Why Did Bitcoin’s Trace Dip as ETF Approval Nears?

Bitcoin, the oldest cryptocurrency at age 15 years, is restful demonstrating teenage volatility.

After adding better than 8% in the first two days of 2024, pushing past the serious trace threshold of $Forty five,000, BTC retreated to as low as $41,800 Wednesday morning, records from CoinGecko displays. BTC is buying and selling round $43,000 on the time of newsletter, down 5.6% in the past 24 hours. The final crypto market is in the same way down 6.7% in the identical interval, per the CoinDesk Market Index.

Anticipation has been heightened in most neatly-liked days as investors comprise anticipated that the U.S. Securities and Change Commission will approve space Bitcoin substitute-traded funds (ETFs) by mid-January. Such approvals would potentially open the restful-area of interest class of cryptocurrencies to the moderate investor loads. However total liquidations on crypto exchanges level to that Bitcoin’s most neatly-liked tumble took crypto bulls by shock.

ARVE Error: src mismatch

provider: youtube

url: https://www.youtube.com/perceive?v=TQCEw_NyJTg&t=8s

src in org: https://www.youtube-nocookie.com/embed/TQCEw_NyJTg?delivery=8&feature=oembed

src in mod: https://www.youtube-nocookie.com/embed/TQCEw_NyJTg?delivery=8

src gen org: https://www.youtube-nocookie.com/embed/TQCEw_NyJTg

All over the closing 24 hours, 203,973 traders experienced liquidation, amounting to a total of $687.38 million in liquidated cryptoassets, per crypto spinoff records-analysis platform CoinGlass. OKX, Binance and Huobi had been the head exchanges seeing essentially the most liquidations.

Trading platforms liquidate – or forcibly terminate – a trader’s space when the trader faces losses that exceed the collateral they’ve posted. Liquidations have a tendency to happen at some level of unstable trace swings akin to unexpected downturns.

What came about?

Crypto X, formerly Crypto Twitter, is awash in theories for the dip. There might be seemingly no single resolution, though many speculate that a single portray predicting the SEC will reject Bitcoin space ETFs is the perpetrator. More seemingly, the largest cryptocurrency by market capitalization slid attributable to a lot of qualitative and quantitative forces. Here are some crib notes to lend a hand form thru the noise:

Pundits punditing

Matrixport, a crypto funding products and providers provider, printed an executive abstract predicting the SEC would reject the dozen or so ETF purposes earlier than it.

The SEC will “reject all [ETF] proposals in January,” wrote Markus Thielen, CEO and head of research at financial study company 10X, as “all purposes fall looking a serious requirement that need to be met earlier than the SEC approves.”

Thielen argues that since Democrats dominate the five-person leadership of the rate and SEC Chair Gary Gensler has an anti-crypto stance, “from a political perspective, there’s no such thing as a motive to approve a Bitcoin Put ETF that will legitimize Bitcoin in its put retailer of worth.”

When Matrixport posted Thielen’s one-page executive abstract of why the SEC will reject Bitcoin Put ETFs at 5:32 a.m. EST, the worth of BTC used to be hovering round $Forty five,000. Roughly an hour later, BTC dropped about 8% to the $41,000 stage.

🚀 The Capacity Ramifications if SEC Rejects Bitcoin Put ETFs Next Weekhttps://t.co/T9oVE6bvoW pic.twitter.com/TQkb5qpGjt

— 10x Learn (@10x_Research) January 3, 2024

It’s fee noting that Thielen used to be till December the head of research at Matrixport, in keeping alongside with his LinkedIn profile. And Matrixport printed Thielen’s prediction factual sooner or later after it posted its maintain rob on its weblog, “Bitcoin Put ETF approval approaching, BTC to leap to $50,000.”

Inverse pundits inversing

More superstitious investors comprise pointed to an ongoing gag and meme centered on Jim Cramer, the ragged hedge fund supervisor and most neatly-liked host of CNBC’s Angry Money.

Dubbed “Inverse Cramer,” the shaggy dog myth refers to how BTC’s trace moves in the reverse route of Cramer’s commentary. When Cramer shares detrimental sentiments about BTC, supposedly its trace jumps, nevertheless when he expresses positivity about BTC, the worth slides, allegedly.

Tuesday in a stay television interview round 9:30 a.m. EST, Cramer declared that “Bitcoin is a technological shock and I feel americans want to delivery recognizing it’s right here to stop.”

Crypto followers on X rapidly afterward started invoking the “Inverse Cramer” meme.

FK…

I feel the Inverse Cramer BLACK SWAN is taking space correct now… DUMPING HARD pic.twitter.com/askcd4DUis

— Ivan on Tech – Moralis 🧙♂️ (@IvanOnTech) January 3, 2024

It’s the records

In step with blockchain analytics company CryptoQuant, the decline in BTC’s trace used to be a foreseeable match, as it predicted the downturn in its Dec. 28 portray in step with a lot of on-chain metrics.

First, Bitcoin holders are preserving on to giant unrealized beneficial properties. Recordsdata from the on-chain records company displays that rapid-term Bitcoin holders are sitting on excessive, unrealized income margins of better than 32% at press time, and per the portray this stage of unrealized income margin “historically has preceded trace corrections.”

Hochan Chung, head of promoting at CryptoQuant, moreover pointed out to Unchained through Telegram that BTC inflows into space exchanges “has been progressively increasing” and that miners had been shifting their BTC to exchanges, causing “promoting stress.”

The 14-day easy shifting moderate of the adaptation between bitcoins flowing into and out of exchanges has been constructive for the closing two days, highlighting how BTC inflows comprise outpaced outflows in the recent year, per CryptoQuant records. Moreover, miners, in the closing seven days of 2023, despatched roughly 14,494 bitcoins, fee roughly $622 million at on the present time’s costs to exchanges.

