Staked Ether Elevated by Practically $1.3 Billion Since ETH ETFs Launched

Since most attention-grabbing Tuesday, July 23, when put ether alternate-traded funds (ETFs) began trading, the tempo of ETH being staked has accelerated, propelling the final to a sage excessive and serving to to bolster Ethereum’s economic security.

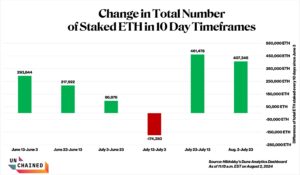

The amount of ETH committed to securing Ethereum has crossed the 34 million designate, rising by 407,346 tokens, worth about $1.3 billion at modern market prices, for the reason that trading debut of put ETH ETFs, in accordance to a Dune Analytics dashboard created by Hildobby.

The growth of staked ETH heightens the aggressive dynamics amongst validators in being chosen to be capable to add a brand modern block to the Ethereum blockchain, lowering the probability of winning attacks on the community by malicious actors.

Particularly, the rate at which crypto customers had been staking ETH climbed by more than 405,000 ETH ten days prior and ten days after the launch of put ETH ETFs. When in contrast, between June 3 and July 13, the trade in staked ETH for each 10-day interval on common leapt by 108,598 ETH, a notably smaller trade than the intervals surrounding the ETH ETF approval.

The launch of the ETFs is more seemingly to push the worth of ETH up, as it did for bitcoin, on the change hand the ETFs themselves discontinuance now not offer yield, the approach that staking ether does. Contemporary stakers would perhaps be availing themselves of the opportunity to expertise the worth of their ETH rising whereas also making further ardour on top.

Learn More: Ethereum ETFs Doubtless Protect Ether From the SEC. But What About Staked ETH?

“For various, the ETF legitimizes Ethereum as a exact investment opportunity for primitive funds,” Richard Bagshaw, the head of advertising and marketing for blockchain validator company P2P.org, wrote to Unchained over Telegram. 2nd, the further return for staked ETH plus the worth impact of the launch of the ETFs makes staking “one of the crucial strongest/most enticing investment opportunities,” Bagshaw added.

The amplify in staked ETH comes as put ETH ETFs, which potential of the ETH that had already been invested in Grayscale’s Ethereum Belief (ETHE) since 2017, bask in viewed more outflows than inflows since their trading debut, in accordance to market records curated by Hildobby and financial overview platform SoSoValue.

Grayscale’s ETHE, which transformed to an ETF, has the biggest rate—2.5%—and is using the outflows. Every of the change ETFs has viewed certain get inflows since most attention-grabbing Tuesday with BlackRock’s ETHA, Fidelity’s FETH, and Bitwise’s ETHW main the pack.

“The chance for higher charges in modern ETFs, in put of Grayscale, the put many outflows are coming from, highlights a market shift. The predominant level here is, there’s mild exact ask for these financial merchandise,” wrote Bagshaw.

As effectively as to Grayscale’s vast ETF rate, one more motive merchants would perhaps be rotating out of ETHE stems from the wider macro uncertainty and the “opportunity worth of now not having staking as share of the bundle,” wrote a spokesperson for blockchain analytics company Nansen to Unchained over Telegram. Earlier than the US Securities and Change Commission accepted put ETH ETFs, issuers who had in the muse needed to give yield on their ETFs eradicated that just, apparently for the SEC, lowering their merchants off from the probability of yields that would perhaps be earned from staking.

Learn More: Why the SEC’s Latest Decision Might perhaps well Now now not Mean It’s Shedding the Case Towards Third-Event Tokens Adore SOL

One component of the broader macro uncertainty revolves across the US presidential election, which can moreover form a more certain regulatory atmosphere for crypto (and linked ETFs) in the area’s most attention-grabbing financial system. Lawful a pair of weeks ago, prediction markets platform Polymarket showed a 72% probability that Donald Trump would modified into the next US president following his assassination strive, however since incumbent president Joe Biden dropped out of the 2024 bustle, on Polymarket, Trump’s possibilities bask in dropped 18 share aspects to 54% at presstime.

Nevertheless, Bagshaw expects to bask in a study staking at most attention-grabbing collect incorporated with US-essentially based entirely ETFs, citing the Financial Innovation Technology for the 21st Century Act, a bill that passed in the House and goals to categorise ETH as commodities, as additive tension for the SEC to adapt.

The worth of ETH has dropped almost 13% from round $3,463 on July 23 when ETH ETFs began trading to $3,025 at presstime, giving it a $363.6 billion market cap, per CoinGecko.

Source credit : unchainedcrypto.com