The Top 4 Onchain Metrics Each Crypto Investor Would possibly maybe well also just quiet Tag

Investing in cryptocurrencies can typically seem delight in a gamble, given their excessive volatility and the best draw unforeseeable events, corresponding to a viral second on X (Twitter), can ship prices transferring in diversified instructions. On these cases, especially amid the sudden rise of memecoins, it will seem as if this market has miniature to no fundamentals to those uncommon with it. But attributable to the public nature of blockchains, which host these coins and tokens, a wide quantity of insights can also just additionally be gathered about these property and place to make use of by consumers.

“Onchain knowledge is delight in working out the physical provide and query of an asset,” mentioned Philip Gradwell, chief economist at blockchain knowledge agency Chainalysis, in an email to Unchained. “Within the occasion you had been shopping and selling natural gasoline, that probabilities are you’ll are attempting to clutch how unheard of gasoline is being constituted of wells, how unheard of is in storage, and the best draw many households and factories are the use of it.”

Listed below are the tip four metrics every crypto investor needs to clutch, fixed with experts.

Metric 1: Distribution and Balances of Whale Holdings

Working out who the finest holders of a explicit cryptocurrency are — a neighborhood another time and another time steadily known as “whales” — can also just additionally be obligatory to working out the asset itself.

One of many simplest methods to detect whale exercise is to gaze at “top holder balances and distribution,” which blockchain analytics agency Nansen lists as a key onchain metric to overview in its 2023 onchain knowledge fable.

For consumers taking a gaze to decipher the “whales” of a explicit token, they would possibly be able to lean on blockchain knowledge platforms corresponding to Nansen. On Nansen customers can leverage “token god mode” and the balances tab to form pockets addresses by proportion of possession, the stability of the asset held, and diversified associated factors.

Users can additionally use blockchain explorers, corresponding to Etherscan and Blockchair, which typically checklist the tip addresses for that respective network’s native token.

Figuring out whales can wait on assess the quality of a challenge; if the addresses maintaining the finest amounts of a definite crypto are associated to revered consumers or entities then right here’s typically a first charge signal for those drawn to the asset, fixed with Nansen’s fable.

Having a gaze at how concentrated the asset is within the hands of whales is additionally crucial. If a token’s provide is mostly held by apt about a then this puts the asset at threat of tag manipulation.

An analysis of token focus can also just additionally be especially precious when taking a gaze into “low drift” coins, which delight in a miniature amount of tokens readily on the market for getting and selling. The larger the share of those cryptocurrencies owned by whales, the bigger the ability to manipulate the worth. It will additionally be crucial for consumers “shopping and selling brief in property with miniature liquidity,” Gradwell mentioned.

“If a whale sends hundreds of property to an change or liquidity pool, then count on the worth to tumble as they’ll be promoting an amount that will crush the market,” he added.

Learn extra: What Is Tokenomics? A Beginner’s Recordsdata

Metric 2: Each day Active Addresses

One of many finest onchain metrics for consumers is tracking the exercise of blockchain customers and what they’re paying for, mentioned Thomas Dunleavy, accomplice and chief investment officer at crypto investment agency MV Capital. He believes the simplest means to enact right here’s by taking a gaze at the every day active addresses participating with a challenge or blockchain.

Each day active addresses, which manner uncommon addresses that ship or acquire a particular crypto within 24 hours, can also just additionally be utilized to enact principal analysis on cryptocurrency initiatives by gauging person exercise enhance, mentioned analysts in Nansen’s fable, and in turn can particularly wait on consumers worth the person exercise enhance for a explicit digital asset.

But another fundamental metric ragged for this style of research is assortment of transactions on the other hand it is no longer a huge draw due to they would possibly be able to typically be spoofed, mentioned Dunleavy, adding that automated transactions made by bots and algorithmic shopping and selling instruments can acquire it onerous to acquire out precise interactions.

Assortment of addresses have to additionally be alive to with a pinch of salt, mentioned Chainalysis economist Gradwell.

