‘Tiresome Bitcoin Prosperous’

+ the Bitcoin metric at a 3-year high

The week got started with Bitcoin prices spiraling down from all-time highs, wonderful to acknowledge the charge procure most of its ground by week’s conclude. The future seems to be to be shining for a Bitcoin ETF, because of Biden’s different of SEC chairman. FinCEN is extending the observation period on its controversial original proposals concerning self-hosted wallets, which is ready to peek comments shut after basically the most stylish administration leaves.

Bakkt goes public forward of its app start, with varied crypto exchanges signaling they are taking a examine the chance of a Wall Boulevard debut as properly. Grayscale is finalizing the dissolution of its XRP positions, in light of the SEC’s lawsuit against Ripple, whereas global agencies original more leniency in direction of Ripple. Crypto-pleasant regulator Brian Brooks stepped down from the OCC, nonetheless no longer forward of publishing, within the Financial Times, a call for federal DeFi law. And, Vitalik Buterin addresses the need for what he calls social restoration of wallets.

On the podcasts, Willy Woo, on-chain Bitcoin analyst breaks down what has been riding the Bitcoin imprint rally in most stylish weeks and the set up he thinks issues are headed over the following year. And, on Unconfirmed, Meltem Demirors of Coinshares and Nic Carter of Citadel Island Ventures focus on layer 2s on Bitcoin and the best arrangement Bitcoin transferring to layer 2s impacts the charge of the asset.

This Week’s Crypto News…

Bitcoin Liquidations Trigger Selloff nonetheless the Bull Speed Isn’t Over

After Bitcoin saw all-time highs shut to $42,000 final week, the charge fell below $31,000 on Monday when a sequence of futures liquidations sparked declines in other locations within the market. On-chain analyst Willy Woo necessary that after space markets began their selloff, Coinbase began failing to register buys. That introduced about its BTC imprint to toddle $350 decrease than on varied exchanges. That in flip pulled down index prices that futures exchanges exercise to calculate leverage funding.

Synthetix founder Kain Warwick took to Twitter to give his thought on how overleveraged longs result in these corrections. He stated that in an early bull market, long-time holders will protect shut profits round a earlier ATH. After that, then again, he stated they’ll plug the charge up to multiples of the earlier ATH. For instance, he wrote, “I purchased round 5-10% of my ETH into stables between $500-$1200, over $1,200 that you might make a choice to claw it out of my cool tiresome hands forward of we hit $3k.” The Block’s Larry Cermak pulled data showing that retail traders are dipping their toes relief into the crypto markets in this rally that has to this point been pushed by institutional money.

