Tokenized Treasuries Grow 20X Faster Than Stablecoins as Crypto Market Languishes

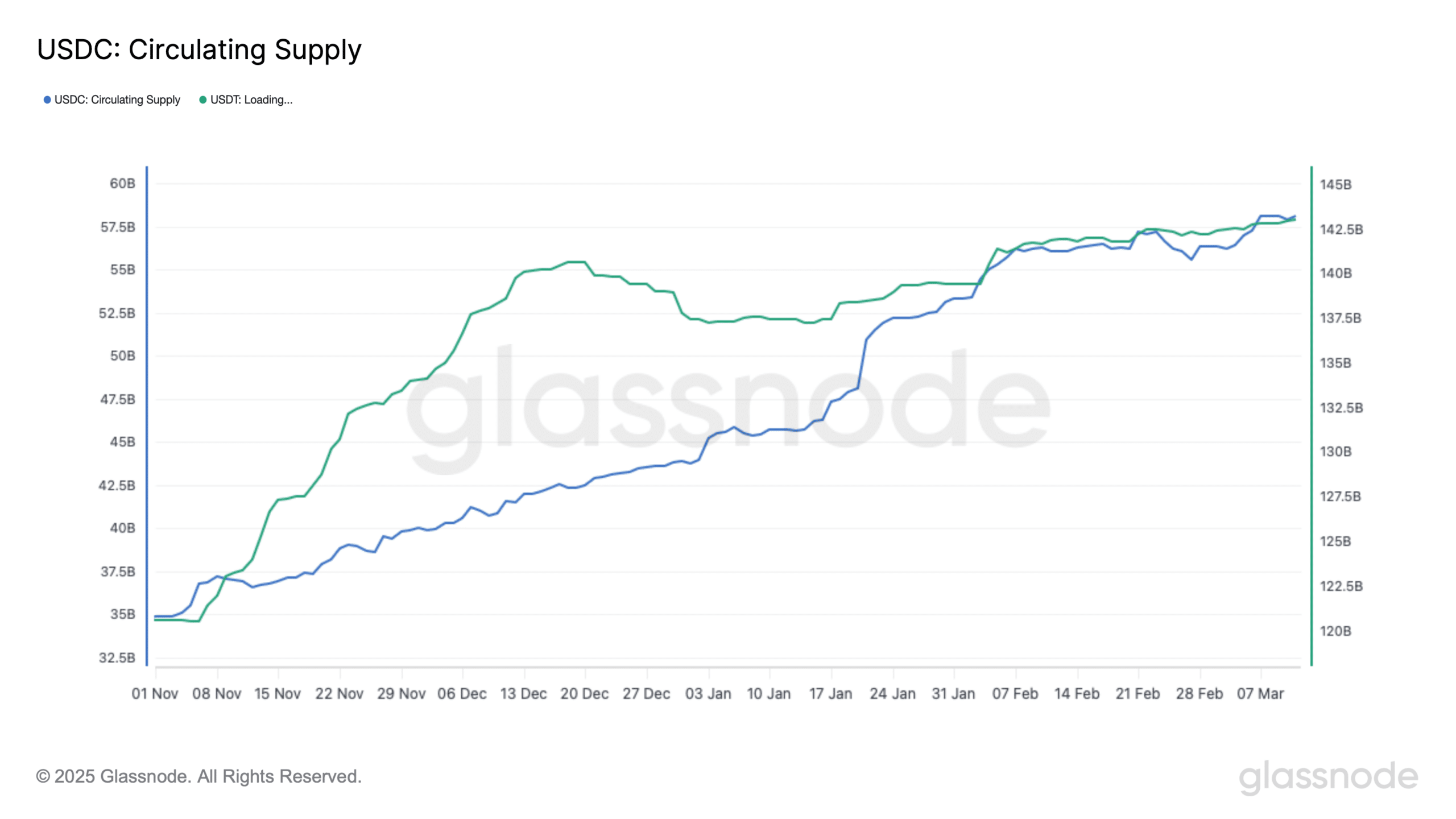

A true argument might perhaps maybe even be made that stablecoins are crypto’s only real killer app. Led by issuing giants USDT (market cap: $143.34 billion) and USDC ($57.85 billion), the $235 billion sector is the lifeblood of the blockchain-essentially based entirely mostly economic system.

