Who Acquired the Greatest Immense Bowl Ad Bump?

February 14, 2022 / Unchained Day-to-day / Laura Shin

Day-to-day Bits ✍️✍️✍️

-

The US Treasury reiterated that crypto stakers, miners, or coders would possibly perhaps now not be realizing to be “brokers” by the IRS.

-

PancakeSwap is reportedly location to dam users from Iran.

-

CryptoPunk #5822 bought for $23.7 million in ETH closing week – the most costly CryptoPunk sale ever.

-

Coinbase’s evolved shopping and selling platform resolved a predominant vulnerability on Friday thanks to a white hat hacker.

-

FTX.US will seemingly be offering stock shopping and selling quickly.

-

Bitcoin’s hash price jumped 30% over the weekend to a brand original ATH.

-

OpenSea launched a endeavor arm to relieve NFT and web3 companies.

-

Evmos, a Cosmos-based mostly mostly project that targets to link up the Cosmos and Ethereum ecosystems, will seemingly be airdroppingrewards to Ethereum and Cosmos users.

-

Bud Mild is giving out bodily glasses to N3XT NFT holders.

-

Block, Argo, and Griid are lined up to aquire Intel’s original blockchain accelerator later this one year.

This present day in Crypto Adoption…

-

Uber’s CEO acknowledged the firm will accept crypto at some level.

-

World Natural world Fund reneged on plans to fund conservation thru NFTs after backlash.

-

Jamaica is decided to roll out a CBDC in 2022.

- The Bitfinex hack and money laundering memoir is coming to Netflix.

The $$$ Nook…

-

Binance invested $200 million in Forbes and Magnum Opus Acquisition Puny, which is a SPAC, to mosey public on the Original York Inventory Exchange. (Disclosure: Forbes is my used employer.)

-

Everyrealm, a digital precise-estate investor, raised $60 million in a funding round led by a16z.

-

Ethernity, an NFT market, raised $20 million in seed funding.

- Dom Hofman, the co-founding father of Vine and creator of Loot, raised $12 million from Paradigm for Sup, the parent firm of the NFT project Blitmap.

What Elevate out You Meme?

What’s Poppin’?

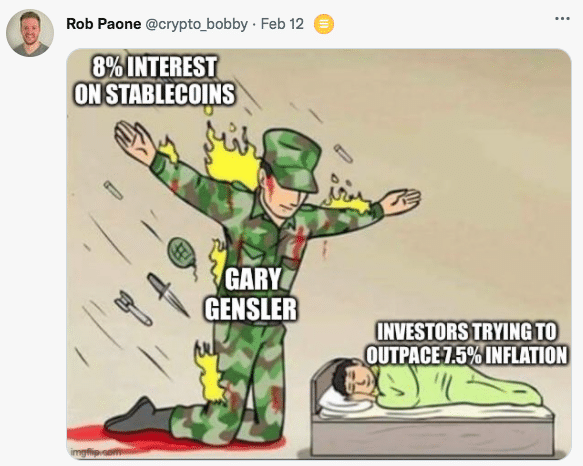

SEC Slaps BlockFi With $100 Million Stunning

BlockFi, a smartly-liked crypto lending platform, is reportedly location to pay $100 million to the Securities and Exchange Price and snort regulators as quickly as subsequent week. $50 million will seemingly be dropped on the SEC, and $50 million will seemingly be sent to varied states, in step with Bloomberg.

The $100 million will mosey towards settling investigations concerning whether or now not BlockFi’s interest-incomes accounts, the build customers lend their digital property to BlockFi in return for yield, are securities choices. As allotment of the settlement with regulators, most People would possibly perhaps now not be ready to originate interest-yielding accounts, experiences Bloomberg, citing folks acquainted with the topic.

BlockFi has been below scrutiny since closing summer when five states issued either terminate and desist or record-motive notices towards BlockFi. Coinbase additionally had a dawdle-in with regulators over its excessive-yield product, dubbed Lend, which it needed to shut down earlier than launching after the SEC threatened to sue.

On Twitter, BlockFi CEO Zac Prince well-liked that the firm has been in “productive” dialogue with regulators and that BlockFi does “now not commentary on market rumors.” He additionally added that contemporary BlockFi accounts will continue functioning as expected. “Prospects’ property are safeguarded on BlockFi’s platform and BlockFi Curiosity Fable consumers will continue to salvage crypto interest as they always bear in mind!”

