Why Bitcoin Surpassed $10k

Why Bitcoin Surpassed $10k

YFI and YFII, defined.

Given the macro ambiance plus the halving this previous spring, it seemed inevitable that the Bitcoin rate would upward push. But perchance the announcement final week that banks could maybe perchance now custody crypto, or DeFi beneficial properties making their design serve to the distinctive cryptocurrency, have been the factors that in the smash tipped the value previous $10,000.

Meanwhile, Ethereum well-known its fifth birthday, which creator Vitalik Buterin and his father Dmitry talked about on each and each podcasts. Whenever you happen to’re seeking to admire Ethereum 2.0 because it approaches, we’ve received some obvious explainers for you, plus breakdowns of what exactly goes on with YFI and YFII on this planet of DeFi. Plus, we dive into exactly what choices the Bitcoin community faces because it tries to instantaneous its next predominant upgrade by technique of comfy fork.

This Week’s Crypto Records…

Bitcoin Crosses $10k

After months of treading water, the value of Bitcoin surged previous $10,000 earlier this week. Even when it’s no longer obvious why, most unusual recordsdata has been bullish for crypto, along side the Administrative heart of the Comptroller of the Currency allowing U.S. banks to custody crypto and the pandemic’s endured dampening of the economy. Some industry analysts additionally deem that DeFi beneficial properties are being redirected toward Bitcoin.

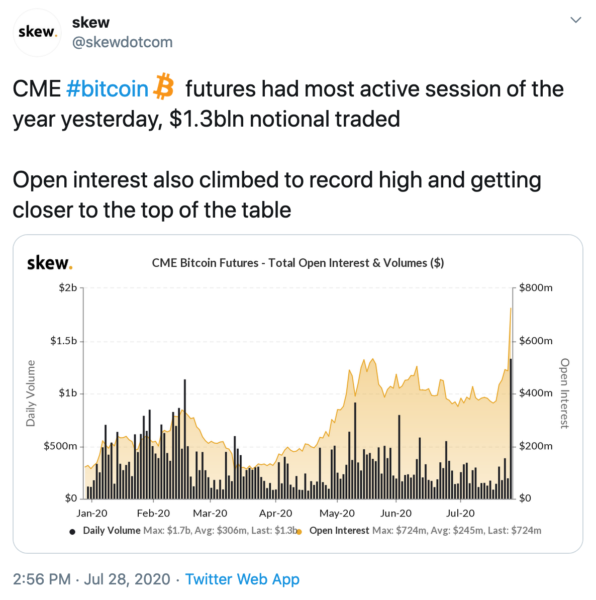

The impression used to be additionally felt on derivatives as Bakkt and CME each and each seen document volumes of their Bitcoin Futures markets.

On a facet present, Coinbase Institutional published a document on the first half of 2020 that presents a factual overview of the 300 and sixty five days in crypto to this level. It stated unique people are buying Bitcoin and an rising replacement of traders are treating it as a retailer of fee. It additionally highlighted a replacement of certain metrics in areas as huge-ranging as DeFi to stablecoins to derivatives to mining. To illustrate, ETH is up 73%, stablecoins have larger than doubled, and derivatives have additionally viewed an lengthen, with BTC alternatives tripling.

An Easy to Understand Ethereum 2.0 Primer

Ethereum 2.0 is coming, and it’s complex. Whenever you happen to haven’t fully wrapped your head around it yet, CoinDesk published a detailed but accessible document on Ethereum 2.0 that entails the complete lot from the definitions of phrases love Serenity, Casper and Shasper to explanations of why, on the initiating build aside, ETH created on Ethereum 2.0 can’t be despatched serve. It breaks down what’s going to happen in each and each portion of the transition. To illustrate, portion 0 launches the beacon chain and proof of stake, portion 1 introduces sharding, portion 2 is for deploying dapps, and portion 3 is the least defined as of yet but will possible consist of extra complex technological aspects, a lot like ones that stretch privacy. There’s additionally a deep dive into the economics of Ethereum 2.0, that could maybe perchance also end result in the advent of digital assets that would be the tokenized variations of staked ETH and rewards earned by validators.

Moreover, if you happen to’re questioning what Ethereum 2.0 will stumble on love and are seeking to hear it the vogue a legitimate friend could maybe perchance indicate it to you, evaluate out Haseeb Qureshi’s article in Bankless on DeFi in Ethereum 2.0. He writes, “Ethereum 2.0 goes to murder a bunch of shards, that can work love loosely linked blockchains. But the complete DeFi stuff will discontinuance up living on a single shard, because it all wants to coagulate together.” He extra provides, “That DeFi shard might maybe be the location where the important DeFi protocols settle—these that make presumably the most of high bustle and being linked to monumental liquidity pools for liquidations, flash loans, or no subject. Perchance there’ll possible be one predominant financial shard, love London, or two city shards with their possess specializations, love Original York City and Chicago. I request if there’s a second city shard, this could maybe be for centralized change settlement, separated from DeFi and all of its chaos.”

Moreover, ICYMI, don’t leave out the Unchained episode with Camila Russo, founding father of The Defiant and creator of a novel ebook on Ethereum, “The Limitless Machine,” who spoke in regards to presumably the most pivotal moments in Ethereum’s historical previous.

What’s the Most efficient Draw to Toughen Bitcoin?

Governance in a protocol that takes decentralization as seriously as Bitcoin does is continuously a tough self-discipline. With the Taproot comfy fork upgrade almost ready, the Bitcoin community is pondering how most effective to instantaneous the comfy fork. Whenever you happen to’re questioning what the principle factors are, a most unusual Bitmex blog submit breaks them down into:

“1. May maybe well aloof the miner threshold signalling length be adopted by a flag day activation?