“To name bots, you’ve gotten to gaze at habits: does this take care of protect property for a brief time, does it acquire transfers in actuality mercurial, what number of counterparties does it delight in, how unheard of does it pay in prices, are those prices paid in an illiquid asset, so can also just no longer in actuality tag as many bucks as you suspect?” he mentioned.

Superior instruments corresponding to Chainalysis and Elliptic can also just additionally be ragged to make a choice up insights on patterns and behaviors of transactions. Furthermore, blockchain explorer Etherscan affords evolved filters when browsing wallets, corresponding to excessive transaction toddle, natty prices, and a huge assortment of counterparties.

Metric 3: MEV (Maximal Extractable Payment)

MEV has seriously change a hot topic in crypto, with some describing it as a main threat to the Ethereum blockchain. MEV is a note in crypto the place validators reorder transactions to maximize profit, through recommendations corresponding to entrance-running and arbitrage, which steadily can lead to bigger prices for the tip person. MEV practices delight in won recognition and as a outcome knowledge from all these transactions can play to the encourage of consumers.

Learn extra: What Is MEV in Crypto?

The quantity of MEV occurring on a blockchain can also just additionally be a trademark of what individuals are gripping to consume on it, mentioned Dunleavy, who has a TradFi background from his time working in fixed earnings at financial services and products agency Jabber Avenue.

MEV exercise resembles co-place and excessive-frequency shopping and selling in ragged markets, mentioned Dunleavy, adding that “MEV can also just additionally be ragged as a proxy for the financialized worth that of us even delight in as their revealed want for the blockchain.”

“Solana’s valuation in actuality isn’t proxied through greenback amount spent or transaction prices delight in it is a long way on Ethereum, however is mostly proxied through one thing delight in MEV as prices compress to zero,” he added.

To gain metrics that will make clear MEV exercise, Dunleavy suggests consumers turn to blockchain knowledge platforms corresponding to Defi Llama, Token Terminal, and Messari.

