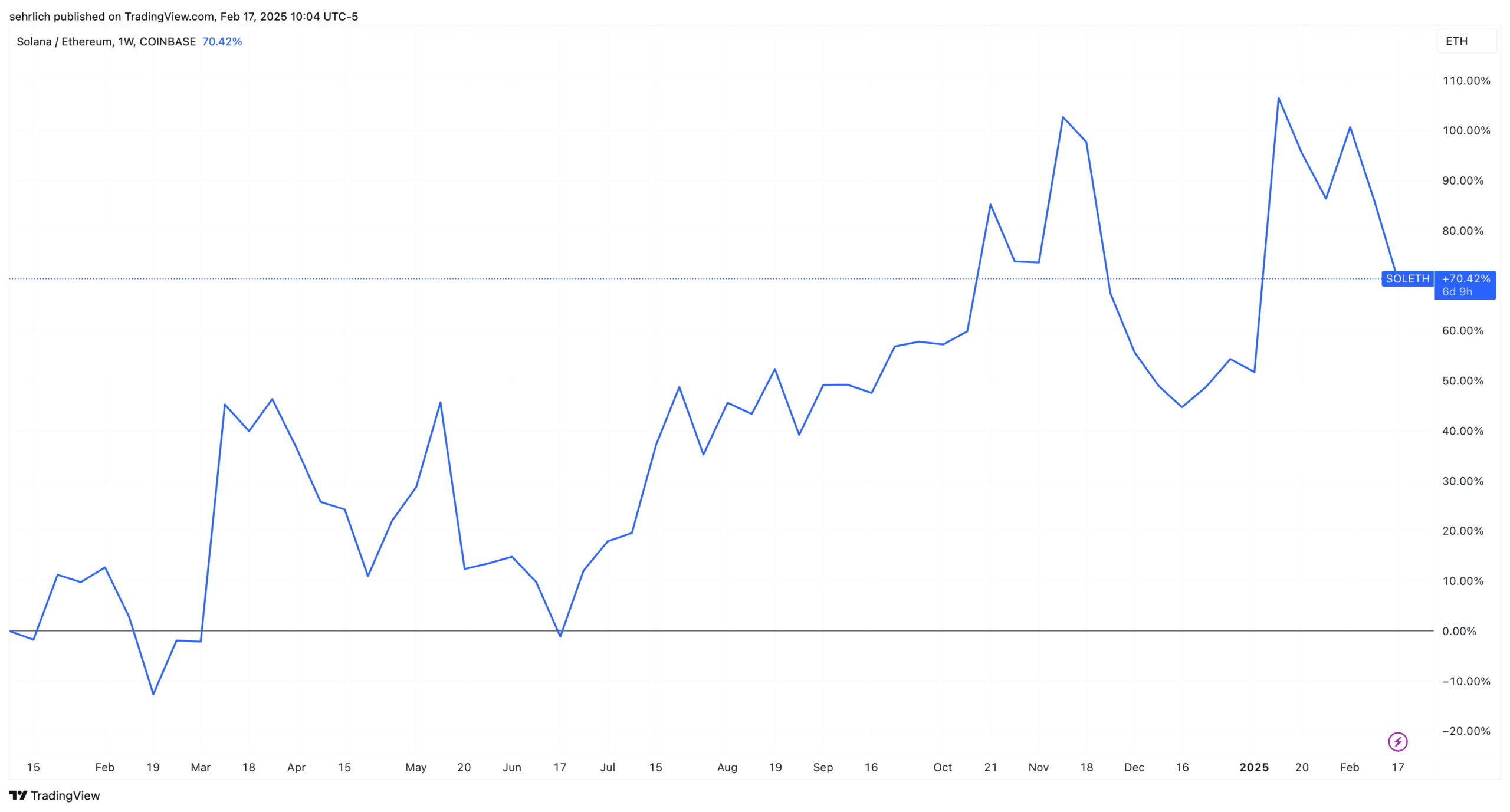

Many investors left Solana for dreary after the give plan and conviction of FTX kingpin Sam Bankman-Fried, who referred to as himself a self-described “fan boy” of the token in a 2021 interview with Forbes. Nonetheless, while the token tanked on the time of FTX’s give plan in 2022, it has had a resurgence in the final two years. In 2024 the blockchain community earned a large $750 million in bills—beating every chain other than Bitcoin and Ethereum, and it is miles driving a 2d tailwind in the create of a self-inflicted crisis by its chief rival Ethereum.

