Why a Trump Presidency Could maybe Be Even More Bullish for Crypto Than You Train

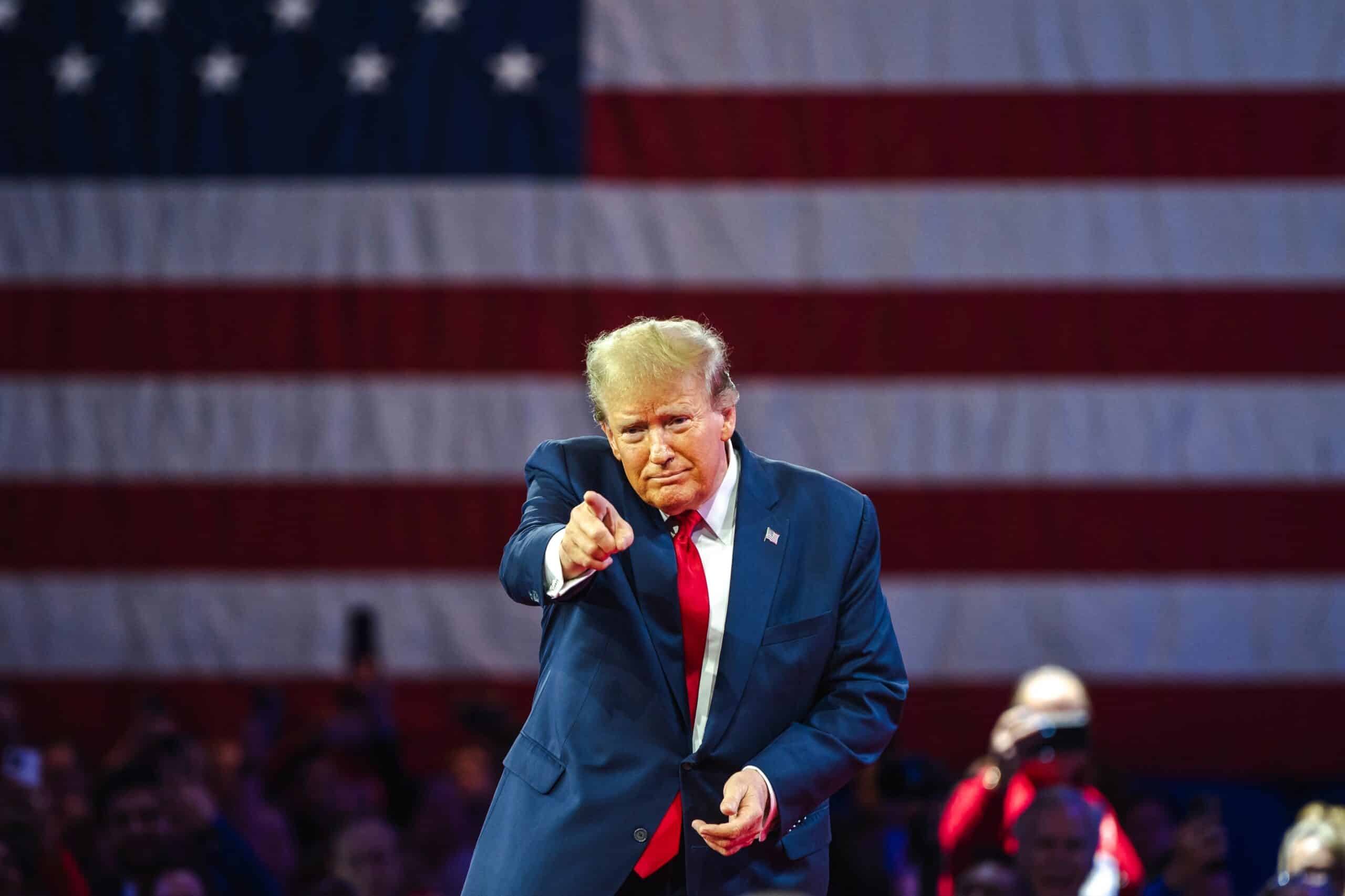

The “Trump Change” has been a focal level among investors ever since aged President Donald Trump grew to turn out to be the Republican nominee for the upcoming US elections. But it completely won even more traction final Saturday when Trump survived an assassination try all the plot in which thru a rally, with a bullet grazing his actual ear.