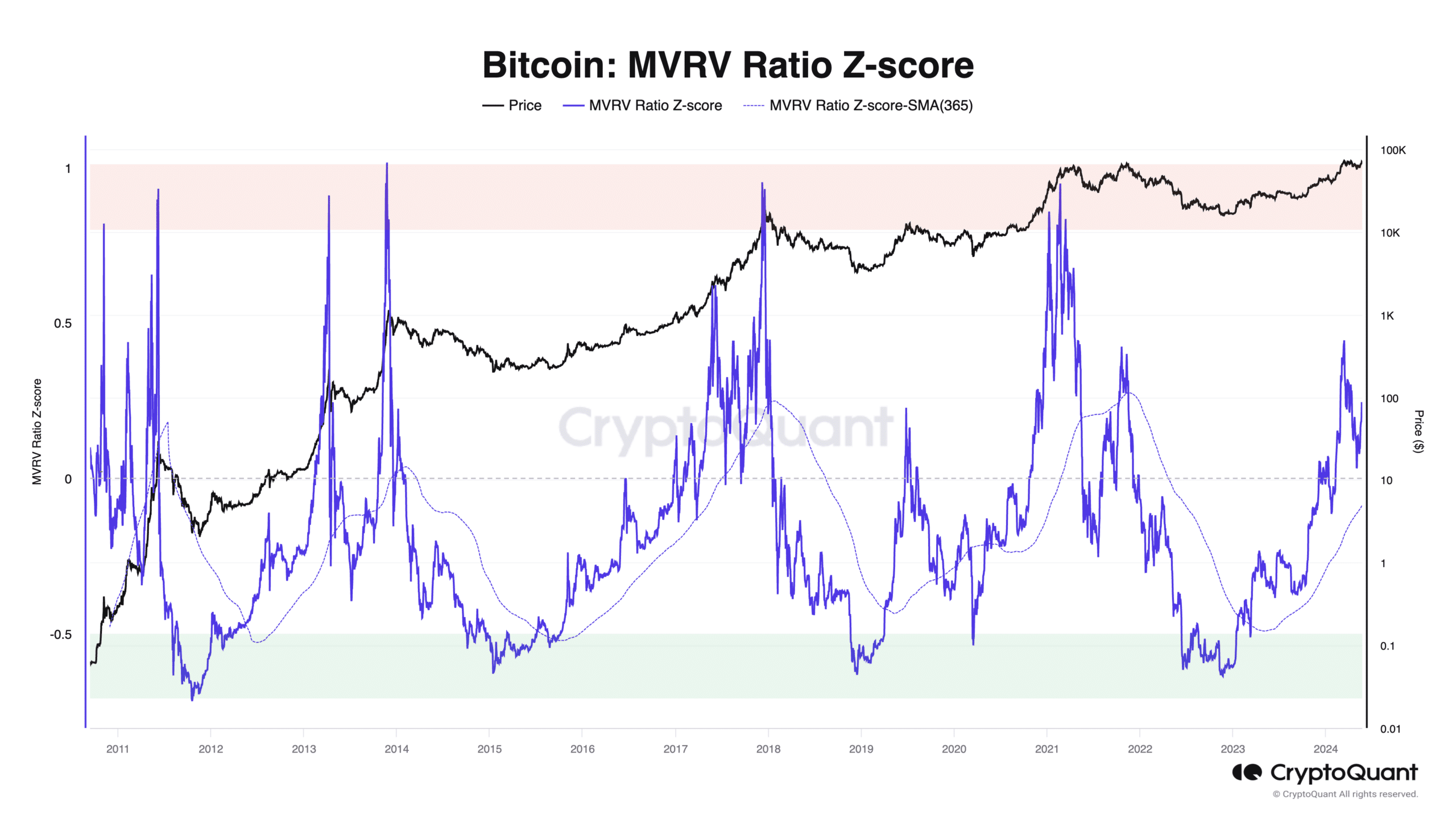

Metric 4: Market Payment to Realized Payment (MVRV)

But another key metric for merchants is a cryptocurrency’s MVRV ratio, especially for those drawn to bitcoin. MVRV is calculated by taking the present market capitalization and dividing it by the usual buy tag, identified as the realized capitalization. MVRV is essentially ragged for bitcoin attributable to the asset’s stability and multi-year shopping and selling historical previous. As the metric is ragged to overview lengthy-timeframe cycles, it is a long way much less professional when examining datasets belonging to more moderen and further unstable cryptocurrencies.

The metric has been notably necessary in determining whether or no longer bitcoin is undervalued or hyped up at a given deadline, mentioned Julio Moreno, head of overview at onchain and market analytics agency CryptoQuant, in an email to Unchained.

For example, Moreno mentioned that at the moment the MVRV is at .2 and is above its 365-day transferring average (illustrated within the dashed crimson line), which signifies that bitcoin remains in an upward cycle. If the ratio had been to tumble beneath the 365-day transferring average this would mean bitcoin has entered a delight in market.

This explicit metric “has been in actuality perfect at calling bottoms,” MV Capital’s Dunleavy mentioned. Nonetheless he has concerns about the metric’s reliability as a brand new wave of institutional consumers enter the bitcoin market.

He mentioned that following the approval of the place bitcoin ETFs within the US and the over $15 billion worth of inflows to those products, “you’re going to delight in these tag agnostic consumers going forward every two weeks hunting for it in their 401ks or with market buys. I contemplate that in actuality distorts the outdated signal of momentum and bullishness that probabilities are you’ll delight in from accurate transaction prices of bitcoin in that ratio.”

With renewed investor interest in cryptocurrencies following the place bitcoin ETF approvals blended with bitcoin reaching an all-time excessive earlier this year, consumers within the crypto residence must worth your total knowledge and instruments readily on the market.

“The verbal change hole to the on a usual basis investor is quiet in actuality, in actuality natty due to it’s in actuality onerous to discuss why these items are quiet precious,” Dunleavy mentioned.

Learn extra: How Token Present Affects the Mark of a Cryptocurrency

Source credit : unchainedcrypto.com