Who’s to Blame for the Underperformance of Low Drift, High FDV Tokens?

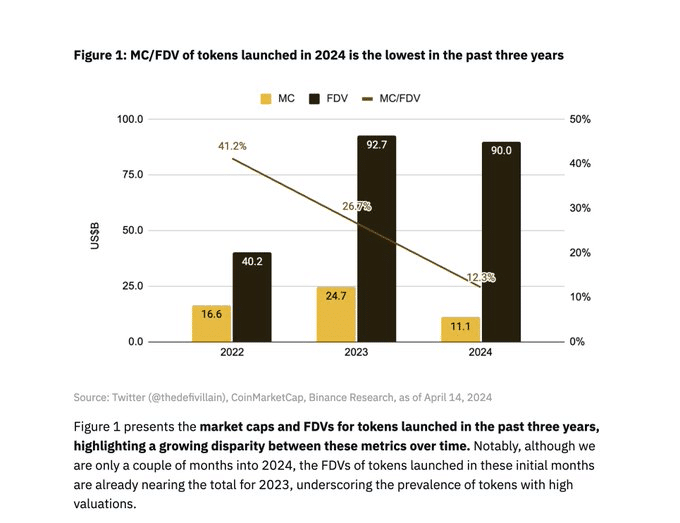

This previous weekend, a Binance document on tokens with excessive entirely diluted valuations and low initial circulating supplies, most frequently is named “low waft, excessive FDV” coins bought the crypto community buzzing.

After lots of response tweets and longer articles by crypto OGs love Cobie, Haseeb Qureshi, and others, on Monday, Binance furthermore answered to concerns relating to the rising vogue by announcing a strategic shift in opposition to checklist shrimp to medium-sized projects.

The cause for the controversy is that low waft, excessive FDV tokens most frequently go away small upside for traders after the token technology event (TGE). Analysts fluctuate on why the price of these tokens has dropped in fresh months, with some pointing to VCs, and others to market stipulations. In the meantime, there’s no agreement on a resolution on be taught the solution to distribute tokens whose cost doesn’t go down straight.

Learn more: How ‘Absolutely Diluted Valuation’ Can Be a Very Dreadful Metric for Crypto Markets to Rely On

The Binance document published Friday highlighted the negative affect of low waft, excessive FDV coins on retail investors and true community contributors. “If this kind of vogue turns into an industry norm, sustainable hiss will be more and more complex with out a corresponding inflow of capital to envision the billions of token unlocks within the impending years,” they wrote.

Right now after Binance published its document, SwissBorg researcher “tradetheflow” ignited the wider dialogue by posting on X: “Sure, as a rule, tokens launching on Binance need to not investment automobile anymore – all their upside doable are already taken away.” He furthermore illustrious that the costs of the unique tokens listed on Binance within the previous six months were all down since then, besides 5 coins, three of which were memecoins (most effective considered one of which had any VC investors nevertheless “[n]o tier 1 VC”), and JUP and JITO, whose beneficial properties he attributed to “[b]ig Solana momentum.”

Crypto OGs Weigh In—and Are Divided

In a Substack put up published Sunday, Jordan Fish, aka ‘Cobie,’ wrote that most of the upside for unique tokens is now captured privately before they even exist, leading to inflated valuations, small for public market contributors and even “phantom markets” where investors with locked tokens sell their tokens at big discounts to the public impress, indicating a dislocation between the non-public and non-non-public markets. Cobie wrote that “unique launches became uninvestable” and known as for investors to opt out of procuring for inflated FDV tokens.

