Who Is NOT Insolvent? 😬

November 14, 2022 / Unchained Each day / Laura Shin

What’s Poppin’?

May well FTX’s Economic spoil Put off a Domino Quit?

by Juan Aranovich

FTX filed for monetary spoil after a chaotic week. Can crypto continue to exist the contagion effects?

Bahamas Securities Price Says It Didn’t Authorize FTX Withdrawals

by Samyuktha Sriram

An announcement from the Bahamas securities regulator denying that it directed FTX to beginning up withdrawals for Bahamian purchasers has fueled speculation that FTX outdated an excuse to abet insiders in sharp funds off the trade.

Crypto.com’s ‘Unintended’ 320K ETH Switch Fuels Insolvency Rumors

by Samyuktha Sriram

Crypto trade Crypto.com says it mistakenly sent 320,000 ETH to a Gate.io pockets within the final week of October.

Serum Fork within the Works Amid Fears That FTX-Owned Upgrade Keys Are Compromised

by Samyuktha Sriram

Solana builders indulge in deployed a fork of Serum after concerns that an FTX-owned give a elevate to contract would possibly per chance per chance also had been compromised this weekend.

Rug Pull or Exploit? $17M Drained From FLARE Token

by Samyuktha Sriram

A Binance Neat Chain-based mostly mission misplaced $17 million in an exit scam, in accordance with evidence from blockchain security companies.

Binance Forms Commerce Recovery to Fight FTX Contagion

by Samyuktha Sriram

Binance acknowledged this can abet stable initiatives strapped for money with an industry restoration fund aimed at rebuilding the industry.

In Other News… ✍️✍️✍️

- Sam Bankman-Fried constructed a “backdoor” to his FTX trade to trade monetary facts and switch funds with out alerting others.

- Kraken iced up the accounts owned by FTX and Alameda Compare on its platform.

- California’s Division of Monetary Protection and Innovation (DFPI) announced an investigation into the failure of FTX.

- The Ontario Lecturers’ Pension Understanding had $95 million in FTX, however acknowledged this can indulge in a “restricted impact.”

- FTX spent $74 million in residential property within the Bahamas for the length of 2022, in accordance with authorities documents obtained by The Block.

- Amy Wu, a inclined accomplice at Lightspeed Project Companions, resigned from her predicament with FTX Ventures.

- Crypto trade Huobi reported $3.5 billion worth of reserves.

- Crypto.com (disclosure: sponsor of Unchained) holds 20% of its reserves in meme coin Shiba Inu.

What Carry out You Meme?

Advised Reads

- The Block’s MK Manoylov on the narrative of NFT royalties

- Haseeb Qureshi, managing accomplice at Dragonfly, on what’s next for the industry

