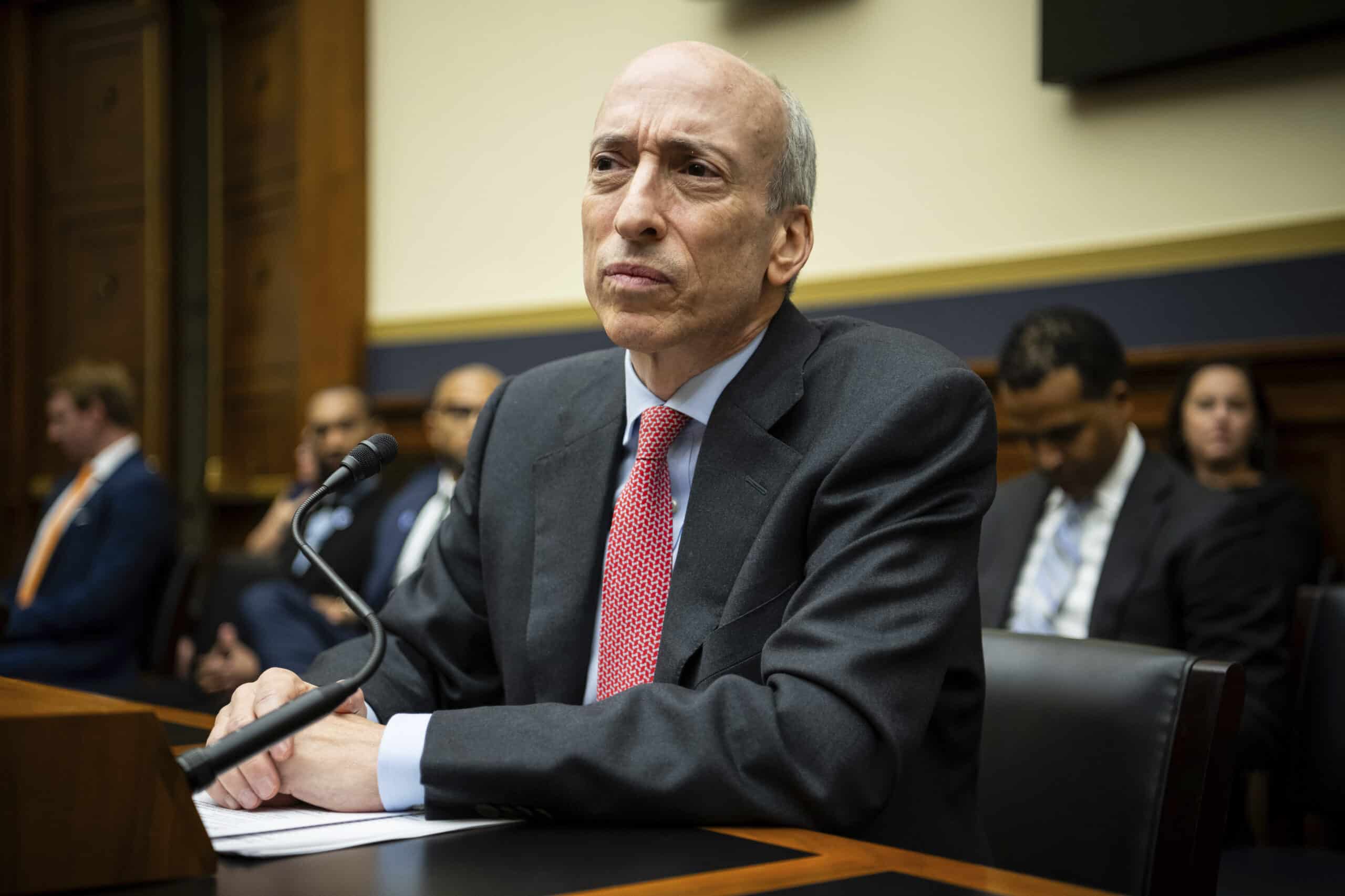

What Gary Gensler Also can Unruffled Manufacture Against Crypto in His Last Days as SEC Chair

After Donald Trump’s decisive get within the US presidential election, crypto markets rallied. Merchants had been delighted to be taught that the self-proclaimed “crypto president” would lead the country for the next four years, supported by a Republican Senate and a seemingly Republican Condo. Politically, the crypto neighborhood’s ultimate closing pronounce now is what SEC Chair Gary Gensler does within the closing 75 days sooner than Trump is sworn in on January 20.

The President-elect has promised to remove Gensler without lengthen upon taking workplace, and political experts are divided on whether that can incentivize Gensler to wreak havoc on the crypto commerce within the time he has left, or lay down his fingers. The place experts agree is that whomever Trump chooses to change Gensler can gain the authority to live ongoing investigations, complaints, and even new rulemaking processes as shortly as they’re appointed.