Since the starting of 2024, Sol has received 70.42% on ether.

About a key reasons mentioned by investors for this surge contain a more person-pleasant on-boarding course of. It is a self-contained ecosystem—all the pieces exists on the L1. In quite loads of conditions other folks greatest must make exhaust of a single pockets and so that they devise no longer prefer to care for observe of which resources are on which L2s. Plus transactions on Solana greatest tag a pair of cents, making the blockchain become the pure home of the memecoin craze for over a One year.

Outlook: The SEC has a final closing date of October tenth to create a final decision on the four Solana applications that had been submitted. A lot take care of XRP, the SEC peaceable considers Sol to be a security, so that hurdle may perchance also can peaceable be overcome ahead of any product can open procuring and selling.

Litecoin: From ‘Digital Silver’ to Memecoin

Litecoin became launched in 2011 as an early Bitcoin fork designed to present a sooner and more inexpensive payments draw. It produces blocks four occasions sooner than Bitcoin, an moderate of 1 every 2.5 minutes in opposition to every 10 minutes for Bitcoin. It also has a laborious restrict on its token present, but due to the it produces blocks 4x as rapid as Bitcoin its present cap is 84 million.

Nonetheless accurate usage of the platform appears to be minimal. In 2024 it greatest earned $371,000 in bills, which is de facto down from its 2023 different of $388,000. Actually, other folks late the project bear reasonably embraced Litecoin as a memecoin. A November 13, 2024 tweet from the Litecoin Foundation’s first fee X tackle, with 1.1 million subscribers humorously acknowledged that the token became now a memecoin.

Outlook: The applications from Canary and Grayscale bear the preferrred likelihood of procuring and selling first merely due to the those products bear the closest final closing date of October 10, and it doesn’t seem that the SEC considers litecoin to be a security.