Stablecoins are vital in loads of programs. At some level of bullish instances traders tune their flows into exchanges, as these sources are the dry powder needed to originate up buying. They salvage also confirmed to be a serious lifeboat all over stormy weather for traders that need the safety of the U.S. dollar nevertheless discontinuance on the ready for buying alternatives.

But on this crypto market dash, traders are extra and extra turning to an different digital asset that no longer only holds its worth nevertheless will pay a miniature yield.

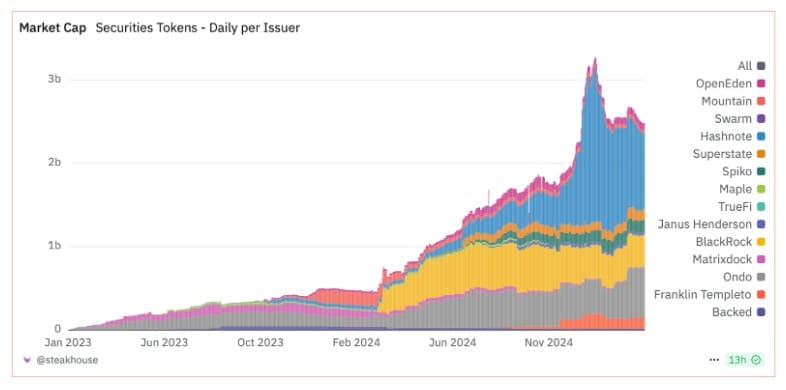

Tokenized treasuries, a subset of the rising real world asset (RWA) market that applications U.S. authorities debt into blockchain-essentially based entirely mostly tokens, salvage long been the shrimp engine that can perhaps maybe perhaps. A year within the past, in March 2024, the RWA business trumpeted that it handed $1 billion in sources below management (AUM).

“Factual came about, $1B Total Tokenized U.S. Treasuries on Public Blockchains,” tweeted business analyst Tom Wan from Entropy Advisors.

Whereas that quantity might perhaps maybe perhaps sound valuable to casual observers, it is miles a sliver of the $28 trillion U.S. Treasury market.

