Why Trump Could perhaps well even simply Salvage Chosen This Week to Grunt a Strategic Crypto Reserve

Thru Saturday the crypto market was down 14% in 2025.

No matter the total hype and promise from the Trump administration, the industry had been left disheartened by a pair of memecoin scandals besides to an absence of tangible progress from the authorities exterior of the dismissal of some conditions from the Securities and Alternate Commission and the free up of a rather vague Govt Uncover on January 23.

However that disappointment very most attention-grabbing got a reprieve. Two days ago the White House announced that this can host its first ever crypto summit this Friday, which “will seemingly be chaired by the White House A.I. & Crypto Czar David Sacks, and administered by the [President ‘s Working Group on Digital Assets] Govt Director Bo Hines.” (Unchained was the first to listing that the Trump administration had pivoted to summits on particular crypto points in station of convening a crypto council, as had been the conventional thought.)

This data garnered excitement from the group, as it promised to lay the groundwork for among the most wishes outlined in the Govt Uncover, which is designed to “promote United States management in digital assets and monetary technology whereas keeping economic liberty”.

However for a president who deeply cares in regards to the stock market and sees its efficiency as a barometer of his success, this announcement in regards to the summit was seemingly no longer ample. The market barely bumped on data.

That could perhaps perhaps well very smartly be why Trump determined to express the principle 5 tokens to be incorporated in a future crypto reserve: bitcoin, ether, cardano, ripple, and solana.

Bull Markets = Fame for Trump

Trump goes out of his manner to equate his job efficiency to a bullish market whenever conceivable. On December fifth Trump posted on Fact Social after Bitcoin crossed the $100,000 ticket for the principle time, “CONGRATULATIONS BITCOINERS!!! $100,000!!! YOU’RE WELCOME!!! Collectively, we can Scheme The United States Immense Over again!”

Taking a gaze out on the broader market, JPMorgan observed that the president tweeted favorably in regards to the stock market’s efficiency 156 events sooner or later of his first administration. Nevertheless, since 2024 he has posted in regards to the stock market very most attention-grabbing as soon as. Per the bank, “Most of the recent posts [by Trump] referring to the ‘US economic system’ are on debt ceiling, authorities spending/effectivity or tariff advantages.”

It doesn’t again his case that the S&P 500 is down 1.47% since he took station of industrial on January twentieth.

What better manner to build the market and industry in a true mood than title-dropping some crypto cash? In a series of two posts on Fact Social Sunday the president announced that work would in an instant commence on constructing a strategic crypto reserve.

The necessary post learn, “A U.S. Crypto Reserve will elevate this extreme industry after years of defective assaults by the Biden Administration, which is why my Govt Uncover on Digital Sources directed the Presidential Working Community to transfer forward on a Crypto Strategic Reserve that entails XRP, SOL, and ADA. I will seemingly be particular that the U.S. is the Crypto Capital of the World. We’re MAKING AMERICA GREAT AGAIN!”

After generating shock and shock internal the industry that the post disregarded the 2 most established crypto assets, bitcoin and ether, the president adopted up with one other post, “And, obviously, BTC and ETH, as moderately a pair of precious Cryptocurrencies, would be the coronary heart of the Reserve. I furthermore love Bitcoin and Ethereum!”

