Why the Ethereum Neighborhood Is Up in Palms Against a Proposal to Swap the Monetary Policy

A serious dialogue to reevaluate Ethereum’s token issuance model has stirred debate over the long bustle of ETH staking economics.

As Ethereum sees an upward model in ETH staking, projections counsel this also can lead to a majority of ETH being locked in staking contracts, prompting considerations over the network’s future dynamics. In response, Ethereum Foundation researchers Ansgar Dietrichs and Caspar Schwarz-Schilling have launched a proposal to tweak Ethereum’s issuance coverage to defend a balanced staking ratio, aiming to prevent likely harmful effects reminiscent of inflationary pressures on non-stakers and centralization risks.

Then all over again, this solution has sparked a contentious debate within the Ethereum neighborhood, with some individuals voicing robust opposition against altering the monetary coverage in a potential they imagine may presumably undermine Ethereum’s foundational solutions and its enchantment to institutional investors.

As James Spediacci tweeted, “It almost seems to be like a coordinated attack on Ethereum that a couple of people are suggesting adjusting the ETH issuance curve all over again and changing the monetary coverage when the SEC currently has Ethereum below a microscope.”

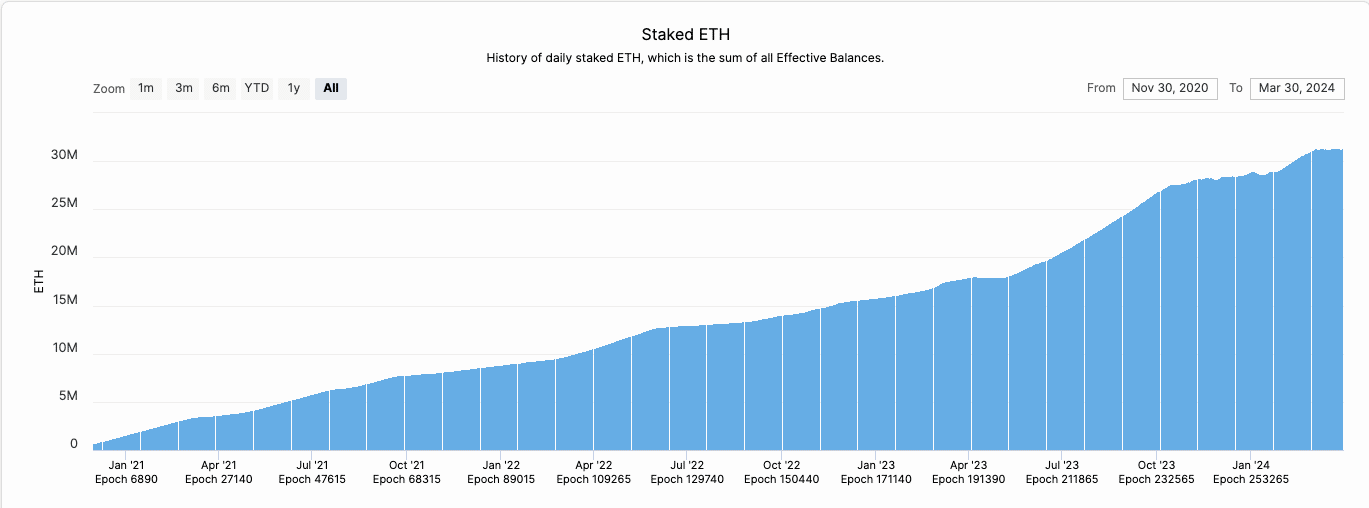

The Quantity of Staked ETH Has Been on the Upward thrust

Since Ethereum’s transition from Proof of Work to Proof of Stake 18 months previously, identified as “The Merge,” the dynamics of ETH staking have shifted dramatically. For the time being, about 31 million ETH, roughly 26% of the final present, are staked. This resolve has been on an upward trajectory, from 11% on the time of the Merge and 15% on the time of the Shapella strengthen, which enabled the withdrawal of staked ETH from the Beacon Chain in April 2023.

There are several drivers in the support of the revolutionary elevate in staking, including the final improvement in the network’s safety and balance, innovations like liquid staking providers that decrease the barrier to entry for staking, and the enticement of additional rewards. Notably, these additional rewards consist of these from Maximal Extractable Fee (MEV), to boot as alternatives for airdrop farming, which add to the beauty of staking past the well-known consensus layer rewards.

Staking Search recordsdata from Will Continue to Extend

The staking ratio is determined to elongate in the upcoming months and years, as highlighted in a weblog post by Mike Neuder from the Ethereum Foundation, due to 5 causes:

- Appreciating ETH Heed: An increasing ETH tag makes staking more honest due to better USD-denominated yields.

- Restaking Search recordsdata from: Platforms like EigenLayer are riding curiosity in restaked ETH, with the aptitude for airdrops including to the enchantment.

- Curiosity Charges: Decrease curiosity charges may presumably shift institutional capital in the direction of staking for better yields.

- Liquid Staking Tokens (LST)/Liquid Restaking Tokens (LRT): These tokens decrease the barrier to staking and are expected to intention valuable capital inflows.