- The Data’s Margaux MacColl on Sam Bankman-Fried

On The Pod…

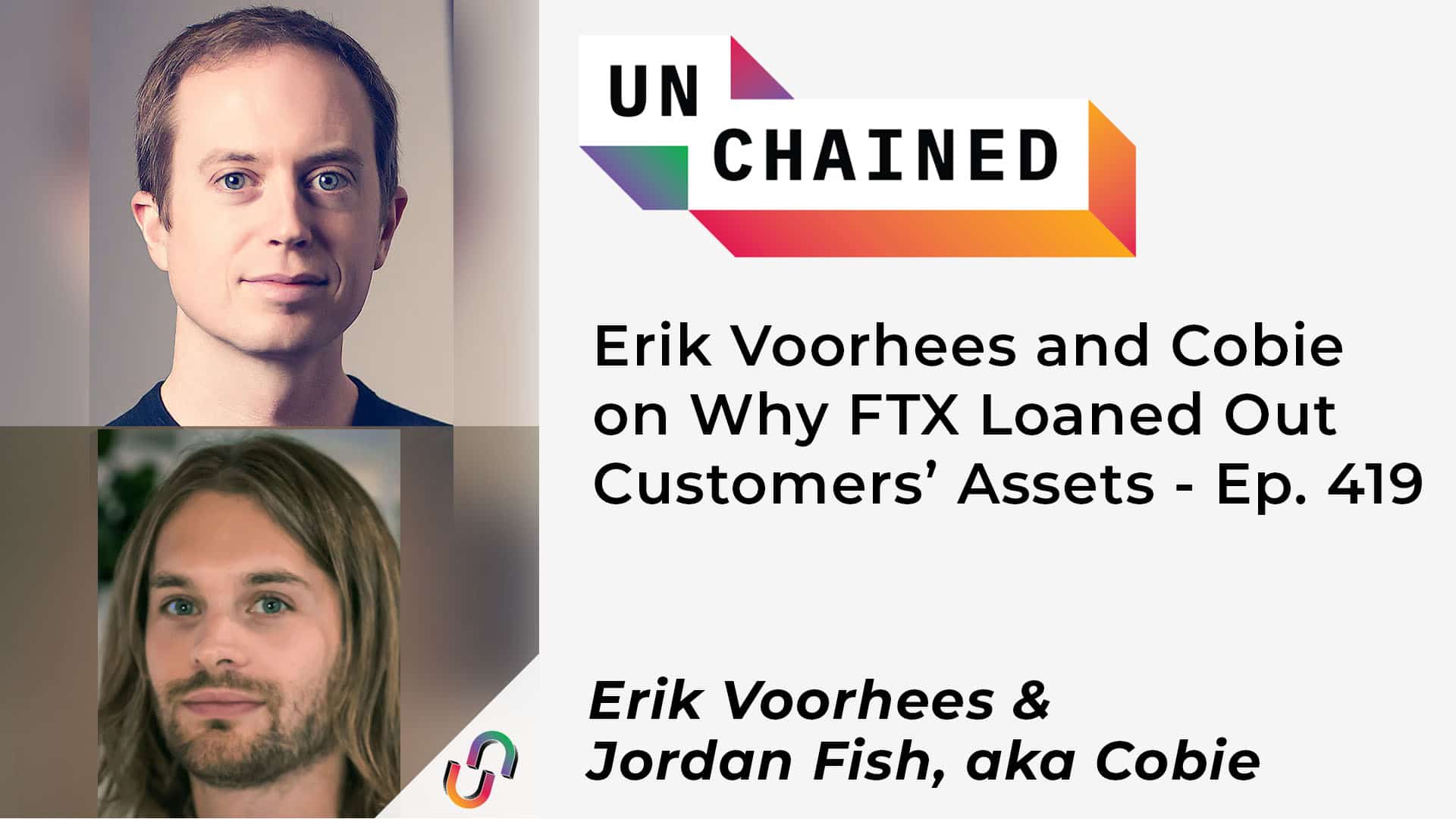

Erik Voorhees and Cobie on Why FTX Loaned Out Customers’ Sources

Erik Voorhees, founder of ShapeShift, and Jordan Fish, aka Cobie, crypto investor and host of UpOnly, discuss the give blueprint of FTX. Expose highlights:

- the links between FTX and Alameda and what kickstarted the blowup of FTX

- why Erik and Cobie mediate that Bankman-Fried’s habits used to be “sociopathic”

- why the $10 billion gap is so shocking to Cobie pondering the advantages that FTX had as an organization

- whether or not this would indulge in ever came about if the costs hadn’t plummeted within the indulge in market

- why Erik believes that SBF’s donations to both political parties are bribery

- the likelihood that this can discontinue in criminal charges

- how blockchain technology is the resolution to the distress of centralized exchanges doing things at nighttime

- Erik’s response to Bitcoin maximalists who boom FTX used to be triggered by altcoins

- how extensive the contagion would be within the industry

- Erik’s message to regulators and whether or not SBF used to be aligned with the values and the ethos of crypto

E book Change

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Tall Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now on hand!

You would possibly per chance per chance also buy it here: https://amzn.to/3CvfrbE

Source credit : unchainedcrypto.com