The Perfect DeFi Hack in History

August 11, 2021 / Unchained Day-to-day / Laura Shin

Day-to-day Bits ✍️✍️✍️

- ETH trading on Coinbase surpassed BTC in Q2 2021.

- PNC, the fifth-supreme bank in the US, plans to give crypto funding products and services to purchasers.

- The Senate handed the trillion-dollar infrastructure invoice with the fashioned crypto modification language intact.

- VanEck filed for a BTC futures ETF.

- a16z led a $100M token sale for Helium’s HNT.

- Venmo launched a bank card providing crypto rewards.

- FalconX, a cryptocurrency trading desk, launched a $210M elevate at a $3.75B valuation.

- Indian crypto alternate CoinDCX raised $90M in a Series C valuing the firm at $1.1B.

- Digital asset funds saw a web outflow for the fifth straight time for the week ending August Eighth.

- Gemini obtained Guesser, a DeFi predictions platform.

- The SEC is disturbing over 1 million Slack messages from Ripple.

What Fabricate You Meme?

What’s Poppin’?

Two tales stood out the day prior to this…

Memoir 1: “Expensive Hacker”

Poly Network, a execrable-chain DeFi mission, change into once hit with a $600M+ hack on Tuesday morning — the supreme in DeFi history. Funds linked to a pair separate addresses were exploited, with $273M in Ethereum tokens, $252M in tokens from Binance Magnificent Chian, and $85M in tokens on Polygon Network, drained from the mission. In step with The Block’s Igor Igamberdiev, the hack change into once caused by a cryptography subject.

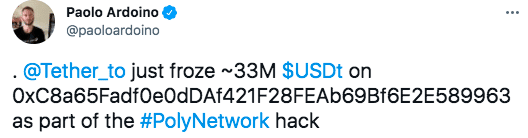

Quickly after the funds were stolen, Tether change into once in a situation to freeze $33M in USDT that change into once segment of the assault. These tokens will now now no longer be in a situation to switch (attributable to the centralized nature of Tether).

In a common crypto twist, after Tether blacklisted the hacker’s USDT, a crypto person despatched a transaction to 1 in all the addresses conserving stolen funds, tipping off the hacker now no longer to use the USDT. The hacker then transferred 13.37 ETH to the person, presumably in thanks for the knowing.

On the alternative hand, the identification of the attacker would possibly well already be acknowledged, in step with blockchain safety company SlowMist. The firm claims to perceive the attacker’s ID, electronic mail, IP knowledge, and gear fingerprint, citing knowledge bought from a Chinese language crypto alternate as its provide.

Primarily basically based on the claim, the hacker despatched one more transaction with a message, studying “IT WOULD HAVE BEEN A BILLION HACK IF I HAD MOVED REMAINING SHITCOINS! DID I JUST SAVE THE PROJECT? NOT SO INTERESTED IN MONEY, NOW CONSIDERING RETURNING SOME TOKENS OR JUST LEAVING THEM HERE.”

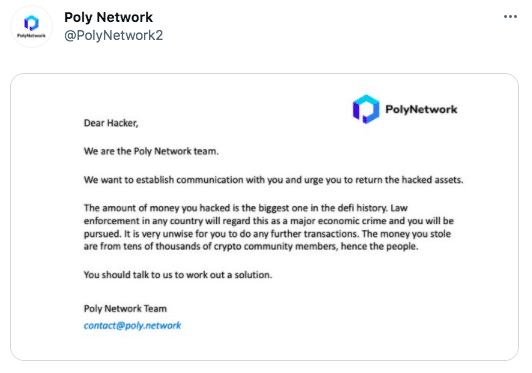

As of publishing time, it appears the Poly Network group would be willing to discuss about returning the funds, posting an announcement on Twitter pronouncing the hacker “must serene confer with us to determine a resolution.”

Memoir 2: BitMEX Settles

BitMEX is settling with both the US Commodity Futures Procuring and selling Payment (CFTC) and Monetary Crimes Enforcement Network (FinCEN). The cryptocurrency alternate has agreed to pay $100M to get cling of to the bottom of costs.