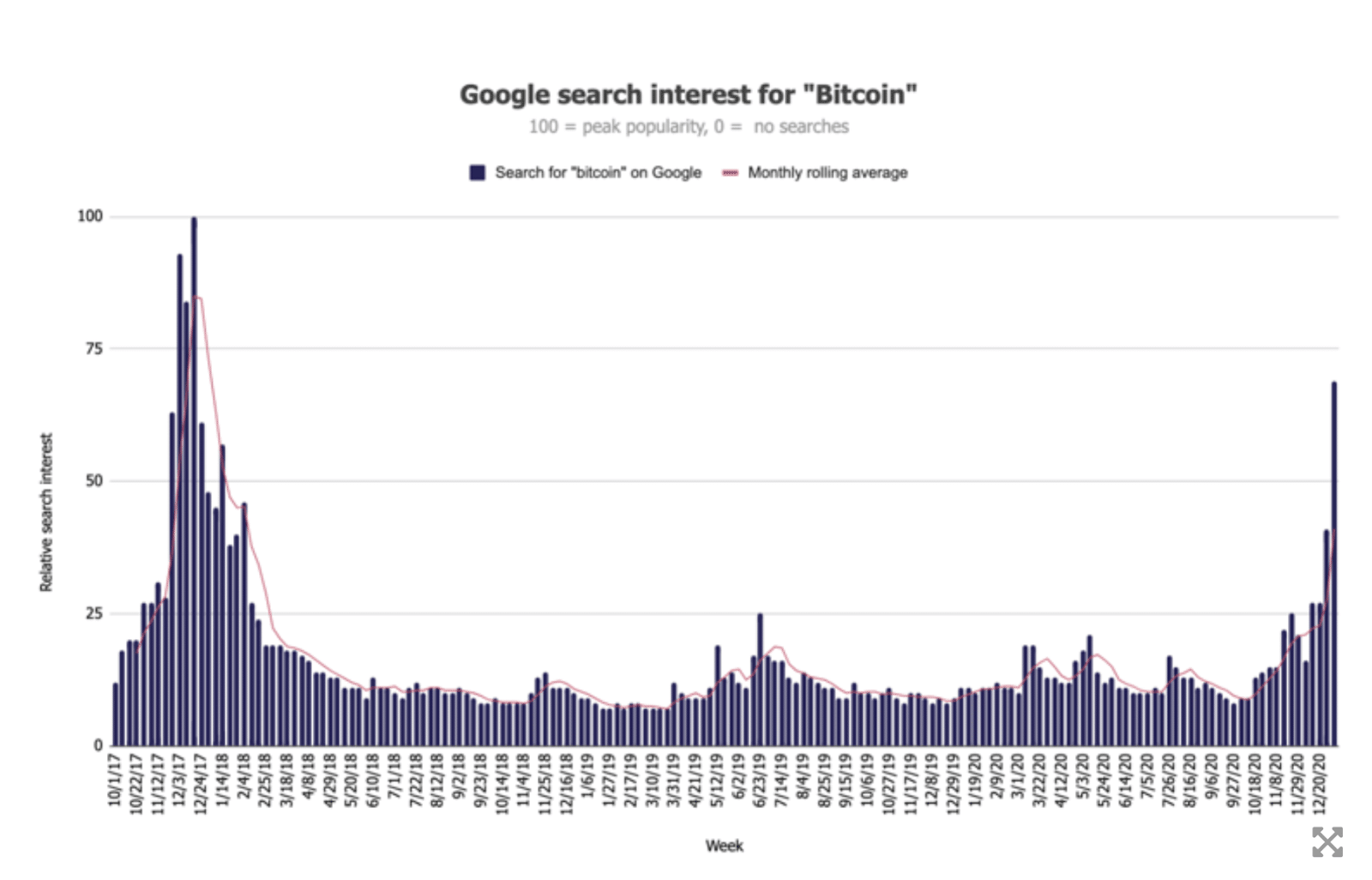

Even supposing the numbers haven’t reached 2017 ranges but, Google search pastime for “Bitcoin” is at a three-year high.

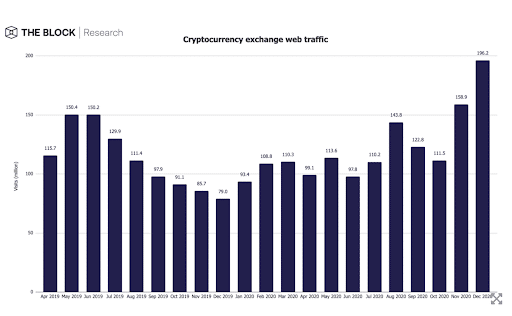

Substitute site visitors shall be beginning to construct up, with but every other consecutive monthly impact bigger of 24% in December and data showing a complete of 196 million web pages visits to crypto exchanges.

Gary Gensler Named SEC Chairman, a Run Hailed as Obvious for Crypto

President-elect Joe Biden is anticipated to call Gary Gensler as chairman of the U.S. Securities and Substitute Rate. Gensler, a historical Commodities Futures Shopping and selling Rate chairman, has testified forward of Congress concerning crypto and blockchain abilities on several times and once called it “a catalyst for exchange within the world of finance and broader economic system.” On Twitter, Compound usual counsel Jake Chervinsky stated Gensler’s different indicators a policy shift in desire of a Bitcoin ETF whereas also pointing out that Gensler was on the file in 2018, pronouncing there was a solid case XRP is a security and so there is now not any longer seemingly to be a shift within the SEC’s case against Ripple.

FinCEN Extends Comment Duration on Controversial Self-Hosted Pockets Rules

The Financial Crimes Enforcement Community (FinCEN) prolonged its observation period for a proposed rule that will presumably presumably require crypto exchanges to store name and take care of data for purchasers sending bigger than $3,000 in crypto per day to self-hosted crypto wallets. It would also mandate that exchanges file foreign money transaction experiences for purchasers whose transactions exceed $10,000 a day. On Thursday, FinCEN stated it might maybe presumably presumably reopen the proposed rulemaking period for an further 15 days from January 15. The extension technique that most stylish Treasury Secretary Steven Mnuchin, largely considered because the sole riding force within the relief of the proposed rule, will no longer be in place of work when comments reach to a shut.