Making Tokens Immense Over again

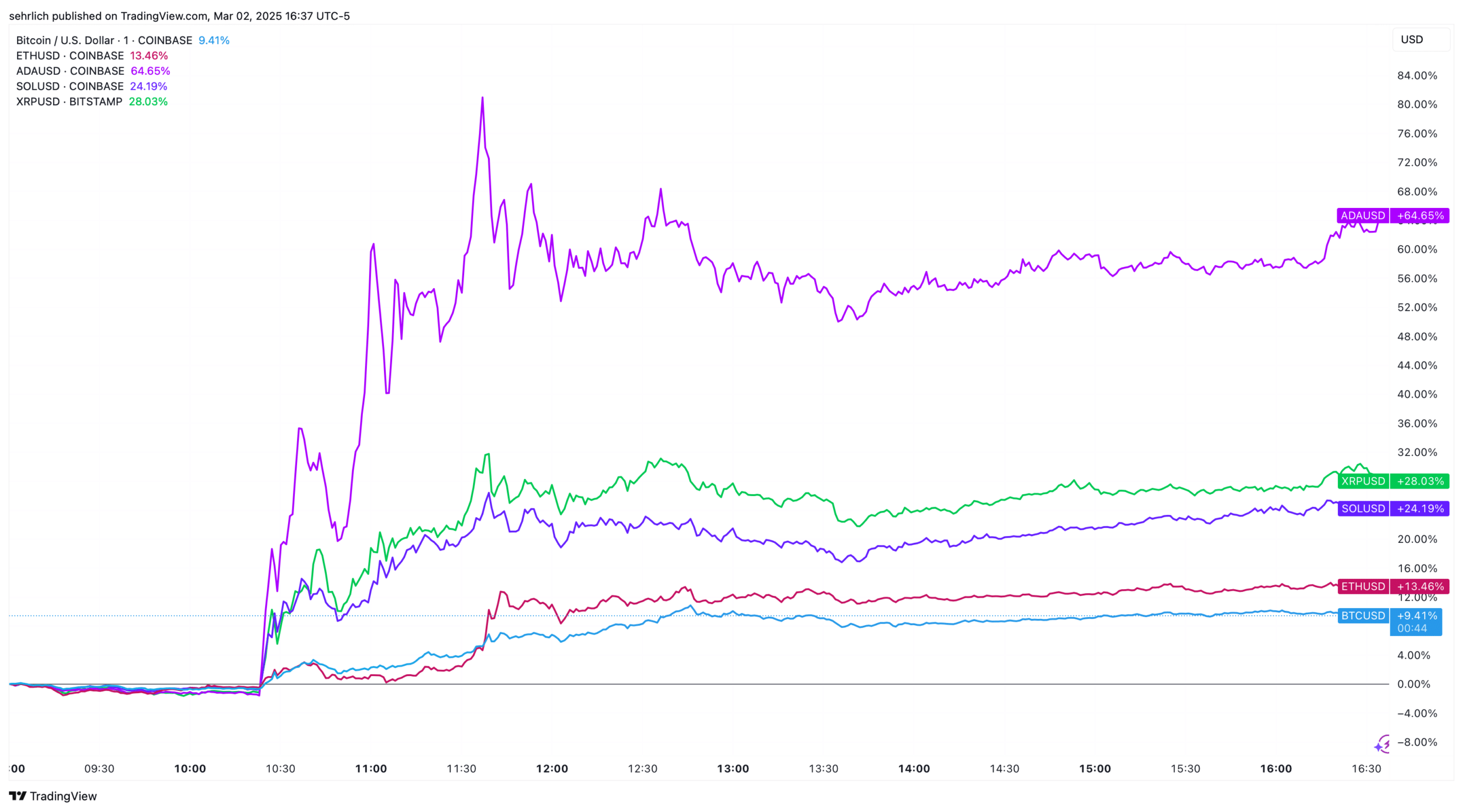

Each and every of the crypto assets soared after the posts. As of this writing bitcoin is up 9.41% and has recovered to $94,070 after falling under $80,000 final week. Ether jumped by 13.46% as it tried to shake off the $1.5 billion Bybit hack and a broader industry story that it’s losing ground to rival Solana. Solana surged 24.19% on the tips and ripple, which has benefitted more than any moderately a pair of necessary token by tying itself to the Trump administration (in the final one year it’s up 452%), jumped one other 28%.

However the excellent winner from recently’s data was Cardano, a native proof-of-stake blockchain that theoretically presents an identical price proposition to customers of moderately a pair of multipurpose blockchains adore Ethereum or Solana, which is up 64.65%.

It’s price noting that Solana, Cardano, and Ripple all seem like slated to get space ETFs this one year. Nevertheless, according to most as much as date evaluation from Unchained many of these tokens were buoyed in most as much as date months as phase of the Trump trade and that merchants could perhaps perhaps well quiet exercise caution earlier than shopping for any tokens.

A Pile of Extra Questions

Trump’s social media posts present no longer regularly any moderately a pair of information on the deliberate “reserve,” as he known as it in his posts Sunday, but the decision of the note “reserve” appears to ticket a alternate from the administration’s stance in January’s govt expose.

The note “reserve” suggests that the authorities will proactively buy more assets, whereas the blueprint said in January’s govt open up to “review the aptitude advent and repairs of a national digital asset stockpile” could perhaps perhaps well be more about keeping onto the $19.1 billion in crypto, 97.9% of which is in bitcoin, that it already has from seizures across dozens of tokens.

If Trump’s unique blueprint is that the authorities buy unique assets on the commence market, that raises the ask of whether or no longer that would require an act of Congress, and whether or no longer the groups and foundations on the again of tokens adore XRP and ADA would donate assets to the reserve. If the authorities goes to buy assets then the timing of any procurement program could perhaps perhaps well be extreme as many merchants would seemingly are attempting to entrance-inch the authorities.

Nevertheless, one thing that’s obvious is that as soon as President Trump steps as much as the podium on Friday for opening remarks on the White House summit, he will seemingly be talking to an industry with renewed wind in its sails.

Source credit : unchainedcrypto.com