This DeFi Protocol’s IP Is Birth Source. Can and Ought to It Sue Copycats?

June 17, 2021 / Unchained On every day basis / Laura Shin

On every day basis Bits ✍️✍️✍️

-

BitDAO, a decentralized self sustaining group, has been formed; several traders, including Peter Thiel and Alan Howard, are backing its $230M fundraise

-

Fox is investing $100M into its NFT studio, Blockchain Inventive Labs

-

Morgan Stanley is eyeing a fourth Bitcoin fund

-

The SEC has delayed its VanEck bitcoin ETF decision and can private to restful ogle extra comments

-

DeFi lender Goldfinch announced a elevate of $11M led by a16z

-

Broad Time Studios plans to sell NFTs on Binance

-

Alchemix experienced a “reverse rug pull,” effectively sending a lucky crew of possibilities free money as a result of a trojan horse

-

In step with the Federal Reserve’s FOMC assertion, “Inflation has risen, largely reflecting transitory factors”

-

The roster for Congress’s crypto working crew is space to characteristic contributors of the Blockchain Caucus and Fintech Job Power

-

Sygnum, a Swiss Digital Bank, is offering Ethereum 2.0 staking to possibilities (as reported by CoinDesk)

- South Korean crypto exchanges private stopped procuring and selling or issued warnings regarding optimistic money even handed too awful

- Scammers are sending out counterfeit Ledger gadgets to possibilities exposed in a fresh recordsdata breach

What Lift out You Meme?

What’s Poppin’?

Welcome to the metaverse: a fresh proposal on Curve’s governance forum calls for the DeFi protocol to put in pressure its intellectual property rights in court.

Curve is a DeFi mission built on Ethereum that makes a speciality of stablecoin procuring and selling. Thru CRV, Curve’s governance token, changes to the protocol might perhaps even furthermore be proposed and voted upon by token holders.

hydrosam, the author of the proposal, believes that Curve’s DAO can private to restful defend its IP on behalf of its stakeholders, appropriate as centralized exchanges would defend IP on behalf of a shareholder.

He argues:

“Curve has proven incredibly standard, with over $10B deposited, an total bunch of hundreds and hundreds in every day volume, and around $1M/week in earnings to veCRV holders. This locations it among the many head of all exchanges in crypto at the moment, even rivaling publicly-traded CEX’s… These CEX’s defend their IP on behalf of their shareholders and there isn’t any motive why Curve, appropriate by advantage of its DAO group, can private to restful no longer defend itself for the coolest thing about veCRV holders too.”

Written the day prior to this, the proposal takes draw at Saddle Finance (a competing AMM), which, because the proposal notes, “has been accused of wholesale copying of Curve code.”

As an illustration, relieve in January, Curve instructed Crypto Briefing that a Quanstamp audit chanced on Saddle Finance’s implementation of its StableSwap unbiased to be “exactly the identical algorithm” viewed in Curve’s codebase.

The proposal argues that Curve’s governance forum can private to restful “ overview any proposals from law companies, fabricate them public, and place them up to a DAO vote. Any proposed settlement can private to restful furthermore be subject to DAO vote.”

For the time being, 75% of contributors of the Governance forum have faith the proposal, though the voter turnout is minute:

It appears that DAO IP and possession is a subject to support an peek on. DeFi is, by definition, decentralized and starting up-offer. Projects and tokens might perhaps even furthermore be launched fairly without problems by copying and pasting code with a pair of fresh changes. Presumably maybe the most neatly-identified example of here’s SushiSwap, which grew to turn into the major major DeFi fork by launching a mission fixed with Uniswap — with the addition of a token and governance system (here’s known as Vampire Mining).

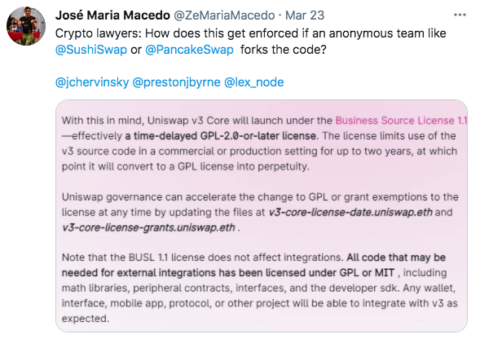

Support in March, Uniswap’s v3, in a an identical vein to the Curve proposal, launched with a “trade offer license” that delays the industrial employ of its code for up to 2 years.

The query for Uniswap now turns into, as Jose Macedo, partner at Delphi Digital, requested on Twitter: how enact you put in pressure a license if an anonymous and decentralized crew forks the code?

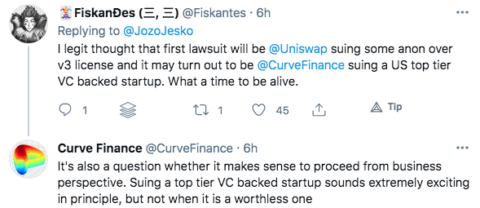

For Curve, the query is a little bit of more than a couple of, as it’d be facing Saddle Finance, which is backed by Polychain and Electric Capital, amongst others.

Urged Reads

- Goldfinch on its $11M elevate and draw, which is to raise loans without collateral to DeFi:

- Financial Instances wrote a fairly scathing article on MicroStrategy and Bitcoin:

- Andreessen Horowitz fair no longer too lengthy ago launched its media property, which aspects a host of appropriate crypto pieces:

On The Pod…

-

what I direct concerning the relationship between psychedelics and crypto

-

maybe the most though-provoking guest I’ve interviewed on Unchained

-

why Coinbase founders can in fact private a more impactful future on crypto than Ethereum founders

-

which present has been maybe the most impactful

-

why I’m a “nocoiner”

-

the place I imagine DAOs fit into the long dart of crypto

-

who my favourite guests were over time

-

what I’m most skittish and most hopeful about within the crypto negate

-

why I direct person-pleasant products are so vital transferring forward

-

which DeFi tasks I procure maybe the most curious

-

what kind of costs slip into producing Unchained

-

which matters I’ll perhaps perhaps favor to conceal within the long dart

-

maybe the most gentle answers I private got in an interview (feat. CZ and Vitalik)

-

what three cryptos I direct will be most main three years from now

-

if I direct I private interviewed Satoshi 🙂

-

my advice for anybody taking a peep to trade careers and slip crypto

-

who has been the toughest person to e-book on Unchained

-

what crypto vogue has surprised me maybe the most within the past five years

Ebook Update

My e-book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Broad Cryptocurrency Craze, is now on hand for pre-relate now.

The e-book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-relate it at the moment!

You’d also aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com