As a lot as 10 Years in Penal advanced

And the third-largest trade hack in crypto historic previous

This tense news week in crypto started with the third-largest hack ever of a crypto trade. The hacker or hackers who attacked Kucoin made out with $280 million, with round $130 million of that up to now frozen in new contracts and laborious forks. Then, YFI founder Andre Cronje teased a new challenge on Twitter, and $15 million poured into his experiment — all of which became then promptly drained by a hacker. In the discontinuance, criminal costs were introduced in opposition to the owners BitMEX, one in all the predominant and most established exchanges yet to be accused of criminal exercise.

Plus, this week, an anonymous denunciation of the corruption inherent in the DeFi dwelling made the rounds. Also, The Verge published an in-depth expose of TRON’s Justin Sun.

On the podcasts, Andreas Antonopolous and Dan Held continue the Why Bitcoin Now series by discussing Bitcoin’s monetary coverage on Unchained. And on Unconfirmed, Frank Chaparro of The Block talks about what no longer handiest the crypto neighborhood but the wider tech and industrial communities were discussing this week — Coinbase CEO Brian Armstrong’s blog put up making clear the firm would pursue an apolitical stance in these tumultuous instances. We’ll demand if that sticks …

This Week’s Crypto Files…

US Regulators File Prison Costs In opposition to BitMEX Homeowners

On Thursday, the Department of Justice charged BitMEX, one in all the predominant crypto derivatives exchanges, with two Monetary institution Secrecy Act violations — each of that can maybe maybe maybe additionally merely carry a maximum penalty of 5 years in penal advanced. The Commodity Futures Shopping and selling Commission also filed costs in opposition to BitMEX for allegedly illegally running a cryptocurrency derivatives trade and violating anti-money laundering regulations. Cofounder and CTO Samuel Reed has been arrested in Massachusetts, while the other two cofounders, CEO Arthur Hayes cofounder and feeble chief technique officer Benjamin Delo as successfully as feeble head of business construction Gregory Dwyer, are all at gigantic.

The DOJ indictment stated Hayes, “bragged in or about July 2019 that the Seychelles became a extra friendly jurisdiction for BitMEX resulting from it cost less to bribe Seychellois authorities — proper ‘a coconut’ — than it would cost to bribe regulators in the usa and in other locations.” The indictment claims that BitMEX didn’t show screen its transactions for money laundering or sanctions violations and didn’t file any suspicious exercise stories from its delivery in November 2014 unless September 2020. It also alleges that unless August 2020, prospects would possibly maybe maybe maybe additionally register to replace anonymously, providing handiest a verified electronic mail address, and that the trade inspired or allowed US prospects to entry the explain and change on it. It also claims that BitMEX allowed prospects positioned in Iran to replace on the platform, in violation of US sanctions. It also alleges that In Could well well also 2018, Hayes became notified that BitMEX became being aged to launder money received by the employ of a cryptocurrency hack but that Hayes and BitMEX didn’t enforce an anti-money laundering coverage in response.

HDR Global, the mother or father firm of BitMEX and one in all the defendants in the CFTC civil lawsuit, launched a assertion, announcing, “We strongly disagree with the U.S. authorities’s heavy-handed decision to carry these costs, and intend to defend the allegations vigorously. From our early days as a delivery up-up, we like constantly sought to follow appropriate U.S. licensed pointers, as those licensed pointers were understood on the time and in accordance with available guidance.”

Third-Ideal Change Hack: $280 Million Stolen From KuCoin

In the third-largest hack in crypto historic previous, $280 million price of crypto belongings were stolen from the new wallets of Singapore-primarily based utterly trade KuCoin. The belongings stolen encompass Bitcoin, Bitcoin Satoshi’s Vision, Ether, Litecoin, Ripple, Stellar Lumens, Tron, Tether, Chainlink, Ocean and others. The trade maintains that its insurance fund will camouflage all losses, and up to now, $130 million of the hacker’s loot has been frozen by different crypto projects. Loads of the stolen money are ERC-20 tokens, and challenge admins like paused contracts, deployed new ones or blocked the hacker’s address, to support catch better money akin to Velo, Tether, Orion, KardiaChain, Ampleforth and others. However, their actions like raised questions about decentralization.

In the period in-between, the KuCoin hack has highlighted the employ of dexes for money laundering, with the hacker liquidating tokens akin to OCEAN, SNX, COMP, LINK and DIA on Uniswap and Kyber to transform them to ETH. In CoinDesk, CipherTrace CEO Dave Jevans stated, “these platforms is seemingly to be aged as successfully the next skills of cash-laundering mixing services. If I’m capable of do my stuff correct into a DeFi contract, it will get mixed up with other folks’s money when it comes support out. Because there’s no tracing and there’s no KYC, it successfully is running as an dilapidated-faculty crypto money-laundering provider.” (Disclosure: CipherTrace has been a sponsor of my reveals.)

$15 Million Emptied From YFI Creator’s Latest Experiment

On Monday, ambiguous retweets by Yearn creator Andre Cronje of the eminence.finance Twitter memoir precipitated traders to pour $15 million into the Eminence card gaming protocol to farm the EMN token. By no means thoughts that there became exiguous info on it.

