The 2024 Bitcoin Halving: What Miners Are Doing In a completely different plot Now Compared to 2020

Bitcoin miners accept as true with been offloading their holdings of BTC within the months main as much as the upcoming halving, a a amount of sample of behavior compared with the 2020 halving, partly on legend of the worth of BTC, now not like in previous years, has surpassed its all-time excessive sooner than the four-300 and sixty five days match.

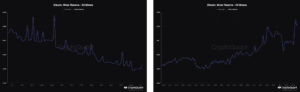

The fourth halving, attach of living to lower block rewards from 6.5 BTC to 3.25 BTC, has been marked by a lower within the amount of BTC held within the miners’ addresses, an effort to observe profit and elevate just appropriate thing about BTC’s excessive tag to upgrade their fleets. The earlier 2020 halving had a a amount of pattern insofar as miners were gathering BTC.

Records from blockchain analytics firm CryptoQuant exhibits that miners’ BTC reserves accept as true with lowered by extra than $866 million worth of BTC since Jan. 1, 2024 — a stark incompatibility to the 2020 halving when miners gathered roughly $429 million within the four months main as much as Bitcoin’s third halving.

Read More: Bitcoin’s Fourth Halving Is Appropriate Across the Nook. Is It Level-headed a Acceptable Time to Buy?

In 2020, miners avoided selling sooner than the halving on legend of they were awaiting a bull trek to happen afterwards. “Blockchain prognosis exhibits that mining pools accept as true with been keeping extra Bitcoin as the halving approaches. This would moreover imply that mining pools deem the post-halving Bitcoin tag surge is on its plot,” wrote blockchain analytics firm Chainalysis in 2020. With BTC already surpassing its all-time excessive in 2024, miners offloading some of their minted BTC is perhaps a stamp they are chuffed with realizing profits.

The chart on the left exhibits the amount of BTC held in miners’ wallets in 2024 and the chart on the applicable displays miners’ holdings of BTC in 2020. (CryptoQuant)

Staying Competitive

Some bitcoin miners accept as true with determined to dump some of their holdings this 300 and sixty five days to upgrade their mercurial of machines to “shield aggressive” and “earlier than the curve” for the 2d block rewards rep crop, acknowledged Colin Harper, Head of Hiss material and Analysis at Bitcoin mining firm Luxor, in a conversation with Unchained.

As an illustration, mining firm Marathon Digital Holdings announced on Mar. 5, 2024 that it had sold 290 bitcoins in February, worth about $19.1 million at right this moment’s costs. Marathon “peaceable intends to sell a share of its bitcoin holdings in future sessions to enhance monthly operations,” its press release acknowledged. “In anticipation of the following Bitcoin network halving, the Firm continues to kind liquidity on the steadiness sheet to capitalize on strategic alternatives.”

Read More: Bitcoin Miners Glance File $2 Billion in Monthly Income

Rebel Platforms disclosed on Feb. 5, 2024 that it had offloaded 211 bitcoins in January. A pair of weeks later, Rebel announced the aquire of 31,500 WhatsMiner M60S miners from MicroBT for $97.4 million.

The Develop on Hashrate

In accordance with how BTC reached an all-time excessive this 300 and sixty five days sooner than Bitcoin’s code executes the block reward lower for miners securing and validating the network, Harper predicts that a key inequity between the upcoming halving and earlier halvings may be the amount of hashrate that can depart offline after block rewards are crop.

“Bitcoin’s tag hitting an all-time excessive sooner than the halving changed the equation for the hashrate that can come offline,” Harper added. Since miners are generating extra earnings in greenback tag from the worth appreciation of BTC pushing previous $69,000, they are operating at increased profit margins in this cycle, which provides them extra room to feature when block rewards are crop in half of.

Read More: Who Is Making an are trying to search out Into Field Bitcoin ETFs? We’ll Rapidly Originate to Net an Thought

For Harper, this system that fewer companies will almost definitely be forced to quit their operations and that a smaller share of general hashrate will depart offline following this 300 and sixty five days’s halving, compared with earlier cycles. Bitcoin’s network hashrate the day sooner than its 2020 halving stood at 114 exahashes per 2d (EH/s), nonetheless dropped 18.4% to 93 EH/s by the following week, in accordance to Luxor Mining’s Hashrate Index knowledge. For 2024, “we’re estimating anywhere from easiest 3% to 7% [of hashrate] will come offline,” acknowledged Harper.

The worth of BTC has lowered 5.6% within the previous seven days to alternate at $66,121 at presstime, knowledge from CoinGecko.

Source credit : unchainedcrypto.com