“Any enforcement actions he launches will almost definitely be rescinded,” acknowledged Jonathan Padilla, CEO of Web3 marketing tool Snickerdoodle Labs, who is active within the Democratic Occasion. Any new SEC suggestions can also moreover be undone by both a brand new Chair or new legislation handed by the particularly extra expert-crypto US Congress subsequent twelve months. “Assuredly, everything will almost definitely be undone in 100 days,” Padilla acknowledged.

Read More: Bitcoin Fine Acquired $100 Billion in Market Cap In a single day. Is it Time to Take hold of Earnings?

No topic Trump’s repeated guarantees to “fire” Gensler on day one of his new administration on memoir of his continuously hostile stance to the crypto commerce and “regulation by enforcement” formula, Trump seemingly can no longer legally remove Gensler from the cost entirely. He can, however, demote him to commissioner, a just with greatly less energy. It will almost definitely be well-liked for SEC chairs, who’re appointed by the president, to resign when a brand new administration takes over, though an SEC spokesperson declined to comment when requested by Fox Data personality Eleanor Terrett on Wednesday if Gensler planned to remove himself sooner than Trump took over.

The Rate didn’t without lengthen respond to questions for this memoir.

What Gensler Also can Manufacture

The chance that Trump will change Gensler with somebody with strongly differing views can also incentivize Gensler to discontinue whatever he can to rein within the commerce in his final days, some within the commerce gain publicly warned. “Crypto policy will without lengthen and greatly shift when new leaders rob over the federal companies,” Variant Fund Chief Factual Officer Jake Chervinsky acknowledged on X on Wednesday morning. “Between now after which, the outgoing administration will almost definitely be busy finalizing suggestions and filing enforcement actions.”

Others, esteem Padilla, speculate that Gensler is inclined to gallop out his final days quietly. A provide with recordsdata of the dynamics in some unspecified time in the future of the SEC also proposed that Gensler’s workers can also “stupid gallop” any actions he wished to enact, making it extra refined for Gensler to create an influence.

Read More: From Pariah to Vitality Player: Crypto’s Political Triumph

If Gensler did settle to switch out with a bang, he has several alternatives. He can also, as an illustration, unilaterally launch new investigations into companies he considers to be violating securities laws, which would change into apparent by newly-issued Wells Notices or subpoenas. If Gensler is in a station to internet rather plenty of Democratic appointees on the cost to switch alongside, it’s also conceivable he can also launch complaints in opposition to companies that already gain Wells Notices, equivalent to crypto gaming company Immutable, NFT platform OpenSea, and inventory and crypto purchasing and selling platform Robinhood,.

Alternatively, Gensler doesn’t gain ample time sooner than January 20 to internet to the underside of any new lawful battles or finalize new rulemaking, since both processes in general rob several months to full. A brand new SEC Chair would then gain the energy to live such complaints whereas the Rate pursued rulemaking, or fall the complaints altogether.

Gensler also has the energy to solidify rulemaking that has already been proposed and long gone by the overall public comment period required below the Administrative Course of Act (APA). As an illustration, he can also finalize rulemaking on the SEC’s up so a ways definition of “change,” which would invent bigger registration necessities for market makers, together with some crypto agencies.

In response, however, crypto advocates can also sue the SEC over any new suggestions, sources acknowledged. And Congress can also moreover exercise the Congressional Review Act to reverse these suggestions so prolonged as it acts within 60 days of Congress being in session. Attributable to this time constraint, reversing any suggestions Gensler handed between now and January 20 would have Congress’s time early within the next administration.

Read More: Immutable Modified into once Issued a Wells Survey Fine Earlier than the Election. Does the SEC Salvage Time to Be aware Thru?

Any suggestions which were finalized and for which Congress doesn’t act on within 60 legislative days can also moreover be unwound by a brand new SEC Chair. Alternatively, this is able to well per chance be a extra extended course of, since the agency would effectively be issuing new suggestions to waste the suggestions Gensler had finalized, and therefore they would also want to apply the APA’s public comment course of.

Though it’s uncommon, there is some historical precedent for the SEC taking stir in some unspecified time in the future of the period between a brand new president’s election and their inauguration. The Trump administration, as an illustration, sued Ripple on December 22, 2020 loyal sooner than ending its term, though the SEC became less politicized at that point and the timing also can gain had exiguous to discontinue with a Biden-appointed SEC Chair being anticipated to rob a distinctly rather plenty of tone.

It is uncommon for the SEC enforcement stir to be so intensely politicized, one provide who spoke with Unchained explained, and the hypothesis as to what Gensler can also discontinue with respect to crypto in his final days is unheard of. “Right here is a symptom of Gary’s term and his anti-crypto campaign,” the provision, who has expertise battling SEC complaints, explained. “The SEC’s enforcement formula has by no formula been dependent on a presidential election within the formula that it’s on the present time.”

Source credit : unchainedcrypto.com