‘The Most Pivotal Match in All of Crypto’

Plus, what of us are 👀 in terms of Coinbase

The relationship between regulators and the crypto industry is simultaneously getting cozier and more fraught. With news that Coinbase was susceptible to cross public as early as this twelve months, on Unconfirmed Jeff Roberts mentioned how the company has been laying the fair groundwork for doubtlessly offering a blockchain-essentially based fully mostly token as successfully. Meanwhile, one other regulator joined the board of analytics company Chainalysis, while the crypto neighborhood decried CENTRE blacklisting an Ethereum handle holding USDC in response to a ask from law enforcement.

On Unchained, we lined all things yield farming, diving into the vogue and the sticky questions it brings up. And more developments came out of DeFi, including the originate of credit rating delegation on Aave, and DeFi reaching $2 billion in entire imprint locked.

This Week’s Crypto News…

CENTRE Blacklists an Ethereum Take care of Preserving USDC

The CENTRE Consortium collectively bustle by Circle and Coinbase has blacklisted an handle that holds $100,000 value of the stablecoin USDC, in response to a ask from law enforcement. Circle mentioned in an announcement, “While we can not comment on the specifics of law enforcement requests, Centre complies with binding court orders which maintain appropriate jurisdiction over the group.” The blacklisted handle can now no longer receive USDC, nor can any of the USDC in that handle be transferred on-chain. The Block reports that USDC balances in blacklisted addresses will seemingly be “wholly and completely unrecoverable.”

Dozens of Crypto Firms Gain $30+ Million in PPP Bailout Loans

More than 75 crypto and blockchain companies obtained over $30 million in payroll loans as a result of coronavirus. Polychain Capital, ConsenSys and CipherTrace, the latter two of which, disclosure, are old sponsors of my presentations, as successfully as Tron and Zcash’s Electrical Coin Firm all bought funds. As an illustration, ConsenSys obtained between $5 and $10 million from Signature Monetary institution, Bittrex, obtained between $1 and $2 million from Celtic Monetary institution, Circle and Shapeshift every was granted between $1 million and $2 million from Silicon Valley Monetary institution, and cybersecurity and blockchain resolution company Kryptoblocks looks to maintain bought between $1 million and $5 million. Several others, including IOHK USA, CipherTrace, Polychain Electrical Coin Firm and Blockfolio obtained between $350,000 and $1 million.

In a file, The Block mentioned pattern companies accounted for 29% of the companies who obtained loans, while financial services and products companies obtained 25%. Shopping and selling platforms came in subsequent at 12%. Eleven of the recipients had done preliminary coin offerings that had raked in $341 million.

Aave Brings ‘Undercollateralized Lending’ to DeFi, Nabs $4.5 Million Seed Funding

DeFi lending protocol Aave launched a recent carrier for “credit rating delegation,” by which a shopper can deposit funds, produce a increased hobby fee, and lend them out to a delegated one who has no longer save down any collateral. In the absence of collateral, the borrower and lender convey a legally binding contract specifying hobby rates and compensation closing dates created by blockchain-essentially based fully mostly OpenLaw. The Block reports that if the borrower would now not repay the loan, the lender “can take him [or her] to court — as long as they’re in the the same jurisdiction.”

Aave had some other news this week: ParaFi invested $4.5 million into what is currently the third-largest DeFi lending protocol.

The Subsequent twelve months in Ethereum

Tyler Smith, a validator for Ethereum 2.0 take a look at nets, wrote up a tweet storm on Ethereum 2.0, asserting this would possibly maybe well also fair additionally be “basically the most pivotal match in all of crypto for the rationale that originate of ETH1.0. Folks discuss Bitcoin halving occasions … they’re minor league when when put next with this.” He mentioned quite about a institutional money was waiting to glimpse if Ethereum would elevate, nonetheless introduced up a different of major issues, similar to how taxes desires to be handled for what he called ETH 2.0 ether vs. ETH 1.0 ether, asking the Ethereum Foundation to abolish an legitimate commentary asserting they were the the same. (One draw or the other, I don’t judge the foundation is regarded as the closing observe …) He additionally eminent, “An further tax headache will seemingly be accounting for staking gains while the tokens are locked on the beacon chain. In the US, mining rewards are taxed as regular earnings. However how are you presupposed to pay taxes on Ether you’ll seemingly be ready to’t promote?”

