SBF Says Excel Spreadsheet Proves FTX US Is Solvent

What Came about: Feeble FTX CEO Sam Bankman-Fried claims that data shared by Sullivan & Cromwell (S&C) just a few shortfall of funds at FTX US is inherently spurious.

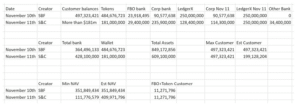

S&C said it had identified handiest $181 million price of digital property on FTX US on the time it filed for financial shatter. Bankman-Fried claims that the firm failed to yarn for $428 million that used to be supposedly in FTX US’s financial institution accounts.

“These claims by S&C are unsuitable, and contradicted by data in a while in the identical yarn. FTX US used to be and is solvent, doubtless with hundreds of millions of bucks in excess of buyer balances,” wrote Bankman-Fried in yet one other Substack submit.

The proof: Bankman-Fried’s own personal records, which appears to be an Excel spreadsheet documenting the allege of FTX US’s balance sheet.

Momentarily inserting aside the indisputable fact that he once claimed he had restricted entry to data, the FTX founder shared his own calculations that apparently demonstrate that S&C understated the switch’s buyer balances, financial institution balances and Web Asset Fee.

Does anybody judge him? No longer genuinely. The FTX founder’s claims own largely been met with sarcastic responses from the crypto neighborhood. Unsurprisingly, turning off replies to his Twitter submit did now now not discontinuance users from sharing their tips on the spreadsheet accompanying his blog.

Source: belief me bro https://t.co/pOogJ3QLKZ

— your outdated buddy julian (@wagyuh0td0g) January 18, 2023

“Scrutinize mother I’m in a position to establish numbers in a spreadsheet,” tweeted one particular person.

“This formatting can own to tranquil carry a minimal 5 year sentence,” commented one other.

Why is he tranquil tweeting? Cherish other once-revered industry leaders which own fallen from grace, Bankman-Fried has now now not shied a ways from sharing his tips on barely just a few occasions leading up to FTX’s crumple, denying culpability for it on loads of occasions.

It remains to be seen what the penalties of these statements, and the figures he presented in the spreadsheet, will doubtless be in the suitable case against him.

On the choice hand, along with his bail stipulations bearing no restrictions on entry to the fetch, there’s no reason to evaluate that Bankman-Fried’s 2nd submit on Substack will doubtless be his closing.

Source credit : unchainedcrypto.com