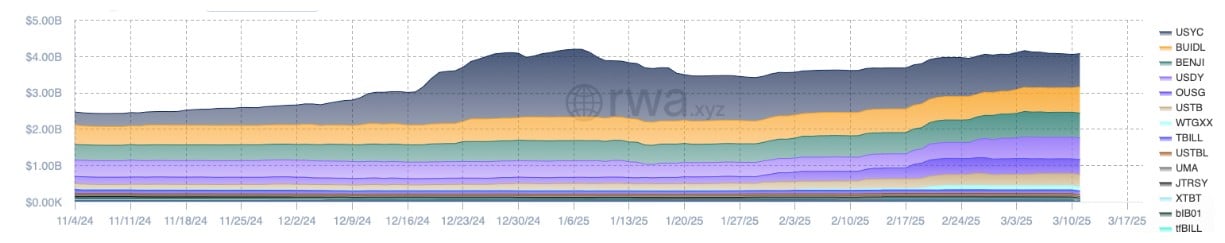

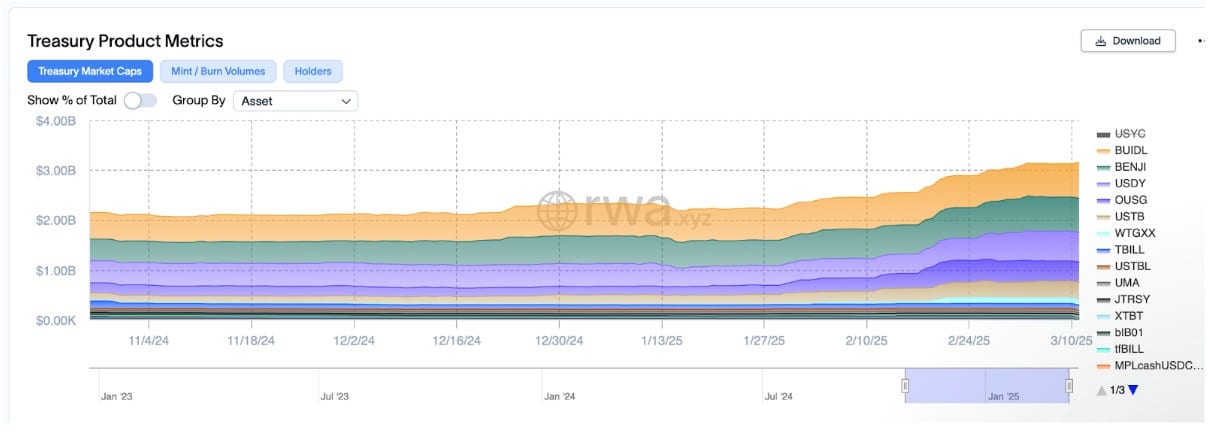

Three hundred and sixty five days later, the tokenized treasury market has quadrupled to potential $4 billion.

That’s serene a pittance in comparison to the total market, nevertheless it represents 400% enhance. Extra striking is that while there is blueprint discussion about the enhance in stablecoins on this tenuous macro atmosphere as traders hover sinking crypto sources, tokenized treasuries salvage grown nearly 20x as rapid as their stablecoin siblings.

Stablecoins pay no pastime to their holders, letting issuers bask in Tether and Circle make investments the collateral briefly-term treasuries and mint billions in chance-free earnings. The product has also been in a regulatory gray zone as lawmakers in Washington, D.C. proceed to originate development on legislation. It has always been a query of when traders would originate up aggravating their allotment of their yield.

That looks to in a roundabout blueprint be happening.

Tokenized Treasuries Improve After Election

Stablecoins seen a valuable enhance surge after Donald Trump was re-elected to the presidency on November 5. On that date the stablecoin market was worth $183.82 billion. Since then it added $50.95 billion, with USDT and USDC every including bigger than $20 billion as traders regarded to capitalize on Trump’s reputable-crypto momentum that propelled the worth of bitcoin to an all-time high of $108,000 in January. That amounts to a 27.71% surge for stablecoins.

Alternatively, tokenized treasuries seen 68.3% enhance over the a linked length, or 2.46x sooner enhance, to head from $2.4 billion to $4.1 billion.