- Staked ETH ETFs: The likely of Ethereum-based mostly totally mostly ETFs, which consist of staking of their model, may presumably introduce a principal modern audience to staking.

Why a Excessive Staking Ratio Would possibly per chance presumably per chance well Be Tainted

Then all over again, the prospect of a continuously increasing staking ratio raises several considerations.

“We argue that excessive staking ratio regimes attain with harmful externalities which have an tag on ETH holders, (solo) stakers, to boot because the protocol itself,” they wrote in the proposal.

Dietrichs and Schwarz-Schilling’s prognosis points out likely problems with almost all ETH being staked, in particular with a valuable half being locked in LSTs reminiscent of Lido’s stETH, Coinbase’s cbETH, or Rocket Pool’s rETH. Primarily based totally on the authors, a scenario where the staking ratio approaches 100% is troubling for several causes:

- True staking yield will diminish: Because the staking fee approaches 100%, exact yields from staking may presumably fall to zero. Though rewards from the protocol continue, the final present of ETH will increase on the identical fee, effectively nullifying exact gains for stakers.

- ETH will change into “costly” money: Excessive staking charges may presumably intention keeping ETH pricey due to elevated inflationary stress on non-stakers. When hundreds ETH is staked, people that don’t stake take into myth the amount of their ETH decrease proportionally in comparison to those that originate stake. This also can undermine ETH’s role as an economical and trustless asset on the Ethereum network.

- Threat to ETH’s standing as default forex: The costly nature of keeping ETH may presumably well venture its pronounce because the default forex of Ethereum, leading to friction in transactions and a shift in the direction of alternative tokens or protocols. Folks may presumably well open the usage of other tokens that give them rewards, like Lido’s stETH, for every day exhaust. This means ETH obtained’t be the well-known forex people exhaust on Ethereum anymore.

- Threat of centralization and “too mountainous to fail” entities: A few dominant staking tokens like Lido, which currently has 30% of all staked ETH, may presumably amass excessive affect over Ethereum’s underlying protocol, posing risks to the network’s decentralization and governance. So, if there’s a beautiful contract vulnerability in Lido’s fee, and besides they pronounce the massive majority of the network, in theory, they would presumably well fork the chain to keep a long way from their losses.

The Proposal

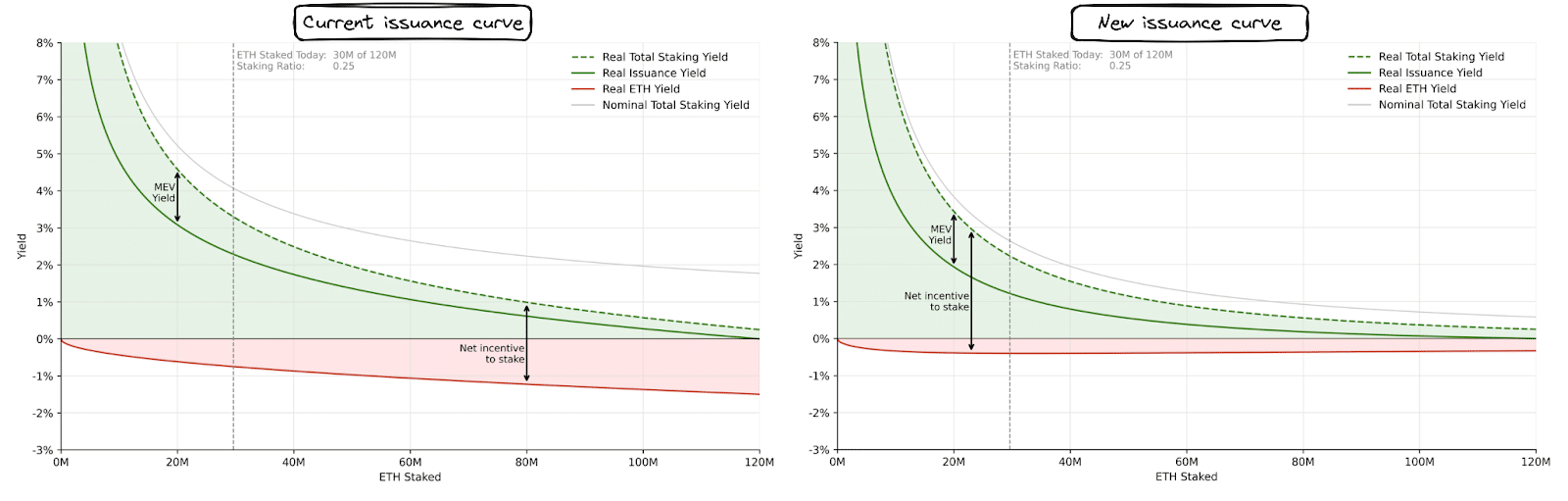

To mitigate these risks, on February 21, Ansgar and Caspar proposed a recalibration of Ethereum’s issuance curve, which involves a shift in the direction of Stake Ratio Targeting, a nuanced technique that aims for a balanced staking ratio in its place of a mounted quantity of staked ETH.

