Solana’s DeFi Ecosystem Lost 60% After FTX Cave in

The contagion effects of FTX’s give device are being felt at some point of the crypto industry, but one blockchain’s DeFi ecosystem is seeing considerably more distress.

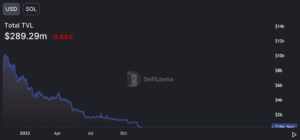

Knowledge from DeFiLlama reveals that the Total Price Locked (TVL) on Solana fell from $963 million on Nov. 5 to $289 million on Nov. 20. Solana, which became once in spite of every thing 3 DeFi blockchains with $10 billion in TVL, now ranks 11th after DeFiChain.

Solana DeFi protocols saw a steep decline after FTX became declared insolvent and filed for Chapter 11 monetary catastrophe on Nov. 11. FTX CEO Sam Bankman-Fried became a backer of the Solana blockchain, most frequently overtly making a wager on the persevered appreciation of the native token’s tag.

On Nov. 10, the Solana Basis shared important functions of their exposure to FTX and Alameda. Despite maintaining easiest $1 million worth of money on FTX.com, the entity also held 3.24 million of FTX widespread inventory, 3.43 million of the change’s native token FTT and 134.5 million native tokens of the Serum DEX founded by Bankman-Fried.

Since FTX’s give device, predominant Solana tokens own misplaced an infinite chunk of tag. These included Serum’ SRM, which is in the meantime 76% lower than it became sooner than FTX’s loss of life and SOL itself, which is down 65% over the identical duration.

These lower token prices own also affected the profitability of Solana validators – stakeholders that draw the backbone of the blockchain. A different of validators own exited the network, leaving 60 million SOL tokens in the closing five epochs.

“My predominant direct about Solana rn is that because the token tag drops, some more validators can change into unprofitable and quit, which may per chance extra hurt tag,” tweeted crypto investor Ajit Tripathi.

Whereas market sentiment round Solana has dwindled, the exodus of TVL from its DeFi ecosystem can also merely no longer real be centered round its ties to Bankman-Fried’s fallen crypto empire.

TVL is a measure that contains stablecoins, and on-chain recordsdata reveals that a most well-known volume of stablecoins are leaving Solana as smartly. On Saturday, USDT issuer Tether eliminated $1 billion USDT on Solana in a chain swap, converting USDT held on Solana to the Ethereum blockchain.

Tether’s chain swap follows a switch from crypto exchanges Binance, OKX and Bybit to suspend operations with USDC and USDT on Solana on Nov. 17. Binance later resumed stablecoin deposits on Solana, but did no longer novel the reason in the back of their initial cease.

Source credit : unchainedcrypto.com