What Data Will Reach Out in the Binance Lawsuit?

Plus, 9 reasons Bitcoin is near its ATH

Binance is taking on the media with a defamation lawsuit in opposition to Forbes filed in the U.S. District Court in Unique Jersey over Forbes’ October fable reporting on the leaked “Tai Chi” yarn. Bitcoin has seen one among its most bullish weeks in years, with the value continuing to fly shut to all-time highs. And one other billionaire has published that he is invested vastly in Bitcoin.

There’s slightly a range of regulatory recordsdata this week, a few of it bullish, a few of it map more cloudy. The ETH 2.0 group hosted its most contemporary AMA, there’s been one other wave of DeFi assaults, and one among the early ICOs is facing solid pushback from one among its first traders.

On Unchained, Jake Chervinsky and Kristin Smith discuss about the looming battle round privacy in the crypto world — one which threatens the overall premise of transactions undercover agent-to-undercover agent from self-hosted wallets. And on Unconfirmed, Nic Carter dives into 9 metrics that time to the Bitcoin rally this time has arrive one day of a more ragged market than we saw the last time the Bitcoin tag was as soon as this high.

This Week’s Crypto Files…

Binance Is Suing Forbes for Defamation

Binance Holdings Restricted has filed swimsuit in opposition to Forbes and two journalists for defamation. The lawsuit comes after Forbes published an article last month detailing alleged regulatory evasion by the crypto alternate. Binance is claiming injure by the fingers of Forbes journalists Michael del Castillo and Jason Brett over a fable they are saying “incorporates a expansive quite quite loads of of groundless, deceptive and defamatory statements.” Binance is worrying the fable be taken down and is furthermore asking for punitive damages.

Stephen Palley, partner at Anderson Homicide, tweeted a screenshot of the lawsuit, in which Binance claimed, “Importantly, Binance would not violate, and fully complies with, all relevant laws, guidelines and guidelines in its operations,” and commented, “Given the indisputable truth that truth is an absolute defense to a defamation claim the discovery on this particular claim goes to be though-provoking.”

Tensions were rising for some time between Binance and the tips media. Ironically, this lawsuit comes the same week that a community of crypto journalists (disclosure: at the side of me) fashioned The Association of Cryptocurrency Journalists and Researchers, which aims to “present training, mentorship, and training to make certain practitioners aspire to the ideal ethical and journalistic standards.”

Bullish Bitcoin Signals Roundup

- Grayscale Investments’ salvage resources below management like surpassed $10 billion.

- Bulk orders for basically the most contemporary and most highly efficient ASIC miners are offered out except spring, and there’s increased quiz from institutions out of doors China.

- Skyrocketing Bitcoin costs like resulted in unique highs in Bitcoin derivatives markets, with CME open interest in its Bitcoin futures crossing $1 billion, an all-time high.

- Mexican billionaire Ricardo Salinas Pliego, the founding father of Grupo Salinas, published in a tweet on Wednesday that 10% of his resources are in Bitcoin. He said, “Bitcoin protects the citizen from govt expropriation.”

Regulatory roundup

- SEC chairman Jay Clayton is stepping down from his post at the tip of this year, months forward of his deliberate June 2021 departure. This recordsdata was as soon as principally welcomed by those in the crypto put, with Larry Cermak of The Block tweeting that this boded well for a prolonged-awaited Bitcoin ETF. Surprisingly, on CNBC, Clayton furthermore said the inefficiencies of present cost techniques like driven the upward thrust of Bitcoin.

- Acting Comptroller of the Forex Brian Brooks has been nominated to a stout 5-year term leading the national monetary institution regulator. Whereas the nomination itself is determined for crypto, CoinDesk’s Nikhilesh De tweeted why “Brooks’ course forward is murky,” citing an upcoming shakeup in the Senate Banking Committee.

- Sian Jones, who has been a well-known participant in crypto anti-money laundering guidelines, talking at the 2nd annual V20 Digital Asset Carrier Services Summit, said the Monetary Action Task Pressure needs to take a completely unique technique to the map it polices crypto. She said that the FATF is trying to graft present AML guidelines onto crypto intermediaries when the core of crypto is to transact without intermediaries. She suggested the regulators search more intently at DeFi. While you neglected Sian on Unchained in August discussing why the stir rule is one among a in reality exceptional crypto guidelines, test out the episode here.

The Most contemporary AMA on Ethereum 2.0

The Ethereum Foundation’s Ethereum 2.0 study group hosted its fifth Reddit AMA on Wednesday, answering a bevy of technical questions, and naturally, questions about the drawing shut starting up of the unique protocol. Sizzling subject issues included alternatives for backup plans to starting up in 2020 if the 16,384 validators wished for starting up aren’t reached by November 24th. Vitalik said, “from a technical standpoint (which is basically the most simple thing the devs can preserve watch over) eth2 did starting up in 2020; what occurs from here is entirely up to the neighborhood.”