Dogecoin: ‘So A lot Wow’ Inflation

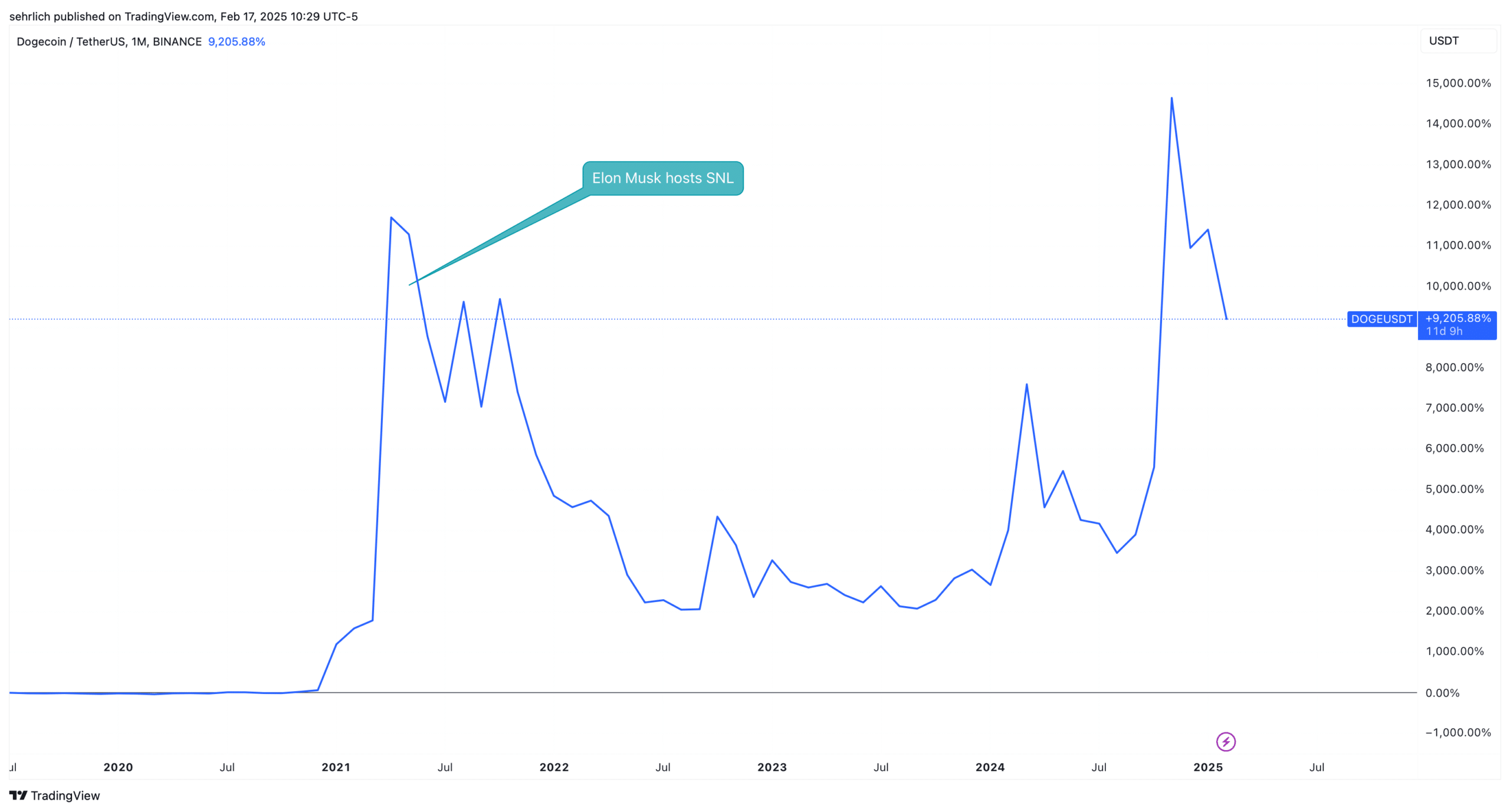

Dogecoin is an OG memecoin that launched in December 2013 basically based on a Shiba Inu canine whose thoughts are rendered in Comedian Sans font. If there may perchance be a token that has professionalized the memecoin alternate, this may perchance presumably be it. It first rode excessive for the length of the COVID bubble in 2021, reaching an initial apex of $0.73 in Could well well 2021 across the time that Dogecoin champion Elon Musk hosted Saturday Night time Live and mentioned it for the length of his monologue.

Nonetheless, it started falling after Musk’s appearance and the token collapsed in 2022 alongside with the rest of the crypto market. It is a ways on a fling again because of its name affiliation with Musk’s Division of Authorities Efficiency and its repute of being a grown-up memecoin.

One thing else for investors to rob into consideration: While Dogecoin makes exhaust of a same proof-of-work consensus mechanism to Bitcoin or Litecoin, it doesn’t bear a equally capped present. Dogecoin’s novel circulation is 148,057,346,383 items, and it will emit some other 5 billion items every One year. At the novel present, this amounts to a 3.4% inflation fee. As the circulating present will increase over time the inflation fee will lower, but it completely also can no longer ever become a deflationary asset. As a degree of comparability, Bitcoin creates 328,500 new items every One year, and its novel present is nineteen.38 million tokens. This creates a tough inflation fee of 1.6%. And the final bitcoin will seemingly be mined in 2140.

Outlook: The SEC has by no methodology named Dogecoin in any of complaints in opposition to crypto corporations, so it seemingly doesn’t rob into consideration the token to be a security. The SEC has to create a final decision on offerings from Grayscale and Canary by October 18.

