Uh-Oh: Solana Goes Down and Gensler Calls Out Coinbase

September 14, 2021 / Unchained Day after day / Laura Shin

Day after day Bits ✍️✍️✍️

-

SEC Chair Gary Gensler indicated that crypto lending and staking platforms most definitely plunge under US securities law; Gensler also renowned that Coinbase lists “dozens of tokens that would maybe doubtless be securities.”

-

Bitcoin Core version 22.0, potentially the most unusual version of the Bitcoin core instrument, modified into once launched on Monday.

-

Ernst and Young (EY) will utilize Polygon to deploy EY blockchain products onto Ethereum.

-

Interactive Brokers launched cryptocurrency trading on its platform.

-

Jump Trading announced the delivery of Jump Crypto.

-

SkyBridge Capital, led by Anthony Scaramucci, is releasing an NFT plot.

-

Bitcoin energy consumption in 2021 has already outpacedall of 2020.

-

Gate.io, a crypto substitute, opened a $100M fund to put money into budding crypto startups.

-

An unsuccessful are attempting at attacking Ethereum managed to idiot a lot of nodes.

-

Immutable, an NFT startup, raised a $60M Assortment B.

-

Amberdata, a crypto records startup, brought in $15M through Assortment A led by Citi.

-

Argo Blockchain, a crypto mining company, commenced its initial public offering (IPO) the day before right this moment.

-

Layer 2 solution Arbitrum suffered a non eternal outage.

What Produce You Meme?

What’s Poppin’?

How mercurial narratives substitute in crypto.

After main Tuesday’s newsletter with the headline “SOL > BTC + ETH” in reference to a surge in hobby for Solana-primarily based mostly digital asset funds when compared to BTC and ETH, this day’s What’s Poppin’ is covering Solana for a thoroughly assorted impartial.

Solana, a excessive throughput excellent contract blockchain, skilled critical points on its mainnet the day before right this moment. As of publishing time, the network has been down for over 10 hours, per records from Solscan. This implies that no blocks, transactions, or network dispute modified into once recorded between 8 am ET to 7:00 pm ET.

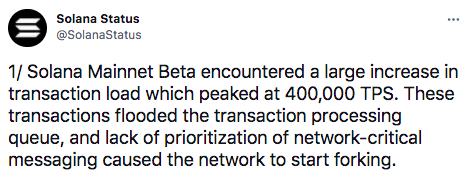

The Solana Foundation addressed the downtime on Twitter, explaining that an amazing lengthen in transactions, peaking at over 400,000 per 2nd, flooded the network, causing Solana to originate forking. Once the network started forking, nodes were overwhelmed as a result of the excessive reminiscence consumption of more than one chains running concurrently.

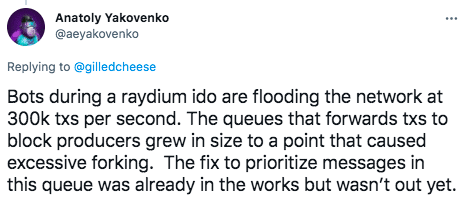

Anatoly Yakovenko, CEO of Solana Labs, believes that a Raydium initial DEX offering (IDO) prompted the flood of transactions.

Solana node operators started coordinating a “restart” of the network at roughly 3 pm ET Tuesday afternoon. In step with CoinDesk, the restart would include a patch of the network that would maybe doubtless enable Solana to arrive help help on-line once 66% of validators, a supermajority, trudge dwell. As of publishing time, Solana stays down, even supposing the validator neighborhood on Discord stays rather appealing.

While rare, it is no longer entirely unparalleled for blockchains to shut down. Even Bitcoin skilled 14 hours of downtime true through its childhood between 2009 and 2013. Since then, Bitcoin has race consistently, with a ninety 9.986% reasonable runtime. For Solana, in particular, an outage is no longer gorgeous, because the network is no longer up to 2 years outdated faculty and composed in beta mode. The day before this day’s outage modified into once Solana’s first since December of 2020.

For Anatoly’s fragment, the CEO took the outage in dart, emphasizing the early life of Solana’s network. It appears to be like Anatoly is more horrified about Solana’s 10-one year outlook and its capability to abet 1 billion customers, other than stressing over its incapacity to tackle 400,000 transactions per 2nd fair 18 months into the blockchain’s existence.

Unsurprisingly, Solana’s native token, SOL, dropped more than 15% the day before right this moment, dipping from roughly $175 down below $150. The dip comes only one week after SOL’s most unusual all-time excessive, which saw the token wrong $216.

Suggested Reads

- Constancy on institutional investors and digital sources:

- The Defiant on airdrops:

- @CometShock on how Solana’s chain-stoppage would maybe doubtless have an effect on the network:

On The Pod…

Can Bitcoin Be Secured Supreme by Transaction Funds? Two Researchers Sound Off

Once the block reward diminishes vastly, can Bitcoin be secured simplest by transaction fees? On Unchained, Bitcoin writer Vijay Boyapati and Ethereum Foundation’s Justin Drake debate the deserves of Bitcoin’s security model, which Drake says will largely count on transaction fees as soon as within 20-30 years, no longer in 100+ years. Highlights:

- Justin’s and Vijay’s skilled backgrounds

- why Justin thinks Bitcoin can not dwell on fully on fees

- how Bitcoin is at this time secured

- what makes Bitcoin’s security subjective other than binary

- how significant it would maybe doubtless trace in dollars to 51% assault Bitcoin

- what the Bitcoin network would maybe doubtless originate in response to a 51% assault

- systems to calculate Bitcoin’s security budget

- why Bitcoin’s trace can’t trudge exponential without raze

- whether or no longer a “nuclear possibility” for Bitcoin miners would maybe doubtless provide protection to against a 51% assault

- why nation-states would maybe doubtless be either skilled or anti-Bitcoin

- why a Bitcoin New would maybe doubtless be equivalent to the Gold New

- how Bitcoin will substitute going forward, and why Vijay thinks transaction fees will lengthen

- why Justin does no longer mediate transaction fees will lengthen sufficient to accurate Bitcoin’s imperfect layer

- how Justin would fix Bitcoin’s security model — and why he thinks the 21 million arduous cap is a meme

- why Vijay does no longer mediate Bitcoin’s security model will ever substitute — notably the 21 million arduous cap

- what Justin thinks Ethereum is doing better than Bitcoin

- why Vijay thinks Ethereum will fail

Ebook Change

My e-book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now readily available for pre-convey now.

The e-book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-convey it this day!

It is most likely you’ll doubtless be ready to aquire it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com