Voyager Digital Data for Chapter 11 Economic extinguish

July 7, 2022 / Unchained On a standard foundation / Laura Shin

On a standard foundation Bits✍️✍️✍️

- Polygon follows Solana and companions with cellular telephone maker Nothing to construct a web3 cellular telephone.

- A false job offer modified into behind the exploit of Axie Infinity, which resulted in a loss of $540 million earlier this twelve months.

- US officers who private crypto investments are in level of fact prohibited from working on crypto-linked insurance policies.

- Genesis Global Buying and selling confirmed its publicity to Three Arrows Capital.

- Ethereum’s testnet Sepolia modified into successfully constructed-in into the Proof of Stake chain.

- Binance will launch charging zero bills to BTC pairs on its platform.

- Hut 8, a Canadian crypto miner, added 5,800 mining rigs to its products and companies.

- Core Scientific, a crypto mining firm, supplied $165 million price of BTC in June.

- Porter Finance, an Ethereum DeFi protocol, shut down its bond issuance platform due to lack of lending inquire of.

- American CryptoFed DAO withdrew its demand to the SEC to register two tokens as securities.

- FTX launched a partnership with hardware pockets firm Ledger.

- Solana Labs gets sued with the scream that SOL is an unregistered security.

At the present time in Crypto Adoption…

- LimeWire will open an NFT sequence in collaboration with Brandy, Travis Barker, Nicky Jam and others.

The $$$ Corner…

- Blockchain startup Bitmark raised $5.6 million after launching an NFT pockets.

- DeFi platform Ondo Finance raised $10 million in a public token sale.

- Planetarium Labs, a web3 gaming startup, raised $32 million in sequence A funding.

What Originate You Meme?

What’s Poppin’?

Voyager Digital Data for Chapter 11 Economic extinguish

By Juan Aranovich

Crypto dealer Voyager Digital filed for Chapter 11 financial extinguish on late Tuesday evening. The court docket cases started in the U.S. Economic extinguish Court docket for the Southern District of Current York.

Chapter 11 is a form of financial extinguish that entails a reorganization of a debtor’s switch affairs, money owed, and sources. It permits a firm to quit in switch and restructure its obligations.

Final week, Voyager halted all trading, deposits and withdrawals from its platform and issued a seek for of default to crypto fund Three Arrows Capital for failing to repay a loan price $650 million. This publicity to 3AC put Voyager in a peaceable monetary put.

Per the observation launched by the firm, Voyager has $1.3 billion in crypto sources. It furthermore holds $350 million in earnings an narrative in Metropolitan Industrial Monetary institution.

“We strongly deem in the trend forward for the switch but the prolonged volatility in the crypto markets, and the default of Three Arrows Capital, require us to grab this decisive action,” mentioned Stephen Ehrlich, CEO of Voyager Digital.

Ehrlich furthermore confirmed that Voyager will continue to feature in the course of the formulation. Below the restructuring belief, if accredited by the Court docket, customers with crypto sources of their accounts will receive a combination of:

- Crypto of their accounts

- Proceeds from 3AC restoration

- General shares

- Voyager tokens

Crypto researcher 0xHamZ mentioned that, even supposing 3AC doesn’t enhance and VYG token has no value, customers would possibly perchance possibly demand 80 cents on the buck between out there money and crypto sources; meanwhile, Bloomberg columnist Matt Levine puts his ground estimate at 72 cents on the buck.

Other folks who had sources in Voyager reacted to the news in the Voyager’s subreddit. “Here’s what’s laborious to stomach. Losses due to loss of value is something that can happen. Losses due to the firm loaning my laborious earned money out, shedding that money after which going bankrupt is a full thoroughly different form of bother,” mentioned one user.

Take a look at out Laura’s interview with one Voyager customer who has $70,000 locked in the platform: “On June twentieth, they reached out to a bunch of companions and entered into these NDAs to grab a behold at to bail them out, and six days sooner than that, they sent an e-mail out to us, reassuring us that they didn’t private any publicity to Celsius, they by no formulation engaged in DeFi lending.”

Advised Reads

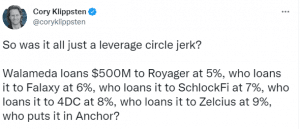

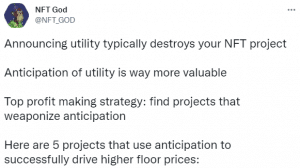

1) NFT God on 5 worthwhile NFT initiatives:

2) Green Pill on Play & Atomize:

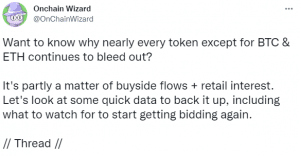

3) OnChain Wizard on token costs:

On The Pod…

Within the Fresh Crypto Market Meltdown, What Role Did Lido’s stETH Play?

Hasu, strategic guide to Lido, and Tarun Chitra, founder of Gauntlet, show everything about staked ETH, aka stETH, how it can silent be priced, Lido’s market dominance, and some distance extra. Display mask highlights:

- the role of Lido, what stETH is, and what its advantages are

- whether Ethereum’s lack of delegated proof of stake contributes to the need for stETH

- why stETH is now not mispriced and why it doesn’t necessarily need to be price 1 ETH

- the inherent risks linked to stETH

- how there modified into now not adequate liquidity to tackle the final liquidations, especially in automatic vaults on, for example, Instadapp

- how automatic market makers work and what Curve’s amplification component is

- whether 3AC and Celsius had a prime affect on the stETH/ETH “de-peg”

- how does the Merge private an set up on the liquidity of stETH

- Hasu’s and Tarun’s degree of self belief that the Merge will happen this twelve months and whether this is in a position to possibly also be worthwhile

- what’s going to happen to the price of stETH after the redemptions are enabled

- why Lido has accomplished such a degree of dominance

- how Lido decreases the price of staking and helps enhance the protection of the Ethereum blockchain

- whether there goes to be a “winner clutch all” in the liquid staking derivatives market

- how liquidity fragmentation can blueprint off the blueprint to blow up

- why LDO tokenholders would possibly perchance now not private the identical incentives as ETH tokenholders

- what’s the Lido’s novel twin governance model and what’s it looking to develop

- whether Lido must silent self restrict its market dominance

- how Lido coordinates validators and the role of the LDO token on this coordination

- what are the lessons to be learned from the stETH enlighten of affairs

- how governance is a felony responsibility to DeFi protocols

E book Update

My e-book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Expansive Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now out there!

That you too can aquire it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com