The total $15 million in Eminence became quickly drained by a hacker, who, in line with Cronje, aged a “reasonably straightforward” arrangement, which became to “mint a spread of EMN on the tight curve, burn the EMN for one in all the other currencies, sell the currency for EMN.” However, the hacker then returned $8 million. The incident appears to be like to be to be “the fundamental fundamental cryptoeconomic hack,” as stated by Kleros CTO Clément Lesaege, who outlined, “Opposite to most of the hacks, the dapper contracts were no longer broken, they worked exactly as supposed. However the economics were.”

Cronje became criticized for teasing an unfinished protocol, but he defended himself, announcing that he intends to continue deploying test contracts. He warned doable traders no longer to employ random contracts he has deployed unless he’s made an first price announcement by the employ of his Medium memoir. He stated, “The contracts I deployed the previous day were purely for myself to engage with.”

Interior the Entitled, Lawless World of Tron’s Justin Sun

A meticulously reported Verge article on events at BitTorrent after Tron’s $140 million aquire of the stare-to-stare machine supplies us a discontinuance demand on the controversial crypto resolve, Justin Sun. Soon after the acquisition, it stories, the firm’s industrial technique grew to alter into, “copy Ethereum” and “catch the pump on the coin,” which supposed to assemble Tron demand correct and catch individuals to aquire the token. However that became proper the starting.

Sun continuously acted love a tainted brat, as an instance tense to grab who employed a driver who by chance locked him in a vehicle with the kid safety lock or castigating the executive assistant who scheduled a health care provider’s appointment with him on the doctor’s office in its attach of having the doctor strategy to him. At a firm Q&A, when an employee submitted a request asking what would happen if TRX went to zero, Sun stated, “Whoever asked this request, we’re going to music them down” after which he threatened to “extinguish their total family.” Moreover, an employee witnessed an altercation in which it appeared Sun hit one other staff member.

On prime of all that, Sun did exiguous to govern the app store on the Tron network, leaving it launch to all manner of scammers, and became in the same arrangement laidback about pirated movies on a BitTorrent product as successfully as about harassment on the firm’s dwell-streaming platform. It’s a riveting be taught. I lumber you all to set up it out.

Is DeFi Injurious? A Survey on the $FEW Token Scandal

Final Thursday, pseudonymous writer crypto_angel posted a prolonged screed, detailing the events of the $FEW token, a yield farming coin that became accused of being an insiders’ pump-and-dump plan, to focus on what they be conscious as the “unspoken agreement between defi insiders and the rotten actors they offer protection to.”

The $FEW token started with a gathering of fifty crypto influencers who then hyped the challenge, so as that inside of minutes of the token launching, a spread of of individuals had already flooded its Telegram neighborhood, inquiring for an airdrop. Crypto_angel says, “this became clearly a pump and dump marketing campaign.” The put up involves screenshots of individuals commenting that the challenge “would possibly maybe maybe maybe additionally merely still in point of fact catch a product no longer proper aquire a domain and mint a token.”

The article is a damning examination of a dwelling in which, they are saying, “the manner to earn these token video games became to assemble chums with the serene individuals.”

SEC Roundup

The SEC has continued to enforce securities regulations with the identical interpretation it’s been following, or getting judges to support its stance.

- Resolve Principles Kik’s KIN Token Violated Securities Legislation

A command for the Southern District of New York agreed that Kik’s providing of KIN became an unregistered securities providing. Kik stated it’d additionally merely appeal.

- Salt Lending Ordered to Refund $47 Million in ICO Funds

The SEC and Salt Lending, which held an ICO in 2017, like settled, and Salt can like 14 days to philosophize its draw to refund traders. This will seemingly maybe maybe maybe register the SALT tokens as a security and pay a $250,000 penalty.

- SEC Components No-Motion Letter for Compliance-Focused Digital Security Exchanges

The SEC stated this would maybe maybe maybe no longer take motion in opposition to exchanges that change tokenized securities.

In a First, Ethereum Charges Eclipse Block Rewards

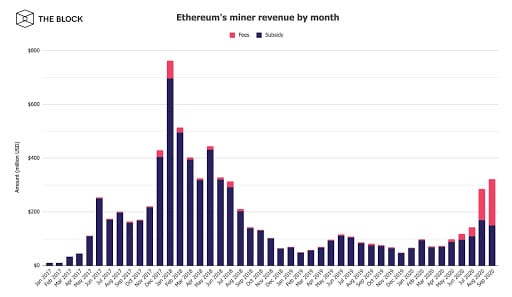

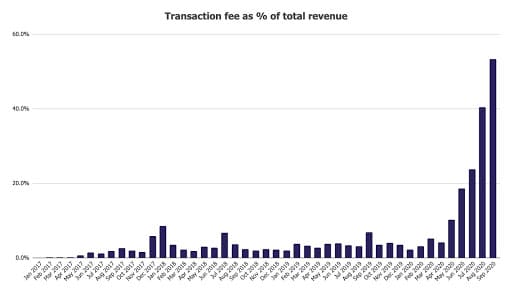

Larry Cermak of The Block tweeted that or the fundamental time in Ethereum’s historic previous, transaction costs like surpassed the amount miners assemble from block rewards.

The 2nd graph, in particular, reveals an improbable trajectory for transaction costs over the last 5 months, in a pattern that Cermak posits is a lot from sustainable:

Source credit : unchainedcrypto.com