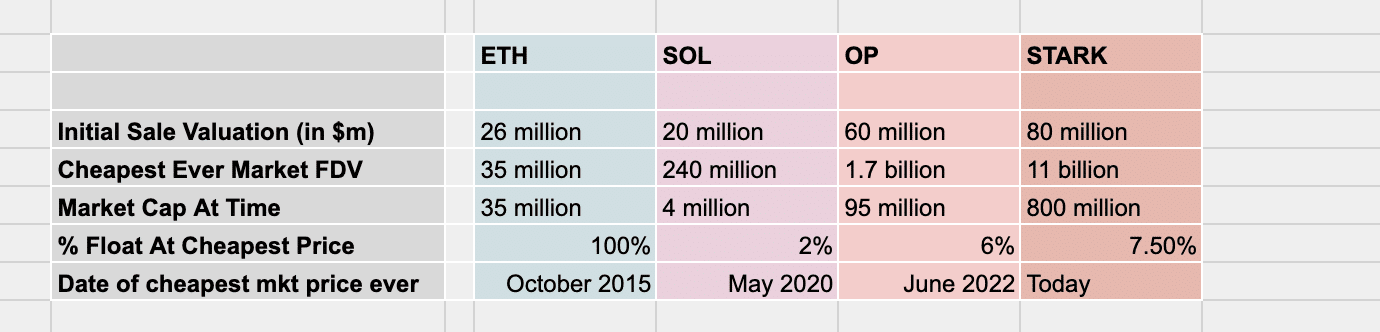

As examples, he cited the info that Ethereum’s Preliminary Coin Offering (ICO), which changed into once public, changed into once at ~$26 million, while the next seed rounds had these entirely diluted values: Solana, ~$20 million FDV; Optimism, ~$60 million FDV; StarkNet, ~$80 million FDV. He then illustrious, “trendy seed rounds for linked projects are now >$100m FDV.”

In various words, he illustrious that Ethereum’s ICO returns were 1.5x elevated than what changed into once within the marketplace, while Solana’s seed spherical returns were 10x elevated than what changed into once within the marketplace, OP’s seed spherical returns were 30x elevated, and STRK’s seed spherical returns “are infinity instances elevated than those available at market, because nowadays is STRK’s lowest ever impress, which methodology all public market customers possess misplaced money — nevertheless the seed is up 138x.” He concluded, “As you would look, the returns are more and more captured in non-public.”

He talked about the core reveal with low waft, excessive FDV coins is that “essentially indubitably since the price discovery has taken field in a non-public market that’s both rigged, delusional or each and each.”