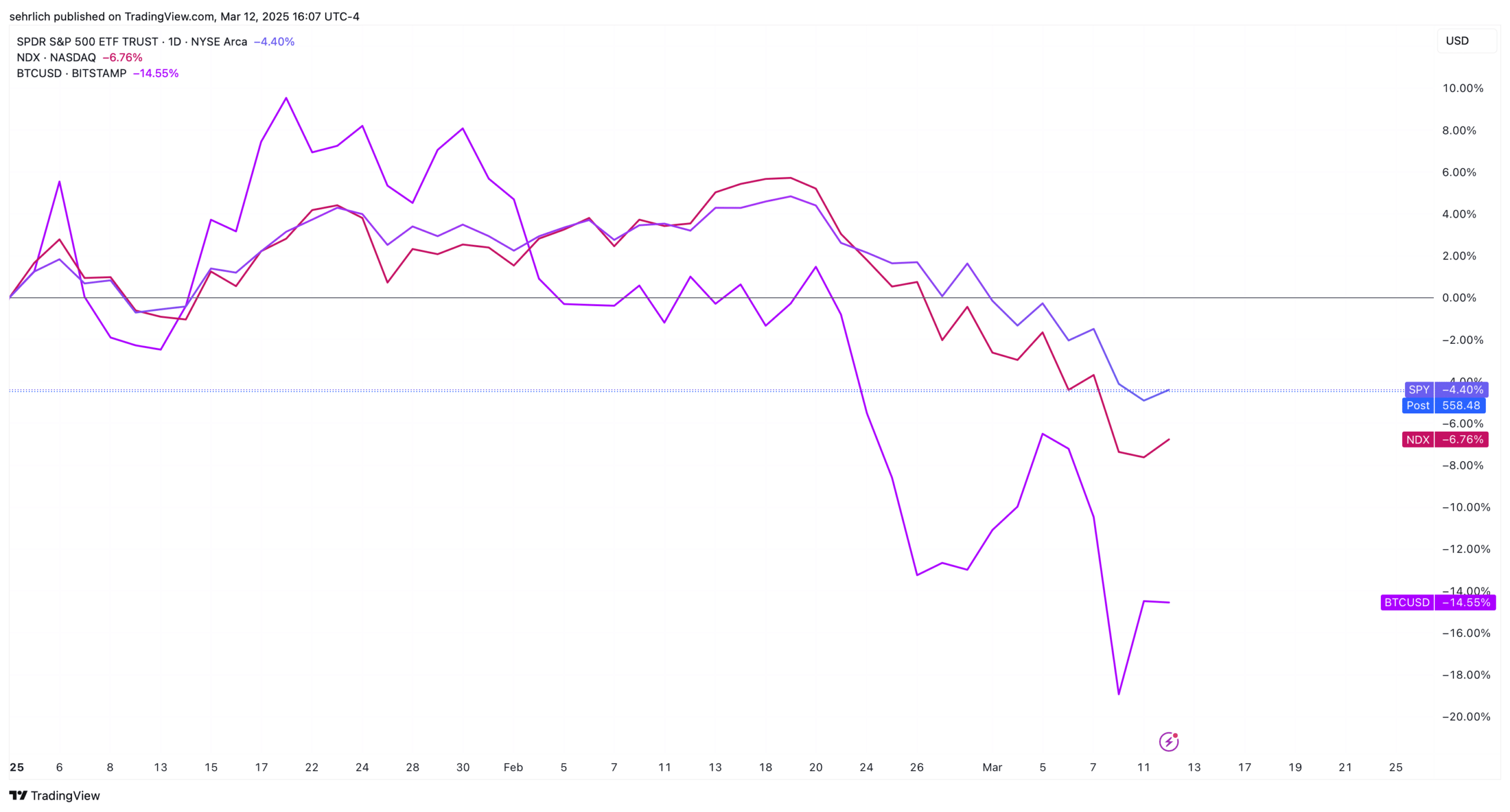

The pattern is even extra striking when taking a look for on the previous few weeks. Analysts in most cases rob veil of the market, or an index, to be in a correction when it drops as a minimal 10% from a most up-to-date high. Every the S&P 500 and tech-heavy Nasdaq 100 started their downward trends on February 19 and entered correction territory within the day gone by or so. Bitcoin is down nearly 30% from its tedious-January high.

At some level of the length from February 19 to March 11, the stablecoin market grew from $233.81 billion to its recent $234.77 billion, a paltry 0.4%. By comparability, tokenized treasuries jumped from $3.8 billion to $4.11 billion. This amounts to eight.16% enhance in real a shrimp over two weeks.

Every Penny Counts

Multiple consultants characterize Unchained that a most important residing off of this enhance in tokenized treasuries is that traders are below stress on this economic system to stretch out every produce. Tokenized treasuries are paying out an moderate of 4.27% yearly to their holders. Which will appear bask in a rounding error in crypto, nevertheless on this unsure atmosphere it without warning turns into field topic, especially for complicated traders.

“We have to seek info from those that publish stablecoin collateral because the most important customers of tokenized treasuries in expose to form yield on the collateral they are posting,” says a spokesperson for USDC issuer Circle, which no longer too long within the past supplied $912 million tokenized treasury issuer Hashnote. One trader who wished to remain anonymous build things extra succinctly: “Why utilize something that doesn’t come up with yield whenever it is possible you’ll perhaps maybe perhaps also form extra on high of it? It’s real striking your collateral expose to work.”

FalconX, a high brokerage, has been accepting tokenized money market funds bask in BlackRock’s BUIDL and Superstate’s USTB as collateral for nearly a year. Recently, the firm also began accepting Jito Staked Solana (JitoSOL) as collateral for definite trades.

“I seek info from the business will proceed on this path, enabling traders to maximise asset efficiency,” said Matthew Sheffield, FalconX’s senior vp of trading.

What’s in Your Token?

