Will ETH Apply Bitcoin’s Path and Reach Recent Highs Now That Build ETFs Are Right here?

In the four days since predicament ether alternate-traded funds (ETF) started shopping and selling, the label of Ethereum’s native cryptocurrency has moved in an identical vogue to BTC’s after the SEC authorised predicament bitcoin ETFs. On the replacement hand, consultants advise this is also more sturdy for ETH to proceed on the identical direction as BTC did within the weeks following its have predicament ETF, when it hit an all-time high.

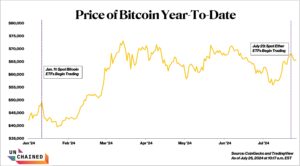

After the Jan. 11 initiate of predicament bitcoin ETFs, the label of BTC sunk more than 21% by Jan. 23 to spherical $38,500. But then it regularly rebounded, in portion as a consequence of the success of those ETFs and resulting quiz for bitcoin, and hit an all-time high of about $73,000 by March.

Be taught more: Ethereum Provide Growth Raises Concerns Amid Birth of Build ETH ETFs

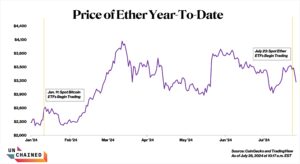

In an identical vogue, when the shopping and selling of predicament ETH ETFs started, ETH was shopping and selling spherical $3,500 and has since slumped as runt as $3,086, a more than 10% tumble, before settling at $3,319, files from TradingView shows.

Why History Would possibly presumably No longer Repeat

Whether or no longer ETH will by some means educate BTC’s label trajectory stays to be considered, but Andy Chen, who is on the be taught and funding crew at early-stage funding company Superscrypt, predicted that ETH’s label will proceed to claim no — at the least within the non eternal.

While bullish lengthy-interval of time, Chen suggested Unchained on Telegram that the details of the predicament ETH ETFs has mostly been priced in. “Most of us that had been bullish relating to the ETH ETF bought publicity thru the [exchange-traded products] love the Grayscale [Ether trust] that had been shopping and selling at a more affordable label, so they’re going to seemingly dump,” Chen acknowledged.

Be taught more: Ethereum ETFs Narrative $1 Billion in First Day Volume and $107 Million Inflows

Kelly Ye, a portfolio manager for project company Decentral Park Capital portfolio manager, agreed. She common that the BTC predicament approval got here after years of backward and forward between the SEC and fund corporations, and additionally established a precedent for the approval of a predicament crypto ETF. This capacity that, “BTC predicament approval is more fundamental” in contrast to the ETH ETF approval, Ye acknowledged. And whereas the ETH approval was smooth a surprise, it was “more on the timing in preference as to whether it would also be authorised or no longer,” Ye added.

Ye additionally pointed out how ETH’s have rally all the diagram in which thru the two months after predicament bitcoin ETFs had been authorised makes it more sturdy for ETH to surge. ETH almost doubled from $2,165 on Jan. 23 to $4,084 on March 13, when BTC peaked in label.

No longer Digital Gold

Other consultants inquire of ETH to salvage well at final, but common that ETH’s rebound may maybe well maybe rob longer and may maybe well maybe no longer be as high, noting that ETH is no longer as easy a promote to traders as BTC.

“We’re bullish on ETH ETF flows within the medium interval of time, as it’s a huge system for used fund managers to make investments in a proxy for blockchain technology,” Seth Ginns, head of liquid funding at funding company CoinFund, wrote in an email to Unchained. “But that’s a more hard pitch than [BTC’s] digital gold, so ETH’s rebound may maybe well maybe rob longer than BTC.”

Be taught more: ETH Drops Under $3,200 as Build Ether ETFs Narrative $133 Million Outflows

In an identical vogue, Jacob Martin, the frequent accomplice of early-stage funding fund 2 Punks Capital, suggested Unchained that, now not like BTC, ETH isn’t pitched as “money” or “digital gold,” making it more sturdy for the frequent particular person to wrap their mind spherical. This capacity that, “the bias is in direction of BTC,” Martin acknowledged.

“We inquire of BTC to be over $100K rapidly, and ETH will seemingly lumber up a lot when that occurs, but it would match up lower than BTC as establishments come up the learning curve,” Ginns acknowledged.

Decentral Ye’s added that she anticipated ETH ETF inflows to be roughly 20-30% of BTC’s ETF inflows, proportional to the variation of their market caps. While ETH’s inflows had been encouraging within the first few days of shopping and selling, it is “too early to stare whether [ETH’s] travel can meet this expectation,” Ye acknowledged.

Source credit : unchainedcrypto.com