The Q3 Blues Starring $COIN, $SQ, $HOOD

November 10, 2021 / Unchained Each day / Laura Shin

Each day Bits ✍️✍️✍️

-

Apple CEO Tim Cook said he owns Bitcoin and Ethereum.

-

Discord CEO Jason Citron hinted that the corporate is working on an Ethereum wallet integration.

-

Landry’s, a cafe chain, partnered with NYDIG to present a BTC loyalty rewards program at its 500 areas within the US.

-

The Ethereum Title Service token, ENS, has a truly diluted market cap of over $5 billion.

-

Microsoft’s Decentralized Identity group launched its ION Decentralized Identifier (DID) community on BItcoin.

-

Reddit co-founder Alexis Ohanian’s Seven Seven Six fund dedicated $100 million to develop decentralized and social media projects on Solana.

-

The Basel Committee plans to handle climate-linked risks for banks facing crypto sources.

-

Austria will apply capital positive aspects taxes to digital currencies.

-

Ripple presented plans to delivery a hub the put aside users can possess and promote BTC and ETH, moreover to XRP.

-

Circle launched a endeavor capital fund for blockchain projects.

-

The Blockchain Affiliation hired Dave Grimaldi and Jake Chervinsky to lead government relatives and policy, respectively.

-

Based mostly fully on a ballotpublished by the Federal Reserve, monetary enterprise people are extra scared about cryptocurrencies/stablecoins than political uncertainty, cyberattacks, or a China slowdown within the next 12-18 months.

What Sort You Meme?

What’s Poppin’?

Not Coinbase

Shares of Coinbase (COIN) fell roughly 10% right by after-hours purchasing and selling on Tuesday afternoon on the heels of a disappointing earnings myth.

Two necessary metrics shrank virtually 50% between quarters:

- Coinbase’s EBITDA (earnings earlier than interest, taxes, depreciation, and amortization) reduced from $1.15 billion in Q2 2021 to $618 million in Q3.

- Rating revenue skilled an identical decline, falling from $2.03 billion to $1.23 billion between quarters.

The tumble in earnings and revenue appears to stem from an total decrease in usage. Every purchasing and selling quantity and monthly transacting users in Q3 had been lower than in Q2, by 29% and 16% respectively.

Curiously, the parable from Coinbase comes rapidly after Square and Robinhood, two publicly traded corporations that offer retail crypto companies and products, printed lowered Q3 revenues too. Square, which gives crypto by Cash App, reported a 23% tumble in its Bitcoin earnings in Q3. Robinhood’s numbers had been even extra drastic, with crypto revenue freefalling 78% between Q2 and Q3, main to its complete revenue shrinking from $565 million to $365 million, respectively.

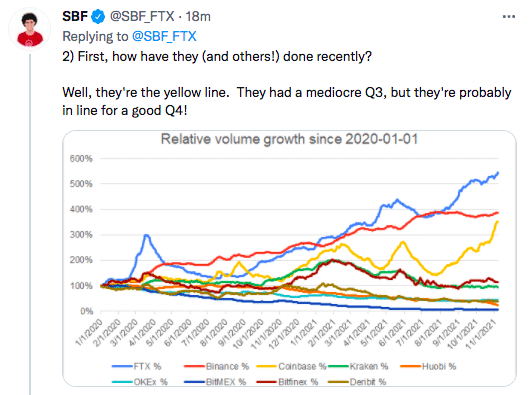

Zooming out, the image gets rosier. As an illustration, Coinbase’s salvage profits in 2021 increased by over 500% when put next to Q3 2020. Month-to-month energetic users also bigger than tripled within the closing month. Moreover, based fully totally on FTX CEO Sam Bankman-Fried (who knows a thing or two about running a crypto change), Coinbase is “doubtlessly in line for a appropriate Q4” according to the charting of relative client enhance.

In an investor letter, Coinbase said that it had outperformed the market right by Q3.

“While we entered Q3 with softer crypto market stipulations, driven by low volatility and declining crypto asset costs, market stipulations improved meaningfully later within the quarter which now we have persisted to appear at into early Q4. This backdrop resulted in global crypto location purchasing and selling volumes declining 37% in Q3 as when put next to Q2, however, Coinbase outperformed the market with complete purchasing and selling volumes of $327 billion, a 29% decline within the the same duration. Now we have consistently indicated that volatility is a key factor influencing our transaction revenue. Q3 illustrates this level.”

As of publishing time, Coinbase is purchasing and selling at $312.60 on Robinhood, a designate at which Messari’s Ryan Selkis would “buy” if he traded “stonks.”

Instructed Reads

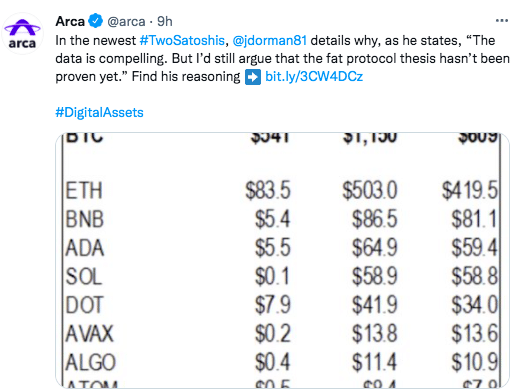

- Arca on the elephantine protocols thesis:

- Coinbase’s Elias Simos on the $ENS airdrop:

- CoinShares’s Meltem Demirors on Bitcoin:

On The Pod…

NFCastle 2021: Art work Controversy – NFTS: Nothing F**king There?

At Non-Fungible Citadel 2021, an NFT exhibition in Prague, four NFT consultants debate one of the most freshest subject matters within the metaverse, love the accurate formula to price NFTs, whether or now not insider purchasing and selling exists, what makes Ethereum-based fully mostly NFTS so particular, and the environmental affect of NFTs.

Company encompass Maria Paula Fernandez, co-founder at JPG, Kavita Gupta, cofounder of FINTECH.TV, Oliver Halsman Rosenberg, artist, and gmoney, an NFT collector. Grunt highlights:

- what an NFT is

- why NFTs have price

- what the “fantasy of decentralization” has to attain with NFT valuation

- why collectors love gmoney prefer to gather NFTs on Ethereum vs. diversified chains

- how provenance and IP rights interact with price

- why gmoney thinks Solana Punks are love deceptive Chanel baggage

- what “proudly owning an NFT” if reality be told formula

- whether or now not learners want to be stable from purchasing rip-off NFTs

- the “rite of passage” of falling reasonably to a rug pull and the thought that of “attain your have research” (DYOR)

- what may even furthermore be done about insider-purchasing and selling-love actions in NFTs

- the accurate formula to navigate public-going by blockchains when your take care of is doxed

- diversified ways to link off-chain sources to NFTs

- what the crypto enterprise can attain to raised realize the NFT affect on climate alternate

Guide Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Massive Cryptocurrency Craze, is now on hand for pre-inform now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-inform it at present time!

It is best to buy it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com