Cardano: Earns 99.8% Much less Than Ethereum in Funds

Cardano is the brainchild of Ethereum co-founder Charles Hoskinson. It became launched in 2017 after his 2014 falling out with the Ethereum crew as a local proof-of-stake blockchain that theoretically provides a same cost proposition to users of different multipurpose blockchains take care of Ethereum or Solana. In September 2024 the project launched its Chang laborious fork, designed to lengthen on-chain governance and take away decision-making authority from Cardano’s three founding entities—the Cardano Foundation, Input Output World (IOHK) and Emurgo.

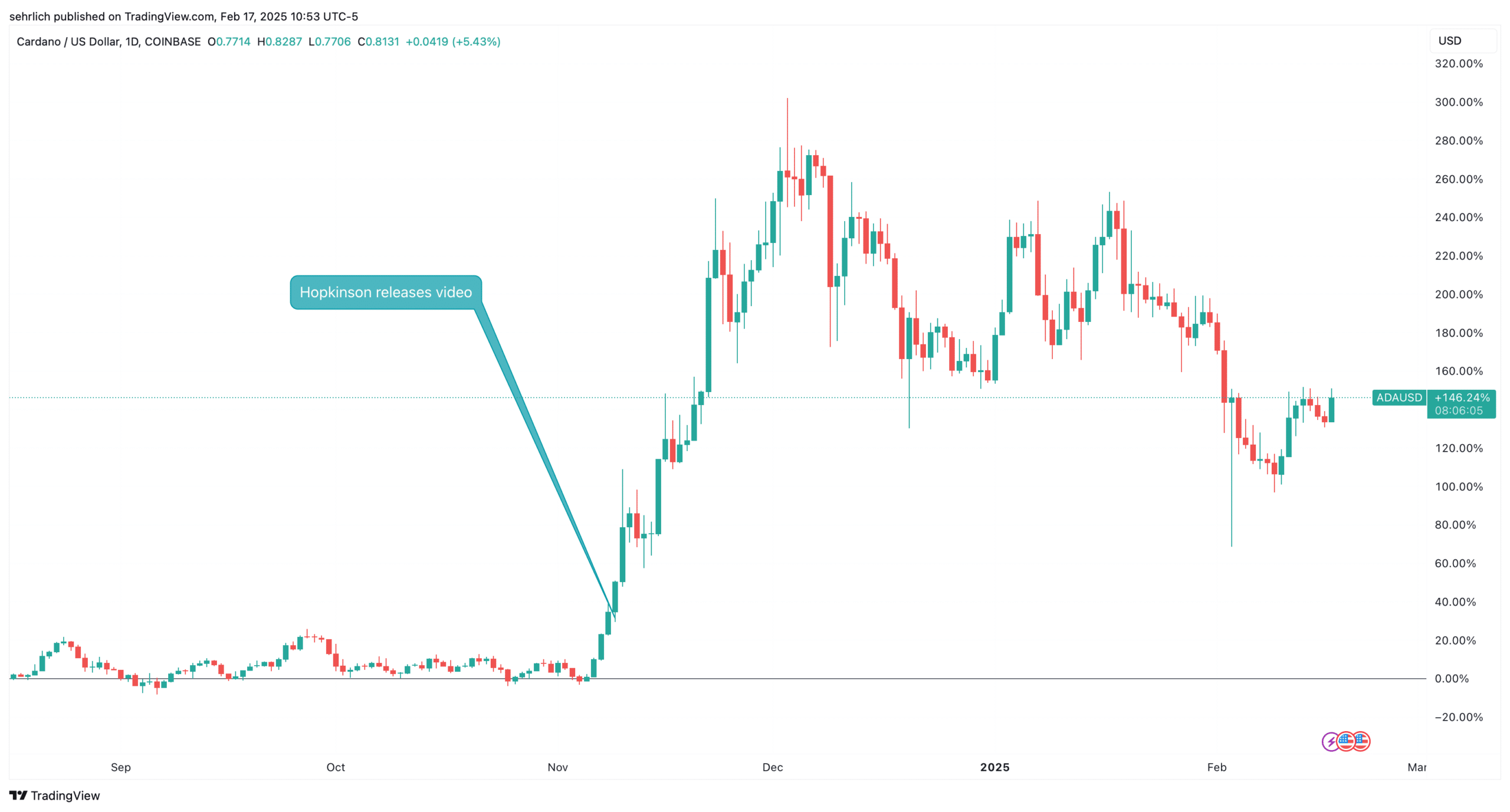

Aloof, it is miles advanced to separate the fortunes of the blockchain from its charismatic founder, who has a relentless online presence and has made internal most overtures in direction of the Trump Administration. In a November 9 video posted to X, he offered that he may perchance presumably be working with lawmakers on crypto coverage in an unannounced role, and no such role has since been made public. Cardano’s tag, which is down 74.1% from its all-time excessive, straight shot up to what would become a 300% surge in a topic of a month.

Hoskinson’s outsize persona helps veil the incontrovertible truth that Cardano is factual now ending its key developmental stages and greatest earned $4.38 million in bills final One year. This amounts to .2% of Ethereum’s $1.9 billion in bills final One year.

Outlook: Grayscale and NYSE Arca bear filed the S-1 and 19-b4 documents most important for the SEC to rework Grayscale’s closed-cease product into an ETF. Esteem Solana and XRP, the SEC considers Cardano to be a security, so decision on this arena may perchance also can peaceable be resolved ahead of any product can list.

