White Dwelling Stories on Crypto Flop

September 19, 2022 / Unchained Day-to-day / Laura Shin

Day-to-day Bits✍️✍️✍️

- Because of a worm in Binance’s accounting plot, there became as soon as a $19 million misallocation of HNT tokens.

- Blockchain tool developer Infura plans to launch a decentralized protocol next one year.

- Celsius asked the industrial end court for permission to promote $23 million of stablecoin holdings.

- The value of ETH fell greater than 20% in one week.

- The SEC and Ripple Labs are both calling for a straight away ruling in the case over XRP being a security.

- After the Merge, Grayscale filed for rights to over 3 million ETHPoW tokens.

- Ethereum’s proof of work fork token (ETHW) plunges over 60% a day after launch.

- Cybersecurity company BlockSec mentioned there like been replay exploits in the Ethereum proof of work fork.

- The US SEC filed fraud charges against a crypto investment advisor in connection with the $4.3 million he raised from investors.

- Construct Kwon mentioned he’s “not on the ride,” and is cooperating with authorities.

Currently in Crypto Adoption…

- Satschel, a Web3 compliance company, raised $5.2 million.

The $$$ Nook…

- Ex-Fortress Securities executives raised $50 million for crypto market maker Portofino Technologies.

- Binance Labs, the company’s VC arm, doubled down on Aptos investment before its launch.

- Token administration platform Magna closed a $15 million funding spherical.

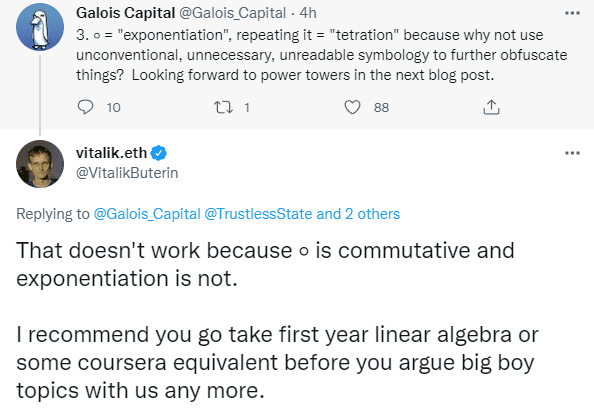

What Construct You Meme?

What’s Poppin’?

The White Dwelling Released a Framework for Crypto, Nonetheless Many Are No longer Joyful

by Juan Aranovich

On Friday, the White Dwelling printed the “first ever comprehensive framework” for digital sources and cryptocurrencies.

Support in March, President Joe Biden issued an govt bellow, by which the government laid out its policy targets for the crypto home. The EO requested agencies to show veil a sequence of experiences to Biden’s assert of business on the facts surrounding the industry.

In the framework, the government outlined the conclusions and suggestions of the experiences these federal agencies like conducted after examining the crypto industry.

Even supposing this framework is not the the same as regulation, which is extremely awaited, it affords a splash to working out how the government is pondering crypto. The experiences emphasize the ability risks of crypto, both for investors and likewise for monetary balance.

The epic cites the collapse of Terra as one among the examples of crypto triggering instability, blaming it for wiping out $600 billion. (Technically, Terra solely represented a $60 billion wipeout. Financial analysts inform that the final $540 billion vanished almost definitely attributable to macroeconomic prerequisites.)

Here are one other takeaways from the White Dwelling’s framework:

- The SEC and the CFTC are likely the agencies that will retain watch over the industry. The administration is asking on the SEC to “aggressively pursue” crypto initiatives which could be not complying with securities regulations and practice enforcement actions.

- The US Treasury will work with monetary institutions to “bolster their potential to identify cyber vulnerabilities” and might presumably honest peaceful be accountable of monitoring risks related to digital asset markets. The company will work in cooperation with international organizations like the Organization for Financial Co-operation and Pattern (OECD) and the Financial Balance Board (FSB).

- The govtis drawn to reinforcing the US’s “world monetary management.”

- The US Treasury and the Federal Reserve will likely be accountable for exploring the possibility of a central monetary institution digital currency (CBDC).

Industry investors and institutions had been eagerly looking at for the launch of this framework. Nonetheless, there like been mixed reactions.

“Currently’s experiences and summaries from the Biden administration’s govt bellow on digital sources are a disregarded opportunity to cement U.S. crypto management,” mentioned Kristin Smith, the Blockchain Affiliation president, in a press launch, noting that the framework centered more on risks than opportunities.

Besides, in step with Sheila Warren, CEO of the Crypto Council for Innovation, the experiences are “out of date and unbalanced.”

Nonetheless, there like been others who took the experiences more positively. “It’s good to appear on the US transferring towards a proposed crypto framework,” mentioned Binance CEO Changpeng Zhao on Twitter.

With regards to the CBDC construction, Obtain. Tom Emmer mentioned, “In the abominable fingers, retail central monetary institution digital currencies might be crooked trusty into a surveillance tool.”

Advised Reads

- Vitalik Buterin on layer 3s

- a16z crypto on the ingredients of the metaverse

- Nikolas on setting up a minimal viable community

On The Pod…

Did the Merge Make Ethereum ‘the Most Obtain Blockchain in the World’?

Justin Drake, researcher on the Ethereum Foundation, talks about the Merge, how this transition impacts Bitcoin, the put Ethereum’s avenue blueprint is going, and more. Present highlights:

- how Justin became as soon as feeling before and by the Merge

- whether or not the toughen is total or there are other things to search around out for

- why Ethereum has slashing and why it’s far a greater invent of weeding out any attackers

- the difficulty about centralization attributable to liquid staking derivatives services, like Lido or Coinbase

- how the Merge impacts MEV and the long-term imaginative and prescient of proposer-builder separation

- whether or not the Merge locations tension on BTC to also transition to proof of stake

- what affect ETH’s more deflationary nature might like on BTC’s epic as digital gold

- why Ethereum is the settlement layer for the online of value

- whether or not there is a winner draw shut all dynamic in the blockchain industry

- why Ethereum is more right than Bitcoin, in step with Justin

- what Justin thinks about the ETHPoW fork and its body of workers and the hazards of interacting with it

- the next steps in Ethereum’s roadmap

Book Change

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Beefy Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now readily accessible!

You will almost definitely be ready to aquire it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com