There’ll be extra at play right here. Despite their name, stablecoins salvage historically suffered courses of instability. Tether has been plagued by so great trouble, uncertainty, and doubt (FUD) that there is a nickname for of us that claim the issuer lacks the collateral to support its big product, a “Tether Truther”. Alternatively, Tether has by no formulation didn’t fulfill a redemption.

USDC was marketed because the antidote to USDT FUD, nevertheless even it hit some snags. In March 2023 USDC de-pegged from its value of $1.00 the total formulation down to $0.87 when it was revealed that the corporate positioned $3.3 billion in unsecured collateral in anxious Silicon Valley Bank. The federal authorities in a roundabout blueprint stepped in and guaranteed all SVB deposits above the posted $250,000 FDIC limit, nevertheless traders had been scarred.

At some level of those dangerous days traders learned a few classes. It might maybe perhaps perhaps maybe also even be laborious to understand the true makeup of a stablecoin’s collateral. 2nd, whenever you happen to bask in to must transform tokens aid to the underlying collateral out of doorways of celebrated banking hours it is possible you’ll perhaps maybe perhaps be out of luck.

In response to Sandy Kaul, Senior Vice President at asset supervisor Franklin Templeton and head of its digital sources division, tokenized treasuries are the acknowledge.

“Yes, stablecoins can switch all spherical the ecosystem, nevertheless they are able to’t be taken off-chain and return into fiat all over courses the build there’s no banking hours begin,” she said. Tokenized treasuries, she said, supply “extra certainty about shifting from an unregulated into a regulated entity.” In the tournament of a market calamity, Kaul said, “there’s of project that the stablecoin might perhaps maybe perhaps de-peg. If I will be succesful to switch out of that stablecoin into a US treasury, as a minimal I know that the US treasury is a regulated car [and] is no longer going to dramatically switch in worth overnight.”

A Tokenized Future?

It looks determined that the business has crossed the Rubicon and tokenized treasuries will be right here to discontinuance. But the tempo of enhance will depend on a few factors.

One most important residing off of the big surge in these merchandise in most up-to-date months was an October dedication by Deribit, the sector’s largest crypto derivatives supplier, to salvage Hashnote’s USYC as collateral for margin trades on the platform. The timing was extremely serendipitous, as it caught the tedious 2024 bitcoin wave early. On October 9, the day of the announcement, bitcoin was worth $60,370. By Trump’s inauguration it had surged 76% to high $106,000.

These forms of traders took earnings of the foundation alternate, which is if truth be told a formulation to originate free money by buying space bitcoin and then promoting a futures contract at a increased value. It’s a ways an awfully worthwhile strategy all over bullish courses.

“The foundation alternate is clearly one in every of basically the most well-favored trades ideally suited now, and it’s attributable to tradfi has in most cases stumbled on an above market yield opportunity that exceeds the celebrated 15 to 25 [basis points] that a money market supervisor is if truth be told always combating for to outperform,” says the anonymous trader. “You might maybe perhaps maybe be in a plot to for the time being form 8% on the money and raise alternate roughly, so whenever you watch it being venerable in leverage scenarios, you’re going to form yield to your collateral.”

The extent of this surge is glaring within the below chart, the build USYC went from nearly about nothing to over $1 billion in AUM.

But it’d be a mistake to attribute all of the enhance in tokenized treasuries to USYC. With the exception of that token, the rest of the tokenized treasury market grew by 17% since February Nineteenth. Since election day, the tokenized treasury market as opposed to for USYC has jumped 51.68% from $2.08 billion to $3.155 billion.

This explicit alternate might perhaps maybe perhaps tumble out of prefer within the short term given the market correction, nevertheless it is going to win reputation once a brand modern bullish cycle hits.

In the period in-between tokenized treasuries might perhaps maybe perhaps also proceed to supply prefer amongst traders who desire to remain on the ready to leap on market alternatives. “It’s bask in any fairness trader who moves from shares into money markets,” said Steve Sosnick, chief strategist at Wall Avenue colossus Interactive Brokers. “It’s the a linked celebrated motivation.”

Source credit : unchainedcrypto.com