Are attractive to Starting up a Token? This Invoice May perhaps presumably well perhaps Create It Stable to Originate So

October 6, 2021 / Unchained Day to day / Laura Shin

Day to day Bits ✍️✍️✍️

-

Bitcoin hit $51,000 the old day, crossing $50,000 for the first time in a month.

-

Sky Mavis, the developer of Axie Infinity, confirmed its new raise, bringing in $152 million at roughly a $3 billion valuation.

-

US Bank, the fifth-ultimate bank within the US, now supplies crypto custody thru a partnership with NYDIG.

-

Arca launched a $30 million fund to make investments in NFTs.

-

NFT sales hit $10.7 billion in Q3.

-

Lawmakers in Brazil are working on making Bitcoin a authorized charge forex.

-

SEC Chair Gary Gensler says the SEC has no plans to ban cryptocurrency.

-

The Block published a little bit of writing summarizing the most fresh updates for both the Infrastructure Funding and Jobs Act and the Delight in Again Higher Act — two bills that can possess massive implications on how cryptocurrency is regulated within the US.

-

Replicate, an Ethereum publishing instrument, staunch opened its protocol up to any individual.

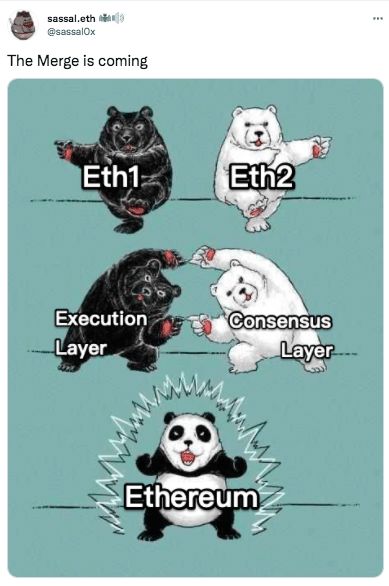

What Originate You Meme?

What’s Poppin’?

1. Hester Peirce’s Stable Harbor Proposal Now Has Legislative Backing

The old day, Representative Patrick McHenry, the ranking member of the Dwelling Monetary Providers Committee, proposeda new invoice, dubbed the Clarity for Digital Tokens Act of 2021, that seeks to flip SEC Commissioner Hester Peirce’s thought of a “safe harbor” for crypto sources into proper regulation.

Under the proposed legislation, crypto companies would be allowed to commence a token with out caring about working afoul of US securities regulation. “My invoice, which builds on the substantial work of SEC Commissioner Hester Pierce, will abet provide the most well-known authorized certainty to digital asset projects after they commence,” McHenry said in a prepared exclaim.

The invoice would give crypto startups three years to ancient into a decentralized order. And, after the years, the hope is that the token would now now not be regarded as a security beneath federal regulation. To be regarded as a safe harbored firm, crypto startups would be required to expose their source code, transaction history, and tokenomics to searching for what you offer.

2. USDC Comes Under Fire From the SEC

Circle Monetary, a key backer of the stablecoin USDC, said in a standard regulatory filing they “purchased an investigative subpoena from the SEC Enforcement Division inquiring for documents and info concerning obvious of our holdings, customer programs, and operations.” CoinDesk’s Danny Nelson first broke the news.

For its fragment, Circle says it is “cooperating completely” with the regulator’s investigation,” which has been ongoing since July 2021. The news used to be on the initiating disclosed in Circle’s August 2021 filing, nonetheless went largely brushed aside.

The narrative that broke the news used to be an S-4 from Circle, which used to be issued as fragment of Circle’s map to transfer public. As of press time, Circle has but to bag a public comment on the subpoena.

The subpoena got here about one month after Circle launched a crypto yield product for companies, touting licenses in Bermuda.

Suggested Reads

-

Columbia’s Blockchain community on Axie Infinity:

-

Coin Metrics on the greatest storylines of Q3 in crypto:

-

Punk 6529 on why NFTs trade, effectively, all the pieces:

On The Pod…

How does the SEC resolve if a token is a security? Why is DeFi in particular laborious to space up? What is going to regulators manufacture about stablecoins? On Unchained, Greg Xethalis, chief compliance officer at Multicoin Capital, and Collins Belton, founding partner at Brookwood P.C., dive into crypto regulation, discussing securities laws, DeFi regulation, and why the US desires to be promoting stablecoins in preference to attempting to shut them down. Highlights:

-

why the SEC and CFTC possess now not offered bigger crypto enforcement news on the cease of their fiscal years

-

why the SEC goes after DINO (decentralized in name ultimate) companies

-

what the Howey and Reves assessments are and the design the SEC makes teach of them to resolve whether an asset is a security or now not

-

why Collins and Greg mediate the SEC has fair now not too long ago begun been making teach of Reves more in total

-

why they mediate centralized crypto lending products ought to aloof now not be regarded as securities beneath the Howey test

-

whether new legislation desires to be written for cryptocurrency-based products

-

what makes Collins mediate the SEC is being “disingenuous” concerning the SEC registration course of for crypto companies, admire Coinbase

-

how regulators will cease up handling DeFi and why both Greg and Collins are long-term optimistic

-

how the US govt has a “substantial history” of respecting privacy and encryption

-

why regulatory strain is at risk of arise around centralized crypto exchanges and what we can be taught from the EtherDelta case

-

why Collins thinks most cryptocurrency companies desires to be regulated

-

why the SEC is the appropriate motivator for forcing protocols to fully decentralize

-

how clean contracts might presumably theoretically be extinct to standardize SEC Commissioner Hester Peirce’s Stable Harbor proposal

-

how blockchain info makes cryptocurrency companies more transparent and simpler to space up than centralized entities

-

what Collins and Greg mediate will happen with stablecoin regulation going forward

-

why the US desires to be pushing to bag buck-pegged stablecoins more notorious

E book Replace

My e-book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Enormous Cryptocurrency Craze, is now on hand for pre-exclaim now.

The e-book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-exclaim it on the fresh time!

You will likely be ready to aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com