What Unsuitable’s Without warning Increasing Income and Usage Technique for Coinbase Stock

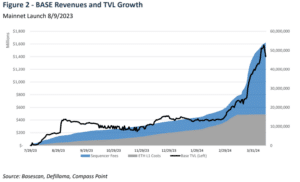

In August of 2023, Coinbase, the tip US cryptocurrency alternate, formally launched Unsuitable, its hold Ethereum Layer 2 blockchain community. Built on the OP Stack, Unsuitable has seen a surge in assignment in present months, including a whopping 3,200% amplify in day-after-day original customers after the Ethereum Dencum give a rob to, and the upward thrust of buzzworthy initiatives on the protocol equivalent to social networking application Friend.tech and the decentralized social community Farcaster.

Since changing staunch into a publicly traded company in April of 2021, Coinbase’s stock efficiency has in overall been correlated with crypto rate fluctuations and predominant trade news. Coinbase reports its first-quarter earnings on Thursday, Would possibly perchance per chance also merely 2, and its shares are up 31% 300 and sixty five days up to now and a whopping 354% over the previous 300 and sixty five days as crypto prices comprise soared. It closed procuring and selling on Friday at $236.32.

As detailed in a February letter to its shareholders, segment of the alternate’s plans for growth comprises having a see previous procuring and selling-connected income and “using utility in crypto with experiments in funds the utilization of USDC and Unsuitable.”

Learn more: 3 Reasons Why Layer 2 Community Unsuitable Has Extra Than Doubled Its Total Price Locked This 300 and sixty five days

Talking no longer too long ago with Laura Shin on the Unchained podcast, Reflexivity Analysis co-founder Will Clemente acknowledged “the Boulevard isn’t the truth is pricing in the crypto native income that I deem a total lot of the crypto natives realize.”

One in all the forms of crypto native income Clemente is relating to is “sequencer charges,” that are paid to the Ethereum Layer 2 entities accountable for ordering and processing transactions that are then recorded on the Ethereum mainnet. For every transaction on an L2, a minute price is paid to the “sequencer,” which in this case is Coinbase.

Clemente acknowledged that he believes the pleasure around Unsuitable initiatives, equivalent to the upcoming Friend.tech airdrop, coupled with the alternate’s high throughput and low charges, space the community to be the “highest competitor to Solana.” Solan’s token, SOL, has seen a large rebound in present months after plunging in price following the give plot of FTX.

“Over the closing 30 days, Unsuitable has accomplished $30 million of high-line income for Coinbase merely in step with the sequencer charges, which annualizes out to bask in $360 million a 300 and sixty five days,” Clemente acknowledged on the podcast.

The TradFi Standpoint

On the assorted hand, Oppenheimer and Co. senior analyst Owen Lau, who covers COIN, told Unchained that regardless of his belief in Unsuitable’s “immense attainable,” he urges “folks to see at their income contribution and no longer get too sooner than themselves before Unsuitable becomes a more arena materials contributor.”

Lau anticipates that in 2024, Coinbase as a total will generate roughly $5 billion in income, with merely $100 million of that, or 2%, coming from Unsuitable.

Learn more: Coinbase to Retailer Extra Customer, Company Balances on Unsuitable

His projections fall in holding with those of assorted COIN analysts, as Needham senior analyst John Todaro wrote to Unchained that “our case is for $50m income in ’24CY and in our bull case we deem $300m in income from Unsuitable.” Additionally, “Coinbase administration has given very diminutive coloration on the [profit] margin profile for this section,” wrote Todaro.

Lau’s perspective is that “their income is connected to among the initiatives taking place on the layer two. If there would possibly perchance be hype, a original mission would possibly perchance perchance well make stronger elevated income on Unsuitable, nonetheless if there’s no mission or that mission dies down, then the Unsuitable income will near down moderately dramatically.”

The previously talked about blockchain-essentially based completely social platform Friend.tech skilled precisely what Lau alluded to in August of 2023, where day-after-day inflow dropped from over $16 million to $1.6 million inner the span of a month.

Past viral initiatives equivalent to Friend.tech, Unsuitable would possibly perchance perchance well comprise more reasonable insist conditions that will per chance well comprise sustainable future assignment. Compass Level Analysis analyst Joe Flynn, who maintains a buy rating and a cost plan of $325 on Coinbase, wrote in an April 17 document that “Unsuitable affords a total lot of optionality and attainable push into funds (no price USDC funds equipped on the present time) that investors are overlooking.”

As Unsuitable stands currently, “will shareholders pay a total lot of consideration to or hold Coinbase as a consequence of of [Base]? I deem investors would desire to peek a more constant income proceed before they produce the closing resolution,” Lau acknowledged, including “I mild deem the #1 driver is mild Coinbase quantity, no longer the Unsuitable quantity.”

Todaro shared a a similar perspective, bringing up that “investors are rather more closely searching at retail volumes, retail rob charges, and the SEC case with COIN as those are vastly bigger drivers for income and margin.”

For Lau, the success of Unsuitable is more reflective of Coinbase’s future trajectory pretty than an instantaneous contributor to COIN efficiency at this point, announcing “longer term, you’re going to peek an increasing number of income sources launch air of procuring and selling, which is candy for the stock.”

Extra namely, Todaro wrote that “Unsuitable is a posthaste-rising product that has severe buy-in from the crypto native community…. It would likely spur Coinbase to launch more on-chain bask in products.”

Bitcoin ETF Custody Income

Past Web 3 building, Coinbase has moreover no longer too long ago a total lot of its income streams by changing into the custodian for eight of the 11 role Bitcoin ETFs launched earlier this 300 and sixty five days, including those issued by BlackRock, Franklin Templeton, and Grayscale.

Needham’s Todaro estimates that Coinbase will accomplish $167 million in income custodying these resources in 2024, inserting both Unsuitable and custody revenues in the same ballpark as minor contributors to the corporate’s overall efficiency currently.

Taking a see forward on the opposite hand, the analyst wrote “we ask the income from Unsuitable to be bigger than custody which is a highly aggressive trade and certain will perceive more opponents at some point soon from mature banking/brokerage corporations. Unsuitable chain, on the assorted hand, is a product we construct no longer factor in a mature finance firm would possibly perchance perchance well replicate.”

Source credit : unchainedcrypto.com