UST Is Now a Bitcoin Backed Stablecoin (In part)

February 23, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

The worn proprietor of a Bored Ape Yacht Club NFT is suingOpenSea for $1 million after his ape was sold for .01 ETH due to a worm on the NFT marketplace.

-

Bitcoin tied to the Canadian “Freedom Convoy” has been moved despite makes an try by the Royal Canadian Mounted Police to freeze the funds, with just among the BTC ending up at Coinbase and Crypto.com (which, disclosure, is a sponsor).

-

Canadian regulators flagged tweets from Kraken and Coinbase CEOs urging customers to reduction in thoughts self-custodial wallets.

-

Huobi has plans to return to the US market as an asset manager.

-

Crypto lender Celsius appointed a brand unique CFO after his predecessor’s arrest.

-

The IMF warned that Nigeria’s CBDC might maybe perhaps pose money laundering dangers.

-

DAO treasuries fell $3.1 billion over the final month.

-

When you didn’t build it to EthDenver, listed below are eight things you omitted.

-

Tether lower down on commercial paper and cash holdings in favor of money market funds and treasury bills consistent with its most up-to-date reserves attestation.

-

Coinbase is adding toughen for Ledger hardware wallets.

This present day in Crypto Adoption…

-

Tourism in El Salvador has increased 30% since its first BTC private.

- Lawmakers in Panama discussed two crypto-centered bills yesterday.

The $$$ Nook…

-

Foxbit, a Brazilian crypto alternate, raised $21 million in a Series A.

What Attain You Meme?

What’s Poppin’?

The 4th Largest Stablecoin Is a HODLer

Luna Basis Guard (LFG), the nonprofit organization serving to to construct UST, launched a $1 billion raise led by Bounce Crypto, Three Arrows Capital, along with participation from others.

The $1 billion raise was created by technique of a non-public token sale of LUNA, the native token of the Terra community. Investors will be required to lock up their LUNA throughout a four-year vesting period. At unique costs, LUNA is the ninth splendid cryptocurrency with a market capitalization of real over $20 billion.

Luna Basis Guard plans to employ the unique funds to amass bitcoin to keep a BTC-denominated Forex Reserve for Terra’s algorithmic stablecoin UST. Pegged to the US buck assign, UST currently holds a market capitalization of $12 billion (or ~7% of the total stablecoin present in crypto). The $1 billion Forex Reserve denominated in Bitcoin is designed to ensure that the cost of UST stays pegged to the buck – even in terrifying market conditions where the cost of LUNA, which helps set the UST peg by technique of arbitrage, might maybe perhaps fail to enact so.

“One overall criticism of algorithmic stablecoins is their reflexive nature and the hypothetical chance of a “bank flee” challenge where seek recordsdata from to promote the stable outstrips present in a approach that causes compounding assign decreases in each native tokens,” defined the group of workers. “Though the in style adoption of $UST as a persistently stable asset by market volatility must already refute this, a decentralized Reserve can present a further avenue to set the peg in contractionary cycles that reduces the reflexivity of the system.”

And, consistent with LFG, Bitcoin is an splendid asset to employ for its UST Forex Reserve. “The $UST Forex Reserve is an LFG initiative to give a further layer of toughen for the $UST peg using resources which will doubtless be regarded as much less correlated to the Terra ecosystem, fancy Bitcoin.”

In essence, the Forex Reserve is being attach into space to support present a 2nd line of protection to UST’s peg to the buck open air of LUNA.

Significantly, this is in a position to maybe perhaps no longer be the final time LFG raises funds for LUNA reserves. “LFG has plans to scale reserve to higher numbers,” wrote Terra founder Attain Kwon on Twitter.

Advised Reads

-

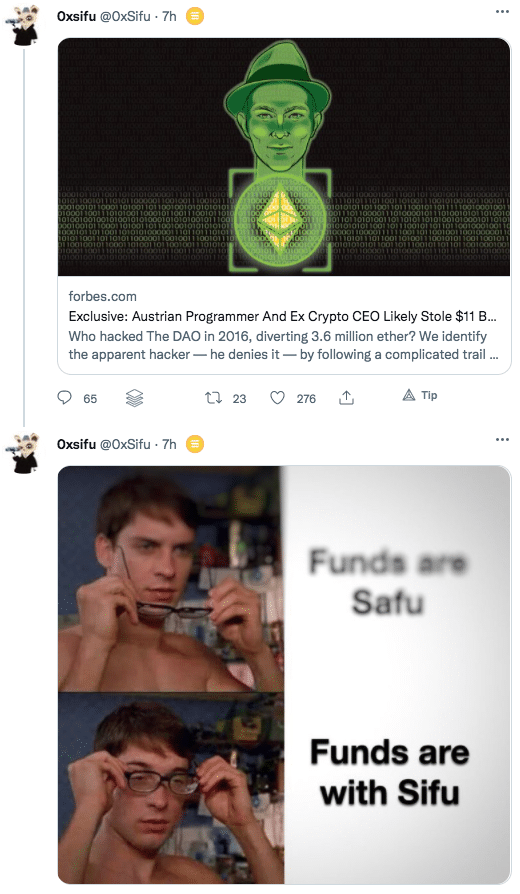

At some level of writing my e book, my sources and I recount we uncovered the identity of Ethereum’s 2016 DAO hacker.:

-

Dr. Julian Hosp, who worked with Toby Hoenisch, the alleged DAO attacker, launched extra info on Toby’s involvement with the DAO:

-

Galois Capital on the recount of the crypto market:

On The Pod…

New: Crypto’s Largest Whodunnit: Who Became as soon as At the assist of the 2016 DAO Attack on Ethereum?

Whereas researching for my e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Mammoth Cryptocurrency Craze, I found proof that I recount resolves the splendid whodunnit in crypto: who hacked The DAO? This podcast is coming out along with an editorial in Forbes revealing the head suspect’s identity.

Fraction 1: Who Attacked the DAO? Here’s the Evidence

To doc the formula of finding the alleged attacker, I wrote an editorial for Forbes, with which I opened the podcast. In it, I existing

-

who, proof signifies, attacked the DAO

-

how my sources and I uncovered this particular person’s identity

-

how a previously undisclosed technical functionality by Chainalysis helped my sources and I establish the alleged hacker

Fraction 2: Contextualizing the DAO Attack

Forbes’s Steven Ehrlich comes onto the pod to interview me about finding the DAO attacker. Subject issues

-

what’s The DAO, and why is it crucial?

-

who’re the important thing avid gamers in The DAO’s story

-

how the attacker pulled off the hack

-

what loyal questions surrounded the hack

-

why finding the attacker is mandatory

-

the loyal implications of identifying the attacker

-

what Laura’s interactions beget been with the suspect

-

what the style forward for DAOs might maybe perhaps reduction

Ebook Change

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Mammoth Cryptocurrency Craze, is now readily out there for pre-show now.

The e book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-show it this day!

You’ll likely be in a position to amass it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com