The US Presidential Election Isn’t the Most productive Motive at the support of Polymarket’s Success

Polymarket, a prediction market venue built on crypto infrastructure, has been rising in recognition, becoming cited usually by the mainstream media because of the the US presidential election. It also speak a myth high in month-to-month trading quantity in July of better than $387 million, a threefold develop from June’s $111.56 million resolve, per a Dune Analytics dashboard by Richard Chen. At presstime, Polymarket’s total quantity stands above $1 billion.

Whereas the whisk has helped Polymarket’s adoption, the November election is rarely any longer the ideal driver of the prediction market platform’s rising prominence, in accordance to early-stage funding firm ParaFi Capital, which could well be Polymarket’s single ideal investor.

In a thread on X, ParaFi also attributed Polymarket’s rising success, which incorporates over 32 million web web stammer online traffic web page views all over the final one year, to a pair of causes, equivalent to a spike in quantity of non-election-linked markets, among diversified statistical metrics.

ParaFi said in a tweet that 58% of the roughly 70,000 addresses which bear outmoded Polymarket started their traipse in non-election markets.

Be taught More: Polymarket Hits Fable Highs in Monthly Users and Procuring and selling Quantity Ensuing from Presidential Election

Of the final 42% of wallet addresses that first traded in an election-linked market on Polymarket, the huge majority of these participated in non-election markets in their following trades. “The truth is, virtually half of of all users who first traded in an election-linked market moved on to markets covering topics equivalent to the economic system, sports activities, and crypto,” said ParaFi.

One current market revolved around when the US Securities and Change Commission would approve a speak ETH switch-traded fund, which noticed a cumulative quantity of over $13 million.

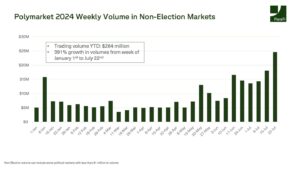

Total trading quantity for non-election-linked markets presently stands at $264 million one year-to-date when when compared with $497.1 million for election-linked markets, and on a weekly foundation, trading quantity has grown 391% since the first week of the one year when the resolve became around $5 million to virtually $25 million for the week of July 22.

ParaFi also famed how Polymarket has no longer considered a “intriguing deterioration in the retention charge as quarters development,” a mark of how sticky the platform is for users looking out to know part in prediction markets.

US Election Silent High Design

Even supposing non-election-linked markets bear helped with Polymarket’s development, the US election aloof dominates the platform. The head markets by quantity and liquidity are in conserving with the presidential contest, equivalent to who could well be the 2024 presidential election winner which has considered $474.4 million in bets, and who could well be the 2024 Democratic nominee which has considered $299.9 million in wagers.

An crucial non-election-linked market by liquidity is about what crew could well be the Neat Bowl Champions in 2025. This market has a trading quantity of $2.7 million, forward of which nation will bear one of the most gold medals in the 2024 Paris Olympics.

“70%+ of each day trading quantity in greenback phrases has been tied to election-linked markets in most up-to-date weeks,” ParaFi wrote, despite the incontrovertible truth that “this is rarely any longer gruesome given the proximity and volatility of events surrounding the election.”

Polymarket’s total fee locked, made of total deposits and the platform’s start ardour, has reached an all-time high of $89.4 million, a better than 109% develop from $42.7 million final month, recordsdata from Token Terminal reveals.

Source credit : unchainedcrypto.com