Solana’s Progress Metrics, Together with Stablecoin Provide, Continue to Rob Off

At presstime, crypto users had locked about $5.4 billion in total price in protocols and positive aspects native to Solana, a as regards to 250% prolong since the first day of 2024, knowledge from DefiLlama presentations.

The head 16 projects on Solana by total price locked (TVL) have all grown their locked price in both the previous 24 hours, seven days, and thirty days, with liquid staking provider Jito and restaking protocol Solayer main the pack. In July, Jito’s TVL increased from as regards to $1.7 billion to $2.1 billion, while Solayer’s has long previous from $67.8 million to roughly $153.7 million.

Consistent with Gurnoor Narula, a research analyst at challenge capital firm Placeholder, originate air of the price appreciation of SOL — which has jumped almost 66% since Jan. 1, in accordance to CoinGecko — the rise in Solana’s TVL stems from Solana’s parallelization skills which allow a pair of transactions to discover processed at the identical time.

Be taught Extra: Solana Reaches a Method Two-twelve months High in Day-to-day Transactions After Launch of Blinks

“An even bigger and more affordable [transaction per second] translates to a new class of positive aspects that don’t have a huge price per interplay, therefore the growth in memecoin purchasing and selling, new user adoptions, and plenty others,” Narula told Unchained. “Provided that, Solana’s TVL will naturally grow with a selection of smaller accounts quite than a bunch of whales.”

Stablecoins Like PayPal’s PYUSD Rising

Serving to bolster Solana’s TVL prolong has been the inflow of most modern capital coming into the ecosystem — in explicit, in the do of stablecoins. Specifically, folks and entities are using key resources in dilapidated finance such as money, US treasury bonds, and other money equivalents to mint stablecoins on Solana, prone to behavior look-to-look and industry-to-industry transfers.

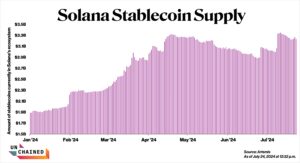

Before the entire lot of 2024, Solana’s provide of stablecoins, which consisted of USDC, USDT, and EURC, stood at $1.9 billion. Since then, the resolve has jumped 71% to $3.2 billion, in accordance to onchain knowledge firm Artemis. FinTech huge PayPal rolled out its stablecoin PYUSD on Solana on Might perchance well 29 and since then, PYUSD’s provide on the community has grown to $233.3 million.

Be taught Extra: Solana Has Cemented Itself in “Crypto’s Mountainous Three,” Per Trading Firm GSR

“Stablecoins themselves are the supreme example of mass proliferation of tokenization we’ve considered and with Solana’s tempo, it permits a new class of micro-interplay sort positive aspects for which stablecoins will even be utilized as a medium of price,” Narula added.

Extra Capital, Extra Process

Rising community activity reflected in costs and weekly energetic addresses has additionally coincided with the increased quantity of funds circulating within Solana.

Now not supreme has Solana broken its all-time excessive in weekly energetic addresses, crossing the ten million ticket in July for the first time in its history, however the four-twelve months-used community is additionally producing substantially extra costs in contrast to the starting up of the twelve months. In the first two months of 2024, Solana supreme had in some unspecified time in the future the keep costs exceeded $1 million, per Artemis. Nonetheless in the finish to 5 months since then, Solana has had 132 days when its costs surpassed $1 million, and supreme 13 days when its costs had been below that resolve.

“Solana has shown basic adoption and continues to ragged, overcoming technological growing pains and highlighting the chance of excessive-throughput, monolithic architectures,” wrote the Franklin Templeton Digital Belongings personnel on X on Tuesday.

The price of SOL has risen in tandem with this twelve months’s prolong in activity on the community. Since Jan. 1, the price of SOL has jumped from $109.44 to $181.31, giving it a market cap of $84 billion at presstime.

Source credit : unchainedcrypto.com