2. Which diagram of the activation good judgment (if any) needs to be incorporated in Bitcoin Core?

3. May maybe well aloof miner signalling in the smash turn into mandatory?”

For the uninitiated, flag day activation refers to nodes and miners switching to a favorable code after a certain deadline whereas threshold signalling genuinely requires miners and nodes to signal enhance for a change. Bitmex created a decision tree that goes in repeat from smallest amount of centralized decision making to most. To illustrate, the smallest amount of centralization might maybe be for there to be no flag day activation and additionally no activation good judgment incorporated in Bitcoin Core. Essentially the most centralized might maybe be to require a flag day activation, a flag day in the Bitcoin Core machine and additionally for miner signalling on the tip of the length.

The document recommends a compromise where Bitcoin Core follows the Bitcoin Boost Proposal 9 (BIP 9) which accommodates “a 95% miner threshold activation good judgment with out a flag day and mandatory miner signalling,” which is in overall a Goldilocks version.

Why All people Retains Talking about YFI

On the planet of DeFi, yield farmers seem to fling high ardour charges from protocol to protocol, love lemmings perchance no longer leaping off cliffs but perchance parkouring between them. But one unique DeFi token stands a little separate — YFI. As community member Ross Galloway save it in a most unusual yEarn.Finance messaging board, “Yfi is a mechanism to divulge reward and yield-farmed tokens which are earned with the funds in yEarn’s various (and upcoming) products. It could perchance well maybe perchance also additionally capture some revenues of upcoming or fresh products, as determined upon by the community by technique of the governance course of. At its core, YFI is the token of a collective yield farm that leverages irregular facets of DeFi and Ethereum to capture yield for customers of its products.” For these of you who’ve been following the home for some time, to me, it is linked to a DAO token, if the DAO had survived. And we all know the design inflamed the sphere had been regarding the DAO which raised $150 million in 2016 — moderately the feat involving about how low crypto costs have been serve then.

On high of that, YFI used to be distributed almost love Bitcoin — in what the community perceives as a piquant distribution, at some level of which no VCs or insiders or even the creator benefited. The token used to be launched by technique of the y.curve.fi pool, in what Ross calls “a continuous farmed providing,” which he describes as “presumably the most unusual, fairest crowd sale.”

WTH Is YFII

Chinese yield farmers, sad regarding the reality that YFI could maybe perchance simplest be earned by technique of liquidity mining, forked YFI to murder YFII, which has a larger issuance plus a halving mechanism. This also can no longer seem love a mountainous deal, but this spinoff was an instance of the differences between the East and West crypto communities, with the Western DeFi community calling it a rip-off and the Chinese DeFi community hailing it as the following mountainous thing. YFII adoption exploded in China with crypto whales, extinct CeFi agencies, exchanges, mining pools and other entities adding it, while Western initiatives had a favorable response. Balancer rapidly blacklisted the YFII/DAI pool from its front-discontinuance interface, which sparked a separate debate about whether Balancer used to be genuinely decentralized. The manager analyst at TokenInsight, @minionabct summed it up in this tweet thread: “Communities in the east are no longer sizable fuss about dangers in comparison with the west, some skilled ones are spirited to ‘gamble’ to fling the high yield, and a few are inserting a tiny amount of money simply to have a study out it out and skills the excitement on such high yield.”

And talking of the East, China arrested 109 people allegedly on the serve of the PlusToken project, Bitcoin’s glorious ponzi design ever with over $3 billion value of crypto being scammed.

DeFi Roundup

There’s so significant exercise in DeFi, we’ll have a like a flash bustle by technique of of a few of the tendencies:

- With the explosion in DeFI, the replacement of contract calls to Ethereum hit an all-time high on July 25, with larger than 3.1 million every day contract calls, the majority of them being attributed to DeFi, in retaining with Coin Metrics.

- MakerDAO was the first DeFI protocol to reach $1 billion in complete fee locked. Alternatively, Kyle Samani tweeted that Complete Volume Locked or TVL is never any longer a precious metric, no longer no longer as a lot as for lending pools love Compound/Aave, because it subtracts ask from the principle metric.

- Meanwhile, Synthetix replaced the Synthetix Foundation with three DAOs, one for protocol upgrades, one to fund public goods in Synthetix, and one to control and deploy funds to contributors.

- DeFi protocol Aave additionally went fully decentralized, transferring governance from the Aave core group to AAVE token holders.

- Dharma built-in with Uniswap and enabled enhance for over 2000 tokens on the Uniswap v2 platform.

- Having a wager platform Augur launched its version 2, which integrates DeFi aspects a lot like IPFS, 0x Mesh, Dai and Uniswap’s v2 oracle community.

- And in the smash, FTX is launching a DEX called Serum on Solana. In keeping with FTX CEO Sam Bankman-Fried, “Solana can course of 10,000 events as significant as Ethereum; and it’s 1,000,000 events more cost effective.”

An Comely Draw to Search Are living Transactions

TxStreet.com is a in point of fact elegant transaction visualizer which represents Bitcoin, Ethereum and Bitcoin Money transactions as little people lining as a lot as disappear buses. On every occasion a novel transaction is broadcast on the community, an particular person appears to be like to board a bus. They earn to board the first bus if the transaction has a high ample price, in any other case they’ve to wait their turn.

Source credit : unchainedcrypto.com