Meanwhile, Larry Cermak of The Block eminent that Ethereum transaction prices as a share of miner revenue were soaring to 18%, far surpassing Bitcoin’s that are at about 4%.

Trump’s Traditional Sanctions Chief Joins Chainalysis Board as It Raises $13 Million Extension

Blockchain analytics company Chainalysis garnered a $13 million extension to its Sequence B fundraising, which now totals $49 million, plus welcomed a recent board member: US President Donald Trump’s outdated school Treasury below secretary for terrorism and financial intelligence, Sigal Mandelker. Furthermore participating in this spherical was actor and investor Ashton Kutcher. Michael del Castillo of Forbes, who reported the narrative, eminent that Mandelker’s cross was allotment of “an more and more positive pattern of influential regulators becoming a member of the cryptocurrency companies they as soon as overesaw.”

Arca Launches US Treasury Fund on Ethereum With SEC Blessing

Los Angeles-essentially based fully mostly money supervisor Arca has launched the Arca US Treasury Fund, which is an SEC-registered closed-halt fund whose digital shares exchange through “ArCoins” on the Ethereum blockchain. It essentially invests in non permanent US Treasury bills and notes. The SEC gave it a “Be taught about of Effectiveness” on July 6, making it the first time the SEC has given its blessing to a fund represented by cryptographic tokens, with the approval coming after 20 months of effort.

TikTok’s Dogecoin Misfortune Causes Imprint to 2x

Seven days in the past, Dogecoin was languishing at one-fifth of 1 penny. As of press time, it’s greater than doubled, with that rise starting Tuesday, when a bunch of TikTok customers started publishing videos urging of us to aquire Dogecoin and take a see at to push the cryptocurrency to $1. The cryptocurrency is supreme-identified for being a meme cryptocurrency with its maintain mascot: a Shiba Inu who says things treasure “great wow” in Humorous Sans font. Bloomberg reports that some customers are prodding others to “all derive rich” and “convey all individuals you know.” But any other client zooms in on an image of Dogecoin while in the background plays the tune, “Cruise Me to the Moon.”

The Block reports that the campaign resulted in DOGE buying and selling volumes skyrocketing to 22 instances the common day-to-day buying and selling volume in 2020 to $27 million, and that Dogecoin hit the halt reputation procure on Google Traits of 100.

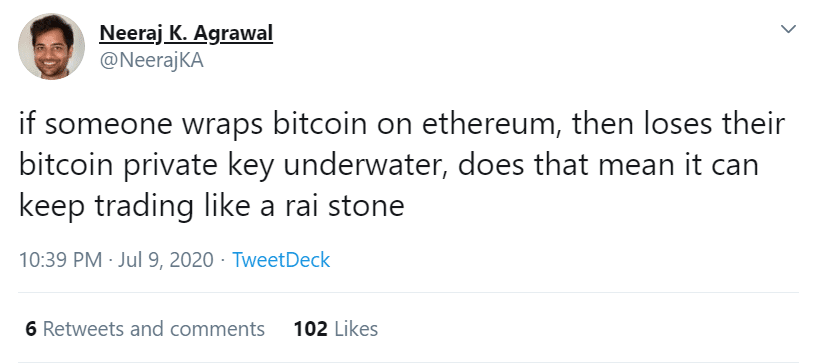

DeFi Rai Stones

This tweet by Neeraj Agrawal of Coin Heart was too droll to no longer point out. Some background to mean you’ll seemingly be ready to derive the joke. Blockchain-essentially based fully mostly programs are regularly mentioned to be same to a construct of money from the Micronesian island of Yap, by which families would convey immense stones called Rai stones as money nonetheless because they were too heavy to cross, they’d convey a ledger-essentially based fully mostly machine to preserve observe of who owned which or how great of any Rai stone. This even applied to Rai stones that had fallen into the ocean after they’d been transported by boat from in varied locations.

So, now, with that background, Neeraj mentioned,

Source credit : unchainedcrypto.com