If Bloomberg’s document proves supreme, $100 million would be certainly one of many supreme fines ever levied towards a crypto firm by the US.

The news precipitated Digital Currency Team’s CEO Barry Silbert to predict that the SEC will now not terminate at centralized lending platforms. “It’d be naive to judge that the SEC and snort regulators are going to supreme-attempting BlockFi $100 million, but now not mosey after DeFi lending platforms as smartly (how, I don’t know),” he wrote on Twitter.

On the opposite hand, Arca CIO Jeff Dorman disagreed: “Blockfi has been working an unregistered hedge fund for years with zero disclosures to depositors in phrases of what they carry out to generate yield. DeFi lenders are 100% clear in regards to how it in fact works and the build yield comes from. You furthermore mght shall be comely, but now not apples to apples.”

Whereas we are in a position to also bear in mind to back to search out how regulators will contrivance DeFi, it can perhaps perhaps now not be too grand longer unless other centralized lenders advance below the same fire, as Bloomberg reported in January that the SEC is additionally scrutinizing Celsius, Gemini, and Voyager Digital.

Bonus What’s Poppin’

Crypto Immense Bowl Ads Attract Beginners

Within the center of the day past’s Immense Bowl, crypto behemoths confirmed up sizable time, with crypto exchanges Coinbase, FTX, and Crypto.com(disclosure: a sponsor) working silly adverts (as smartly as to crypto being talked about by TurboTax and eToro).

Basically based completely on Twitter, FTX looks to bear in mind won the night. As reported by The Block’s Frank Chaparro, the change added 100,000 followers closing night, bringing its total from 415,000 to above 535,000 after it ran an advert headlined by the famed curmudgeon Larry David (from Curb Your Enthusiasm and Seinfeld) fake denouncing inventions love democracy, transportable song, and, needless to claim, crypto.

Chaparro well-liked that Coinbase won a mere 50,000 or so followers (even though the change already had 4.7 million followers). Talking of Coinbase, its commercial used to be a ways extra functional than FTX’s. The change’s minute-lengthy advert confirmed a QR code bouncing all the map in which thru the display conceal conceal; viewers that scanned it’d be invited to participate in a $3 million giveaway. (Clearly, Coinbase then needed to throttle relieve salvage admission to to its internet site attributable to increased traffic.)

Whenever you missed the recreation or were logged out of Twitter, you’ll doubtless be in a position to take a look at out all of the crypto-commercial bid material on this thread:

Cover: The recreation, which the Rams won, featured a famous individual-studded halftime record in which Snoop Dogg wore an NFT.

Suggested Reads

-

@thomasg_eth, a DAO founder, used to be lately focused by a elaborate social engineering rip-off. Here’s what he realized:

-

RAC, a Grammy award-a hit artist, on money, song, and NFTs:

-

brunny.eth within the marketplace cap of Ethereum:

On The Pod…

How Regulations Enforcement Tracked Down $3.6 Billion in Bitcoin

On Tuesday, the US govt seized $3.6 billion in bitcoin from the 2016 Bitfinex hack and arrested two participants, Ilya Lichtenstein and Heather Morgan, on charges of money laundering. Tom Robinson, cofounder and chief scientist on the blockchain analytics firm Elliptic, breaks down how law enforcement used to be ready to rob the BTC, what programs the alleged money launderers feeble to manual certain of capture, and who would possibly bear in mind pulled off the preliminary hack. Indicate highlights:

-

background on the 2016 Bitfinex hack

-

who used to be arrested this week and why

-

how the US govt won salvage admission to to the non-public keys in Lichtenstein’s and Morgan’s retain an eye on

-

why AlphaBay, a now-defunct darknet internet site, used to be crucial to law enforcement’s effort to be aware down the stolen Bitfinex funds

-

what money laundering programs were feeble to money out the stolen Bitfinex funds earlier than this week’s arrests

-

whether or now not, as blockchain analytics technology advances, this can always salvage up so that you just would possibly perhaps trace the movements of crypto as its laundered

-

why the consume of Monero, a privateness coin, to money out stolen funds is a pink flag

-

why Tom would now not judge the two participants arrested this week for money laundering the stolen Bitfinex funds were the fresh hackers

Book Replace

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Immense Cryptocurrency Craze, is now on hand for pre-affirm now.

The e book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-affirm it today!

You furthermore mght can aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com