After the AMA, Vitalik tweeted one among his replies to the quiz, “What’s the max present of ETH?” Vitalik answered, “Realistically, for the subsequent ~3 years, Ethereum will likely be an ecosystem below fleet transformation.” He then named a quite quite loads of of the technical shifts, resembling transition from POW to POS, and said contributors should not be in Ethereum this day because they imagine in conserving and stabilizing basically the most contemporary guidelines, but because they imagine in the roadmap and that, after the upgrade, “we in reality will gain to a put of dwelling where the network is efficient and steady and highly efficient and capable of being the rotten of mighty parts of the enviornment economy.” Then he said over the subsequent two years, the issuance will likely be 4.7M, after which after that up to 2 million a year minus costs, noting that that would possibly well maybe be increased than issuance.

DeFi Hack Roundup

- On Tuesday, Origin Protocol misplaced $7 million in funds in a reentrancy assault the usage of a flash mortgage that initiated a rebase, artificially inflating the provision of OUSD protocols, which were then swapped for Tether.

- An attacker drained $6 million from the Rate DeFi Protocol — every other time the usage of a chain of complex tricks at the side of a flash mortgage.

Arca Says Gnosis Might maybe honest aloof Pay Aid Traders

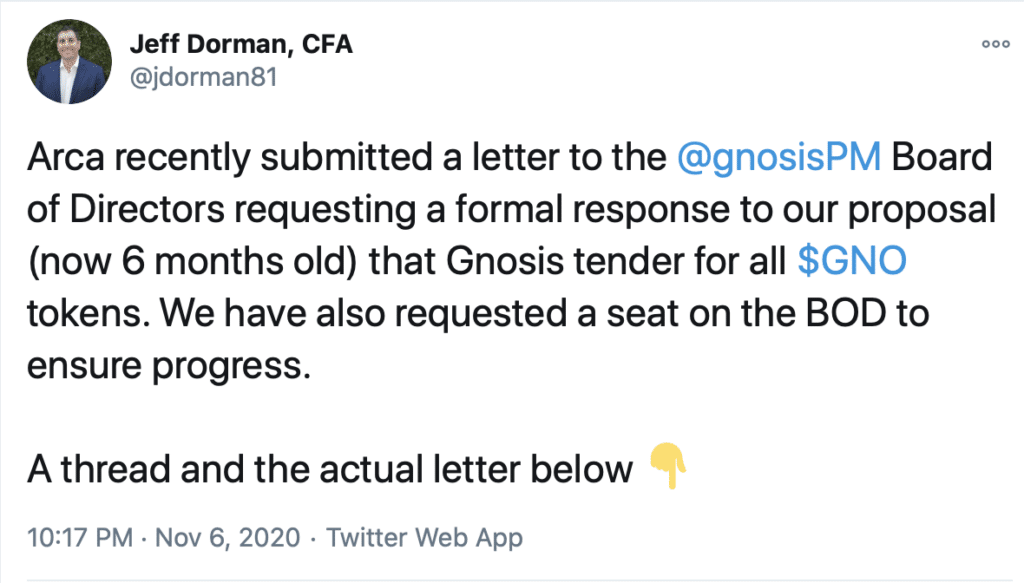

Cryptocurrency investment firm Arca, one among the well-known traders in decentralized prediction market Gnosis, which held an ICO in 2017, has known as for traders’ money to be returned and for the mission to be overhauled. Arca CIO Jeff Dorman tweeted:

Arca beneficial properties to changes in Gnosis’ product roadmap and mismanagement of its treasury, arguing that in consequence, the mission’s merchandise like failed to manufacture traction. Furthermore, the letter claims that the Gnosis group has deviated from the white paper and irresponsibly managed mission funds. Arca has outlined a quite quite loads of of ideas for Gnosis, at the side of buying encourage tokens from holders which, “would allow Gnosis to bolt as a lean startup, rework the token’s consume instances and redistribute the the relaxation tokens in characterize to form network effects on present merchandise.” Gnosis cofounder Martin Koppelman said in a assertion to The Block, “we had already been working on an quite quite loads of course for the GNO token, which we concentrate on is map more appealing. Our comprise proposal incorporates a Gnosis DAO and offers map more ownership to GNO holders. This would possibly well maybe also be presented to the neighborhood very soon.”

Crypto Twitter had an very ultimate time with the “this claim is disputed” flag on Twitter this week, applying it to all sorts of tweets, resembling this one by CZ:

Source credit : unchainedcrypto.com