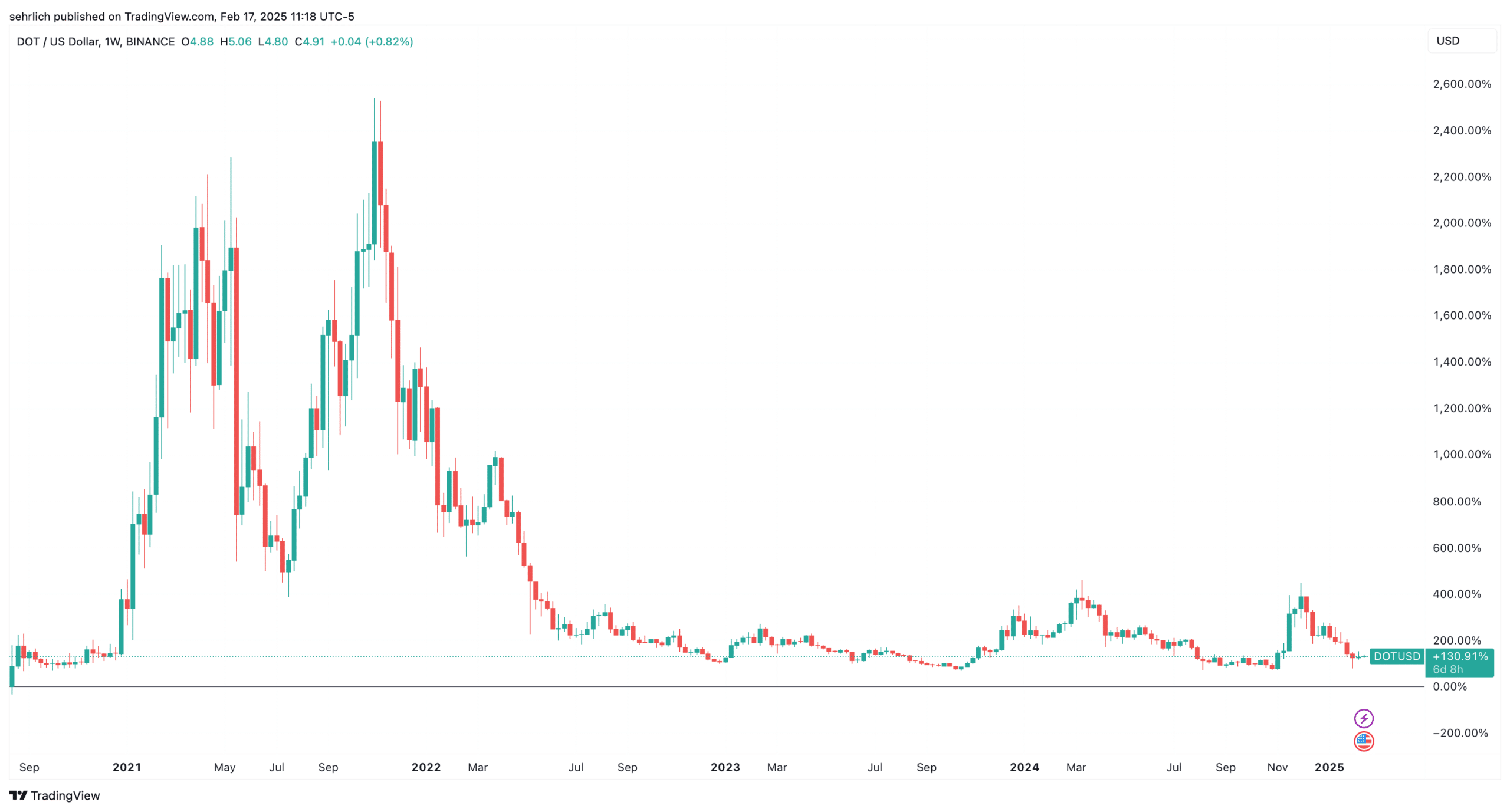

Polkadot: Down the Most From Its All-Time High

Polkadot is a Swiss-basically based blockchain project basically based by the Web3 Foundation. Unlike L1 blockchains take care of Ethereum or Solana, Polkadot is believed to be to be a L0 blockchain, which utilizes dozens of parachains that will also be feeble to toughen a most important selection of applications.

Polkadot’s $7.8 billion blockchain also has a sister project referred to as Kusama, that will presumably also moreover be regarded as a testnet, and has a $325 million market capitalization by itself. Purchasers of Polkadot’s native DOT token receive Kusama tokens (KSM) for free.

It is a ways price noting that of your entire tokens with pending ETF applications, Polkadot has just a few of potentially the most tough economics to beat. At its novel tag of $5.12 it is miles down 90% from its all-time excessive, the preferrred gap of any token. Additionally, the community introduced in the 2d smallest quantity of income in 2024 at $1.08 million of some other tokens having a take a look at up on to secure ETFs.

Outlook: 21Shares is the correct asset supervisor to observe to list a Polkadot ETF and a 19-b4 is yet to be filed. Polkadot has no longer been named in any SEC crypto suits, but it completely is unclear whether or no longer the agency would rob into consideration it to be a security.

Hedera Hashgraph: Ruled Handiest by 30 Entities

Hedera is a permissioned proof of stake blockchain that is governed by 30 world entities on what’s named the Hedera Council. As an alternative of fashioned crypto names take care of Chainlink Labs and BitGo, Hedera has managed to onboard quite loads of blue chip companies corresponding to Dell, Google, IBM, Hitachi, Licensed Monetary institution, and Deutsche Telekom.

The permissioned plan, where greatest pre-authorized entities are allowed to course of community transactions, is designed to create blockchains more amenable to regulated companies. Nonetheless, the project plans to become permissionless one day.

Hedera earned the 2d-most income of any blockchain up for an ETF this One year at $5.5 million. Nonetheless, investors also can peaceable direct warning because it is miles up 313% over the previous six months yet is down nearly 25% so a ways in 2025.

Outlook: Canary is the correct asset supervisor to observe to list an HBAR ETF and a 19-b4 is yet to be filed. HBAR has no longer been named in any SEC crypto suits, but it completely is unclear whether or no longer the agency would rob into consideration it to be a security.

Source credit : unchainedcrypto.com