Worthy extra records

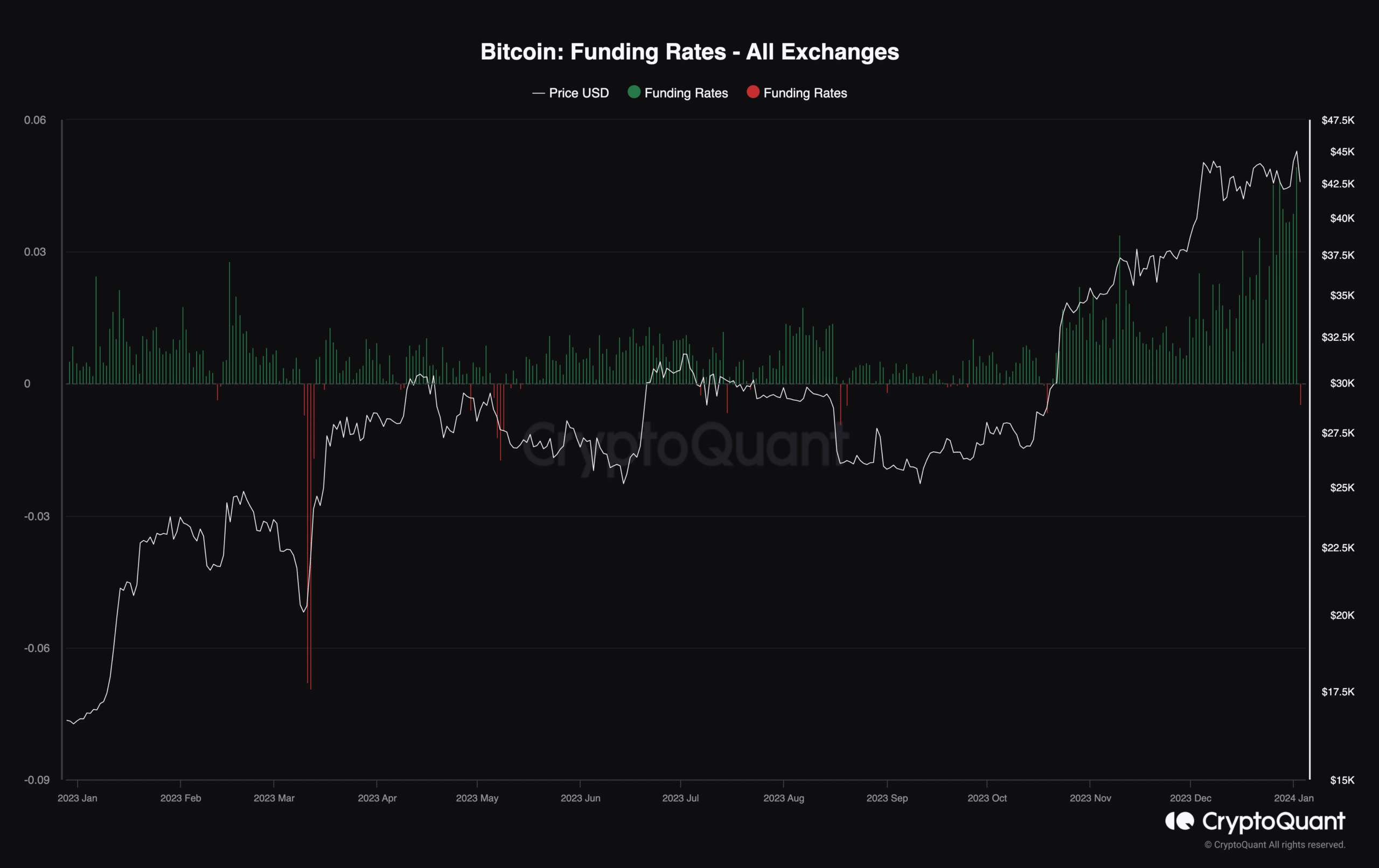

Lastly, Chung famed that “exceptionally excessive funding rates” in derivatives markets played a role in the BTC downswing.

“The spinoff markets are exhibiting the highest stage of funding rates in better than a year for Bitcoin and Ethereum, that means that traders are paying too noteworthy to open long positions,” acknowledged CryptoQuant’s portray.

The Takeaway

Whatever the explanation for the pullback – whether or now not or now not or now not it’s quantitative, qualitative, specious, or all of the above – investors look the pullback itself as a motive to quiz whether or now not space Bitcoin ETFs shall be licensed by mid-month.

“The put there’s smoke, I imagine there’s fireplace, that means somebody has recent records,” Jim Hwang, chief running officer at Firinne Capital, wrote in a textual lisp material message to Unchained. “So for me, the percentages of a Jan. 10 approval seem extra delight in a coin flip now. The energetic pullback in the markets is reflective of the leveraged positions that speculators comprise built in anticipation of an approval.”

Charles Storry, head of allege at crypto index platform Phuture, doesn’t think an ETF approval will happen in January. “I feel the SEC will fight it till the bitter stop. We’ve viewed them attain this time and time again,” wrote Storry to Unchained on Telegram.

Traders on decentralized prediction platform Polymarket remain assured that the SEC will approve as a minimal one Bitcoin ETF by Jan. 15, alternatively. In step with its website online, the probability of the noteworthy-anticipated match taking place is 83%. Though that’s excessive, it’s a cramped lower from the day earlier than, when the probability stood at 89%.

Source credit : unchainedcrypto.com