Some Bitcoin HODLers Have Cashed Out

Long-term Bitcoin merchants have offloaded about a of their holdings all throughout the week culminating in the U.S. Securities and Alternate Commission’s approval of pronounce Bitcoin replace-traded funds (ETFs), data from blockchain analytics firm Glassnode reveals.

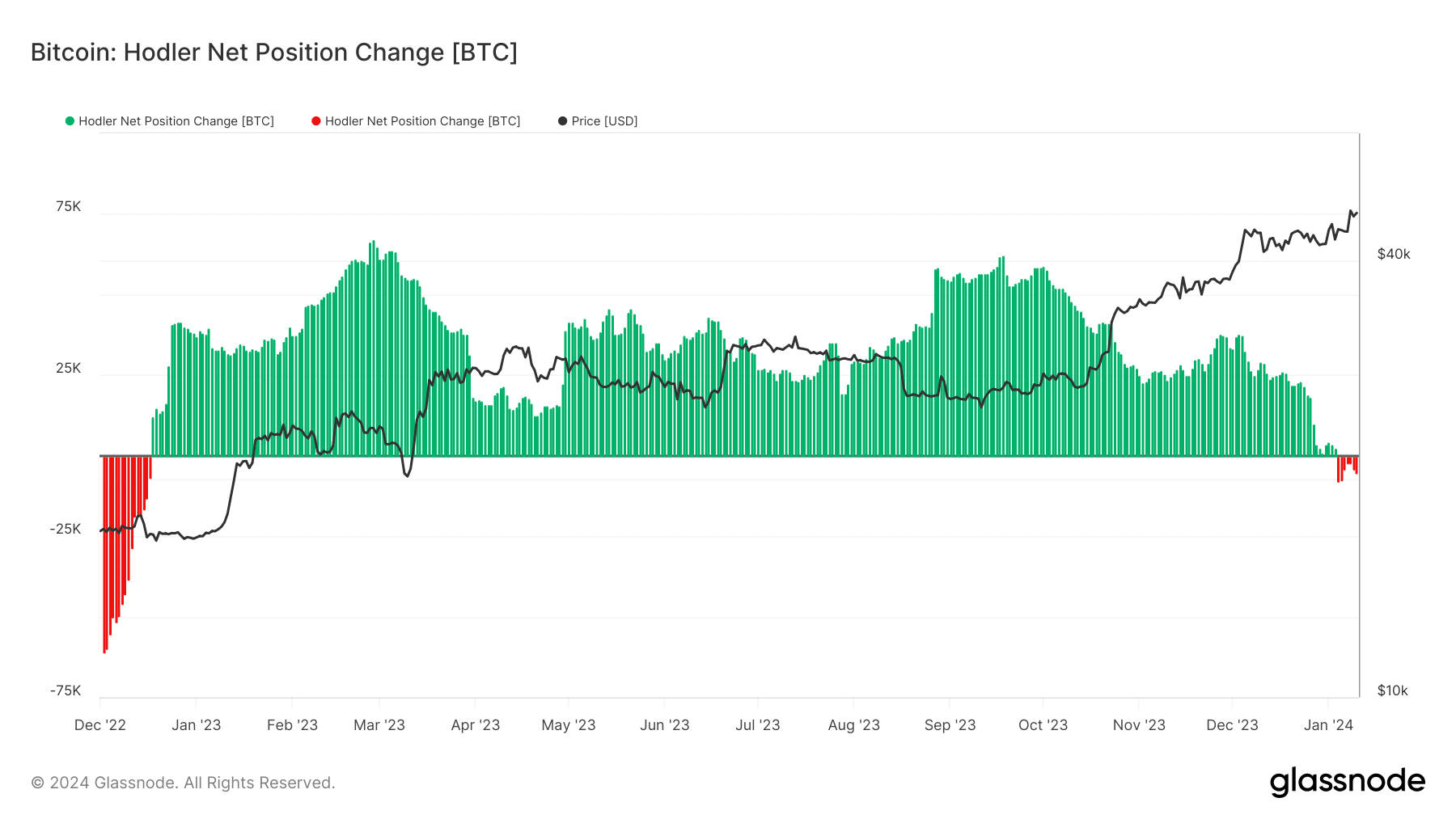

The get location switch of Bitcoin “HODLers,” crypto parlance for prolonged-term merchants, has been adverse for every of the seven days from Jan. 4 to 10. A adverse get location switch indicates that HODLers have cashed out.

Right here is the first time since Dec. 2022 that this metric has been adverse, even supposing the magnitude of the differentials in 2022 became powerful extra severe. The get location switch amongst Bitcoin HODLers in the previous week ranged from -2,389 BTC to as easy as -8,019 BTC. Between Nov. 11, 2022 and Dec. 17, 2022, the get location spark off on a regular foundation became on common -36,776 BTC.

And the circumstances at the moment time versus a year ago may perhaps presumably well maybe no longer be extra diverse.

In the iciness of 2022, the crypto ecosystem had been rocked by a sequence of failures and frauds amongst about a of the most coveted brands in the trade. FTX had filed for financial worry in November, and by December, Binance became coping with rumors and questions on whether or no longer it can presumably well maybe fold in the subsequent apocalyptic crumple. BTC became hovering around $17,000 at the moment, down 75% from its all-time high of around $69,000 in Nov. 2021.

“In December of 2022, we faced total and notify fear that the ‘depended on’ centralized exchanges were going to fold. This location performed out with some realizing BTC positions to address for the worst-case scenario,” wrote Charles Storry, co-founder of crypto index platform Phuture, to Unchained on Telegram.

Throughout the subsequent endure market of 2023, Bitcoin HODLers gathered original get certain positions on every day foundation.

With pronounce Bitcoin ETFs legally on hand to merchants from Wall Avenue to Main Avenue, on the different hand, merchants may perhaps presumably well well moreover very nicely be adjusting their behavior to lock in their earnings. “Unheard of establishments I’ve spoken with were pondering whether or no longer the ETF announcement is already factored into recent prices, sparking concerns amongst prolonged-term players,” acknowledged Storry.

Source credit : unchainedcrypto.com