This Share of US Households Frail Crypto in 2021

Might presumably well 24, 2022 / Unchained Each day / Laura Shin

Each day Bits✍️✍️✍️

- Graphic artist BEEPLE’s Twitter story became hacked to advertise a rip-off.

- Two major Korean exchanges warned traders about litecoin’s activation of confidential transactions, a signal they might maybe well delist it.

- South Korean authorities are in search of to freeze sources from the Luna Foundation Guard.

- Lockheed Martin and Filecoin Foundation belief to detect net hosting blockchain nodes in repute.

- Crypto fund sources under management maintain shriveled greatly, in accordance to Coinshares.

- DESK, CoinDesk’s social token, is relaunched.

- The CFTC charged two men with perpetrating a $44 million crypto fraud.

- Davos’ World Financial Forum showed hundreds of pastime in crypto.

Nowadays in Crypto Adoption…

- French banking extensive BNP Paribas joined Onyx, JP Morgan’s permissioned blockchain.

- eBay launched they’ll promote a sports activities NFT assortment.

- GameStop launched a self-custodial wallet that enables avid gamers to maintain interplay with Web3.

The $$$ Corner…

- Protego Belief Monetary institution, a chartered crypto bank whose board entails Brian Brooks, objectives for a $2 billion buck valuation.

- Pebble crypto app raised $6.2 million.

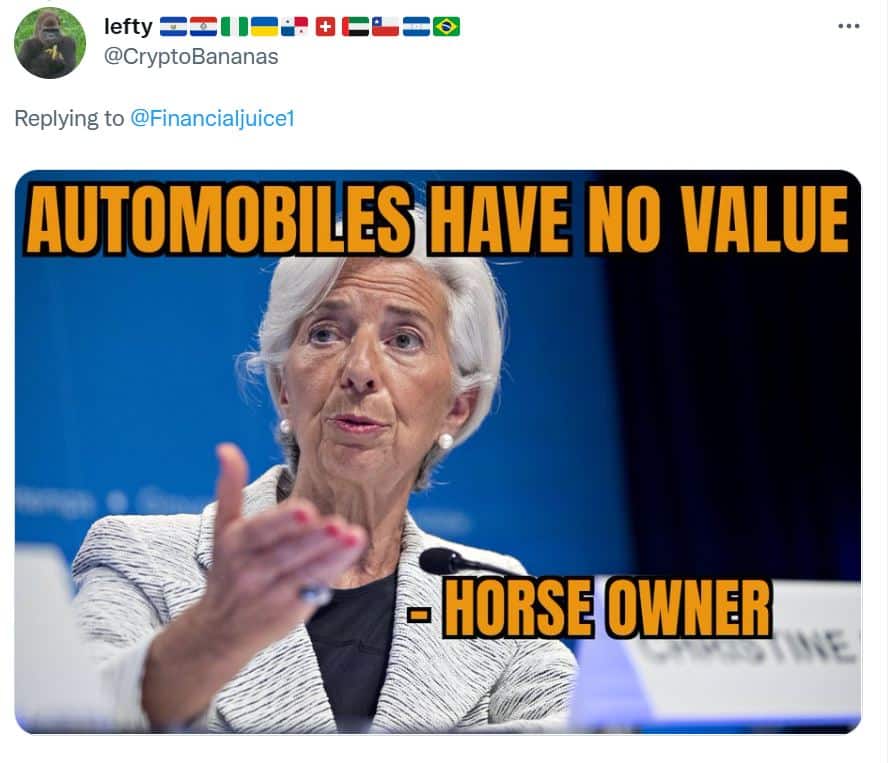

What End You Meme?

What’s Poppin’?

Fed: 12% of US Adults Frail Crypto in 2021

In step with a anecdote launched by the Federal Reserve, 12% of US households both ancient or held cryptocurrencies for the length of 2021. The tips became disclosed in the Financial Successfully-Being of U.S. Households anecdote, which is published every twelve months, but here’s the main time that it entails data about cryptocurrencies.

One conclusion from the anecdote is that crypto is seen as an investment machine rather then as a medium of charge. Files shows that 2% of americans the use of crypto are the use of it to buy stuff, and finest 1% use it to ship cash to family or chums. “Cryptocurrency use as an investment became intention more popular than use for transactions or purchases,” acknowledged the anecdote.

Another conclusion has to support out with what selection of americans support and use crypto. It looks handle low-earnings americans assuredly tend to use crypto as a transactional machine. “Whereas transactional use of cryptocurrencies became low, these the use of cryptocurrencies for purchases rather then as investments assuredly lacked primitive bank and bank card accounts,” the anecdote famed. In distinction, increased-earnings americans had been more most likely to use crypto as an investment and “nearly repeatedly had a primitive banking relationship, and in most cases had other retirement savings.”

Whereas some snarl it’s optimistic that nearly all efficient 12% of the country ancient crypto for the length of 2021 due to it system we’re very early, there are others who disagree.

Adam Cochran, accomplice at Cinneamhain Ventures, acknowledged on Twitter that here’s “disappointing data” due to despite the incontrovertible truth that we’re peaceful early on the adoption curve, 12% is peaceful a enormous sufficient number to overwhelm crypto applications, which might maybe well per chance be peaceful early of their product pattern curve and might maybe well go many mainstream users harassed. “When users strive a product that is now not willing for them, they in most cases churn away from it but are furthermore in most cases left with a negative expertise,” added Cochran.

Instructed Reads

- MakerDAO on Rocket Pool’s rETH token as a most likely novel collateral variety.

- The hazards, recent and future of inappropriate-chain communication by CoinYuppie.

- Lightcrypto on TRXUSDT.

On The Pod…

Cobie and Chris Burniske on How to Navigate a Crypto Undergo Market

Cobie, co-founding father of Lido and UpOnlyTv, and Chris Burniske, accomplice at Placeholder Ventures, discuss surviving a crypto endure market, the Terra collapse, lessons they’ve realized from their errors, and plenty more and plenty more. Repeat highlights:

- whether Chris and Cobie snarl crypto is in a endure market

- why Chris says these are the times to buy

- what conclude the Terra debacle can maintain on the crypto industry

- why Chris became anticipating UST to blow up

- why Chris thinks there goes to be every other massive liquidation occasion

- whether an algo stablecoin might maybe well work

- why endure markets are as soon as rapidly an proper side

- how USDT became stress tested and proved its resilience

- how macro is affecting the crypto repute and what the role of the Fed is

- when will we take a look at up on the bottom of this endure market

- how meme cash are the symptoms of a broken system

- why this crypto cycle is diversified

- whether rules are helping VCs rather then the retail traders

- why unstable sources are the ones that will well magnify 10,000x

- whether the long plug of crypto is multichain or now not

- how developers signal what ecosystem goes to procure in the next expansion cycle

- whether Cobie thinks staking is dying

- how Chris judges market bottoms and tops

- what lessons Cobie and Chris maintain realized from their errors

- what innovations will catalyze the next bull cycle

- what needs to happen in due direction for crypto to be triumphant

E-book Replace

My e-book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Colossal Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now readily available!

You’ll be in a position to also buy it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com