Learn more: What Is Tokenomics? A Newbie’s Recordsdata

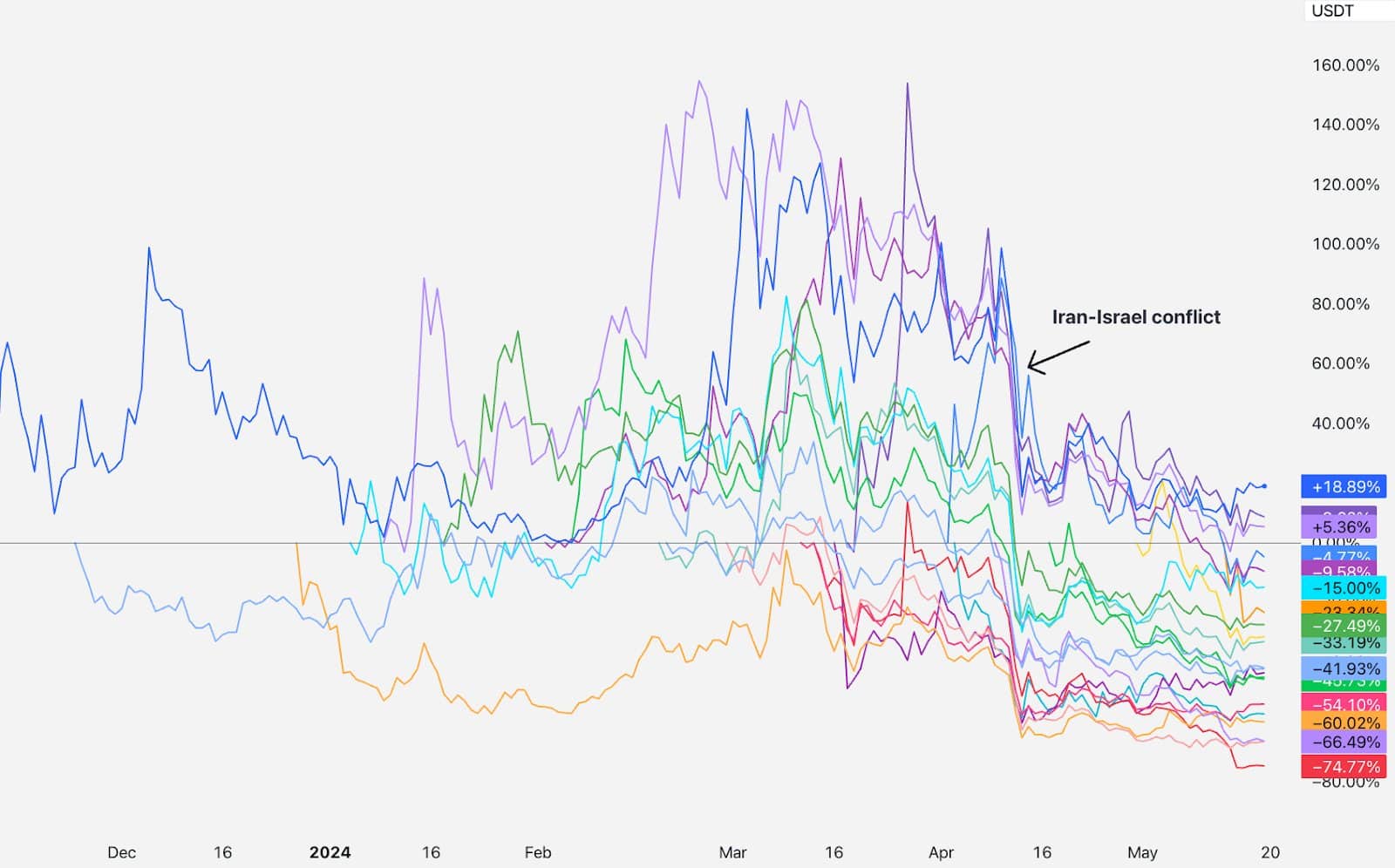

On the various hand, in a prolonged 11-minute be taught on X, Haseeb Qureshi, managing partner of crypto VC firm Dragonfly, examined three theories about why low waft, excessive FDV tokens are struggling: VC dumping, retail investors favoring memecoins, and inadequate supply for impress discovery. After an wide prognosis with charts debunking every of these theories, Qureshi then confirmed a chart that started in uninteresting 2023 (a shorter timeframe than Cobie’s prognosis) of how the costs of your whole coins listed on Binance (and analyzed by Swissborg’s tradetheflow) took a nosedive in mid-April. “For the first couple months, these tokens mostly traded about flat from their listings, except mid April,” he wrote. “Without notice Iran and Israel started threatening WW3, and markets tanked. Bitcoin recovered, nevertheless these coins didn’t.”

Also, Qureshi pointed out that the Binance chart that has dominated Crypto Twitter is injurious: “My brother in Christ, I changed into once around in 2022, projects were not launching with circulating supplies of 41%.”

Is There a Solution?

Addressing the considerations with low waft and excessive FDV tokens has sparked various solutions from industry consultants. In his article, Qureshi reviewed a few proposed alternatives, together with bringing support ICOs, unlocking 100% of tokens straight, the use of bookrunners love mature IPOs, and checklist tokens at decrease costs. Nonetheless, he realized these alternatives both impractical or ineffective. As an different, Qureshi suggested that free markets will naturally factual mispricings over time, asserting that market forces would push for decrease FDVs, exchanges would adjust their checklist systems, and VCs would keep up a correspondence realistic valuations to founders. “[I]f you is vulnerable to be a crew whose token went down, don’t terror,” he wrote. “You’re in factual firm. Endure in mind: AVAX changed into once down ~24% 2 months after checklist. SOL changed into once down ~35% 2 months after checklist. NEAR changed into once down ~47% 2 months after checklist.”

Learn more: 5 Most effective Airdrop Practices All Crypto Protocols Will possess to serene Note

Rob Hadick, regular partner at Dragonfly, emphasised the necessity for a elementary shift in how tokens are issued and valued: “The appropriate formula to remedy right here’s go in opposition to a variable supply of tokens in protocols subject to governance for unique issuance (vs mounted supply).” Hadick argued that the latest system incentivizes immediate-term beneficial properties and detrimental habits from founders and VCs, hurting retail investors and pushing them in opposition to memecoins. By rising the proportion of liquid tokens at beginning and adopting a variable supply methodology, he talked about he believes the market can foster more fit dynamics and noteworthy impress discovery.

Wassielawyer, a pseudonymous crypto attorney, had a new belief: “Per chance low waft excessive FDV coins need to serene switch to impress essentially based entirely unlocks vs time essentially based entirely unlocks. Very coarse instrument nevertheless if people know VCs can’t beginning dumping except 1b FDV reasonably than three months from TGE there’s a small bit more alignment.”

Davo, chief janitor at Solana-essentially based entirely dapp Poke with the waft, suggested one other doable resolution: launching tokens at the closing non-public spherical valuation. “A venture that launches at a low FDV that enables its community to amass at cheap costs goes to be far more anti-fragile and resilient when in contrast in opposition to the community member who buys for hype at an inflated impress most effective to skills down-most effective circulate,” he wrote. By aligning the beginning impress with the latest non-public valuation, he talked about he believes projects can steer certain of artificially inflated costs and verify that early supporters catch pleasure from the venture’s success.

Source credit : unchainedcrypto.com