The settlement concludes October 2020 costs in opposition to BitMEX from the CFTC, alleging the firm illegally operated a cryptocurrency trading platform in the US and violated anti-money laundering regulations.

Severely, the $100M will easiest settle the civil costs in opposition to BitMEX. The CFTC’s criminal case in opposition to BitMEX founders Arthur Hayes, Benjamin Delo, and Samuel Reed will proceed. Arthur Hayes, worn CEO and billionaire, can be tried next one year.

Concerning FinCEN, BitMEX is closing the door on alleged violations of violating the Bank Secrecy Act and FinCEN’s implementing regulations. “BitMEX’s like a flash state into one in all the supreme futures price merchants providing convertible digital forex derivatives with out a commensurate anti-money laundering program set up the U.S. monetary scheme at most important danger,” FinCEN’s Deputy Director AnnaLou Tirol said. “It’s far serious that platforms bear in monetary integrity from the starting up up, so that monetary innovation and alternative are protected from vulnerabilities and exploitation.”

In a blog post the day prior to this afternoon, Alexander Höptner, Chief Government Officer of BitMEX, expressed reduction at striking a rocky generation of compliance “in the aid of” the firm. He wrote:

“This day marks a well-known day in our firm’s history, and we’re very ecstatic to establish this in the aid of us. As crypto matures and enters a brand new generation, we too bear evolved into the supreme crypto derivatives platform with a fully verified person unsuitable. Comprehensive person verification, sturdy compliance, and anti-money laundering capabilities are now no longer easiest hallmarks of our industry – they are drivers of our long-term success”.

Instantaneous Reads

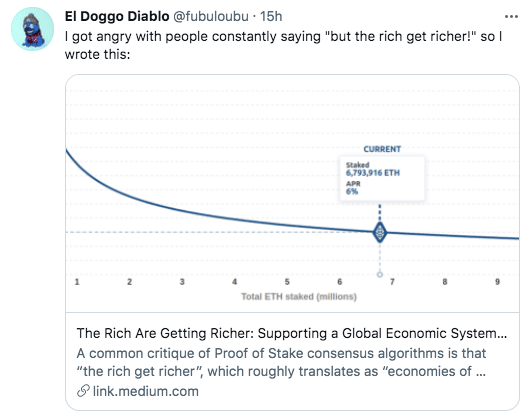

- Proof-of-stake versus proof-of-work:

- Coinbase CEO Brian Armstong’s tips on the infrastructure invoice:

- Coin Metrics on burning ether:

On The Pod…

Is ETH on Its Manner to Changing into Ultra-Sound Money? Yes, Says Justin Drake

Ethereum actual went thru its most complex aid ever. Justin Drake, researcher at the Ethereum Foundation, discusses what the aid, aka the London onerous fork, method for ether’s future as what he calls “ultra-sound money.” At the tip of the episode, he also drops about a Bitcoin sizzling takes. Disclose highlights:

- his background and how he bought fascinated with crypto

- how EIP 1559 will impact Ethereum now that it’s are dwelling

- why burning ether is appropriate for the Ethereum financial system

- what two ideas are well-known to knowing money

- what three systems ether is ancient as money

- why he believes ether will change into “ultra sound money,” when gold and silver are actual “sound money”

- what the well-known drivers of ETH’s cost are

- how the merge from proof-of-work to proof-of-stake will happen for Ethereum

- how worthy more efficient Justin calculates proof-of-stake can be compared with proof-of-work

- why people are pronouncing Ethereum is going thru a “triple halvening”

- what components influence how worthy Ethereum is issued and burned

- how Ethereum would possibly well change into deflationary

- why web promote stress is set to diminish

- what initiatives are burning the most ETH now that EIP 1559 is are dwelling

- why Justin is worried about Bitcoin’s future

- what Bitcoin would possibly well impact to continue to exist once it easiest subsists on transaction costs

- whether or now no longer Justin considers himself a bitcoiner

- how ETH as ultra-sound money is popping actual into a meme

Ebook Replace

My ebook, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Spacious Cryptocurrency Craze, is now available in the market for pre-tell now.

The ebook, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-tell it these days!

Chances are high you’ll well aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com