Bakkt Will Run Public on NYSE By SPAC Deal

Bakkt goes public on the Original York Stock Substitute by technique of a SPAC, or special motive acquisition firm, merging with VPC Impact Acquisition Holdings, which is backed by investment agency Victory Park Capital. The VC agency can even provide original funding, as Bakkt raises an further $532 million. The venture is anticipated to have a public valuation of $2.1 billion once the merger is finished. The firm also launched that it had appointed Gavin Michael, a historical Citi executive, as its CEO.

The digital assets procuring and selling and payments app, which is anticipated to have a March start, will allow users to aquire and sell cryptocurrencies and prepare varied digital assets corresponding to loyalty points and gift cards. Its regulatory submitting states that Bakkt, which has bigger than 400,000 folk preregistered forward of its start, hopes to reach bigger than 30 million potentialities by 2025.

The details comes as but every other longtime participant within the crypto exchange space, Gemini, says it is indignant by a debut on the stock market. Gemini would be following within the footsteps of Coinbase, who filed bureaucracy to toddle public at the conclude of final year. In conserving with The Block, pre-IPO futures for Coinbase on FTX are procuring and selling at $303, implying $76 billion valuation.

XRP Update

The XRP securities saga continues to play out, with digital asset investment agency Grayscale confirming in a press assertion Wednesday that it is dissolving its XRP trust. This announcement comes days after the agency launched the liquidation of XRP positions from its Digital Immense Cap Fund. In both cases, the catalyst was the SEC’s determination to file suit against Ripple.

On the opposite hand, it wasn’t all defective data for Ripple this week, with the stay securities regulator in Japan pronouncing XRP is now not any longer a security. Japan’s Financial Products and companies Company confirmed to The Block this week that it views XRP as a cryptocurrency and no longer a security.

As a facet masks, the XRP Military has taken to replying to SEC tweets thoroughly unrelated to the Ripple case, with comments cherish, “Here within the UK, [the finance ministry] has declared XRP as an exchange token … NOT A SECURITY!!!”

An Argument for Social Recovery Wallets

Ethereum creator Vitalik Buterin revealed a weblog post about growing pockets security with what he called social restoration. Social Recovery is a neat contract pockets with a single “signing key” to approve transactions, as properly as a effort of three or more “guardians,” who can even be called upon when the user loses his or her signing key. For the time being, he or she would put a inquire to their guardians to imprint special transactions to exchange basically the most important registered within the pockets to a brand original one. Valid suggestions for likely guardians are 1) varied devices owned by the user, 2) mates and household, and 3) institutions.

As if to highlight factual how precious this style of pockets would be, The Original York Times came out with an article the following day in regards to the bother of Bitcoin millionaires who have lost accumulate admission to to their pockets, at the side of one who has $220 million sitting on a hardware pockets that will wonderful give him two more tries at the password forward of encrypting the contents without a ruin in sight.

Brian Brooks Quits the OCC

Brian Brooks stepped down as performing head of the Position of job of the Comptroller of the Foreign money on Thursday. Brooks had a daring tenure as performing OCC head the final eight months and was expected to step down or get replaced by the incoming Biden administration. Brooks will be remembered for issuing several interpretive letters that cleared the fashion for banks to work alongside with cryptocurrencies, with many describing him because the nation’s “first fintech comptroller.”

On Tuesday, Brooks revealed an op-ed within the Financial Times calling for twenty first-century law of emerging DeFi projects. Magnificent as self-riding autos have seemed within the last few years and upended the ways we own transportation, Brooks called for more clarity in federal law of DeFi because of he expects DeFi applications to protect shut off rapidly, risking a field in which US states beget the void of federal regulatory clarity, impeding the increase of a nationwide market.

How a Normie Artist Grew to turn out to be ‘Tiresome Bitcoin-Prosperous’ and Paid It Abet

Ali Spagnola, an independent artist and creator of outrageousness, as she calls herself, made a hilarious video about how she earned a bitcoin relief in 2013, logged relief in precisely lately — and found it was charge $11,000, and then $40,000 by the time she edited and released the video. The video then significant points how she paid her newfound wealth relief. She’s a humorous personality, and the legend is consuming, and even heartwarming.

Source credit : unchainedcrypto.com