Merchants at prediction market Polymarket now predict a 70% likelihood that Trump will acquire against Joe Biden, versus 60% forward of the try on his lifestyles. In the most contemporary Bits + Bips podcast, hosts Alex Kruger and Joe McCann expressed their belief that a Trump victory is now assured after the plucky imagery of the ex-president that emerged from the taking pictures incident. And in conserving with McCann, “the myth and concept of what he would possibly maybe perhaps presumably scheme is very influential to [crypto’s] stamp.”

The “Trump Change” refers to the market response and investment approach in accordance to the expectation that a Trump presidency will result in favorable prerequisites for certain sources, in particular cryptocurrencies, because of the his pro-crypto stance and potential economic insurance policies.

Trump because the Crypto Candidate

After previously criticizing cryptocurrencies, Trump has now been positioning himself because the crypto candidate. In Can also simply, he grew to turn out to be the first predominant presidential candidate in American historical past to simply opt up cryptocurrency donations. He is scheduled to focus on at next week’s Bitcoin Conference in Nashville, and in a Bloomberg interview on Tuesday, Trump emphasized the need for the U.S. to rob the lead in the crypto home forward of China does and teased a fourth NFT start.

Moreover, Trump has chosen Ohio Senator J.D. Vance as his working mate. Vance disclosed that he owned between $100,001 and $250,000 price of BTC in 2022, and he’s been vocal in disagreeing with how Gary Gensler has regulated the crypto change. Therefore, Vance is “doubtlessly fabulous for crypto,” mentioned James Seyffart in the Bits + Bips episode.

Read more: Trump Picking J.D. Vance as Vice Presidential Running Mate Sends Vance Linked-Memecoins Hovering

With Trump in the White House, it’s anticipated that the foul regulatory ambiance for crypto in the U.S. will change. Gensler’s SEC has been very combative in the direction of the change, largely pursuing law by enforcement. A Trump administration would possibly maybe perhaps presumably result in more regulatory readability and enable for increased innovation. For occasion, some of us demand that a Solana ETF will likely be accredited beneath his presidency, following the paths of bitcoin and ether.

Macro Under a Trump Presidency

But there’s more than factual Trump’s pro-crypto views at the support of the optimism among crypto investors about a 2d Trump presidency. Trump would possibly maybe perhaps presumably neatly shape the macroeconomic ambiance in a ability that is bullish for crypto.

As Kruger mentioned on the podcast and pointed out on X, Trump’s fiscal insurance policies, alongside with tax cuts and increased government spending, would possibly maybe perhaps presumably result in bigger inflation and a steeper yield curve. This ambiance in most cases makes crypto more horny as a alternative investment. Billionaire investor Trace Cuban echoed this sentiment on Wednesday on X, declaring, “Decrease tax charges and tariffs will likely be inflationary,” which would possibly maybe perhaps presumably drive the price of Bitcoin “plot bigger than you affirm.”

More namely, a Trump-Vance administration would possibly maybe perhaps presumably change U.S. economic protection all the plot in which thru the ability of the dollar. Every Trump and his working mate hold argued that a weaker U.S. forex would better give a boost to American exports by making them more aggressive globally. This stance contrasts with frail Republican positions favoring a trusty dollar.

A weaker dollar would possibly maybe perhaps presumably boost domestic manufacturing and change balances, but it completely would possibly maybe perhaps presumably also result in increased inflationary pressures. For the crypto market, that would be a bullish style, as investors in most cases turn to bitcoin and different cryptocurrencies as hedges against forex devaluation. As Cuban eminent in his post, “Geopolitical uncertainty and the decline of the dollar because the reserve forex would possibly maybe perhaps presumably go up BTC prices.”

The U.S. Dollar Index (DXY), which measures the dollar’s stamp against a basket of assorted predominant currencies, has traditionally moved in the alternative route as bitcoin and the broader markets. When the DXY falls, indicating a weaker dollar, bitcoin in most cases rises as investors look conceivable decisions to frail fiat currencies.

Source credit : unchainedcrypto.com