The proposed commerce aims to decrease the motivation for trace modern staking inflows by introducing a revised system for calculating staking rewards. The present issuance curve, outlined by a parameterized inverse sq. root feature, doesn’t cap rewards in a potential that prevents an excessive total staking ratio.

The modern system intends to tackle this by adjusting rewards to discourage staking past a obvious threshold, thus aiming to stabilize the staking ratio and make sure network safety with out titillating harmful externalities. While the curve obtained’t must turn harmful with out note to be efficient, a leisurely technique in the direction of zero rewards past a obvious staking level may presumably suffice to goal a lawful staking vary. As an illustration, below the present issuance curve, at 80 million ETH staked, the nominal yield would be 2%, whereas below a conceivable revised curve, the identical quantity of ETH staked may presumably yield 1%.

Then all over again, the authors don’t explicitly explain what the final word staking ratio needs to be. “It’s inherently onerous to objectively reason about it and wishes to be talked about more broadly in the neighborhood,” they wrote.

Dietrichs and Schwarz-Schilling’s proposal, premised on the assumptions that almost all ETH will at closing be staked, predominantly through Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs), is mainly about steering the network in the direction of an inevitable future below managed phrases. They argue that as staking turns into an increasing number of prevalent, the staking rewards will naturally diminish below the present issuance curve.

By proposing a commerce in the issuance curve now, while the staking ratio is soundless pretty low, they goal to regulate the incentives in a potential that preempts the aptitude harmful outcomes of an excessively excessive staking ratio. This proactive technique seeks to defend the balance and well being of the Ethereum ecosystem by guaranteeing that the transition in the direction of better staking ratios does no longer compromise the network’s safety, dilute ETH holders unnecessarily, or disadvantage solo stakers.

Detrimental Neighborhood Reaction

While the Ethereum Foundation researchers intended to tag a dialogue, the neighborhood modified into up in fingers, with the majority signaling that this modified into now no longer a unswerving suggestion for Ethereum to pursue.

Eric.eth, a co-author of one in every of Ethereum’s most critical improvement proposals (EIP-1559), is against changing the curve. “Seeing some rising dialogue from researchers and others in the neighborhood about tweaking the PoS issuance curve. The final dismiss for how onerous we’ve labored for a decade establishing ETH being money is referring to. I’ll war this concept with something I truly have,” he wrote on X.

His feedback echo some critics who explain that frequent adjustments in monetary coverage erode self belief amongst users and investors, distancing Ethereum from the “onerous money” attribute and “credible neutrality” that underpin its fee proposition, unlike the perceived balance of Bitcoin.

Gnosis co-founder Martin Köppelmann identified that changing the issuance curve “does no longer mainly strengthen Ethereum – it appropriate shifts incentives from one neighborhood to one other,” while Jon Charbonneau, founding father of DBA, said that “these tweaks strive and resolve an unsolvable venture of well-known tradeoffs in PoS.”

Additionally, altering the issuance curve may presumably dilute Ethereum’s beauty as a yield-generating asset for ETFs and institutional investors whose curiosity in Ethereum is in accordance to its present “yield” yarn. In an identical plot, initiatives constructed on Ethereum may presumably well endure as a result of shift in expectations round monetary coverage balance.

Regulatory Dangers?

Another neighborhood member identified that, in the midst of the Securities and Alternate Commission investigation of the EF, this sail is now no longer beautiful, because it may per chance truly presumably indicate that the Foundation indeed runs managerial efforts over Ethereum. Here is valuable because it’s a long way one in every of the prongs of the Howey Check, and the SEC may presumably exhaust it to argue that ETH is a safety.

I like and admire EF researchers.

We would now no longer be where we’re with out their treasured work and besides they'll support on being very critical.

But goddamnit, regularly, they’ll't read the room! pic.twitter.com/Lcau6VWpAE

— Jrag.eth (@JimmyRagosa) April 1, 2024

Debate to Continue?

Researcher Emmanuel Awoski criticized these that wouldn’t even have interaction in a conversation relating to the issuance curve. He wrote, “This day is a unswerving day to open calling out the model of anti-intellectualism that’s slowly permeating the discourse across the issuance curve commerce. No longer handiest are memes like this distasteful, besides they pronounce how low we’ve fallen as a neighborhood. Now, EF researchers are getting mocked by people that haven’t spent their days/nights obsessing about solving onerous problems. Folks whose sole contribution to crypto has been ‘I’ll pour money into some protocol and await the numbers to sail up’.”

But harmful sentiment has to this point perceived to prevail. Ryan Berckmans countered saying that “it’s now no longer anti intellectualism to display (in meme fetch or in every other case) that for all its laudable technical rigor, the issuance modification proposal fails to note an working out of common key facets of the commerce administration environment.”

Substitute, Monday, April 3, 04:15 pm ET: An earlier version of this text mistakenly displayed the title of Caspar Schwarz-Schilling as Caspar Schwarz. Unchained regrets the error.

Source credit : unchainedcrypto.com