Sanctioned: A Russian Mining Company

April 21, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Coinbase unveiled the beta model of its NFT marketplace.

-

Binance immediate abandoned a singular logo form after of us pointed out a shared resemblance to a swastika.

-

Tesla’s BTC holdings had been unchanged in Q1 2022.

-

Coinbase showed a label web page for Optimism, hinting that an airdrop might well also be coming quickly.

-

The associated payment of Apecoin (APE) is surging on rumors that this might occasionally well also quickly be broken-down in a metaverse land mission.

-

MakerDAO is determined to combine StarkNet.

-

Index Coop launched a singular fund that offers publicity to major NFT collections.

-

Gnosis Chain, an Ethereum sidechain, accomplished a tricky fork at present time.

-

BinanceUS has left the Blockchain Association and is increasing its in-residence lobbying shop.

-

Connext, a blockchain bridging protocol, unveiled plans to launch a token and transition to a DAO.

-

80% of Ethereum Foundation’s $1.6 billion treasury is in ETH.

Right this moment in Crypto Adoption…

-

The US Treasury Department sanctioned BitRiver, a crypto miner, over its operations in Russia.

-

Blockchain gaming exploded by 2,000% in the final year.

-

LVMH, a luxurious goods ticket, is taking a look into the metaverse.

- The NBA dropped an 18,000-share NFT assortment that can evolve over the playoffs.

The $$$ Corner…

-

First payment DAO raised $10 million at a $56 million valuation.

-

The TON Foundation, the group unhurried Telegram’s failed crypto mission, has raised $1 billion in donations from customers to reach its ecosystem.

- Trim, a decentralized identification startup, raised $34 million.

What Carry out You Meme?

What’s Poppin’?

OFAC vs. Russian Crypto Miners Share One

The US Workplace of Abroad Resources Abet watch over (OFAC) added Bitriver, a Russian crypto mining company, to its sanctions record on Wednesday. Particularly, in step with a press release, “Right here’s the first time Treasury has designated a digital currency mining company.” Bitriver modified into regarded as one of 40 contributors and entities, including the publicly traded Transkapitalbank (TKB), to be sanctioned.

“Treasury is additionally taking motion in opposition to companies in Russia’s digital currency mining replace. By operating mountainous server farms that promote digital currency mining capacity internationally, these companies motivate Russia monetize its natural resources. Russia has a comparative advantage in crypto mining due to energy resources and a cold local weather,” wrote Treasury in its press release. “However, mining companies count on imported computer equipment and fiat funds, which makes them prone to sanctions. The United States is committed to guaranteeing that no asset, no subject how advanced, turns true into a mechanism for the Putin regime to offset the impact of sanctions,” Treasury concluded.

Curiously, OFAC did now no longer record any Bitcoin or diversified crypto wallet addresses associated to Bitriver.

While right here’s factual one company, the inspiration of the US going after Russian mining companies might well also get vital implications. Cambridge’s most contemporary Bitcoin mining stare reveals that Russia produces 11.23% of Bitcoin’s month-to-month hashrate, making it the third-greatest offer of Bitcoin mining in the realm. Furthermore, Russian President Vladimir Putin expressed interest in crypto mining as unprejudiced at present as January twenty sixth.

Urged Reads

-

Unchained Capital on six causes to come to a decision up BTC in retirement:

-

Mario Gabriele on Dune Analytics, the crypto data analysis king:

-

Bankless on Terra:

On The Pod…

Why Crypto Twitter’s Disrespect Against Regulators Is a ‘Genuinely Infamous Trade Decision’

Two policy consultants, Chris Lehane, chief arrangement officer at Haun Ventures, and Niki Christoff, the founder of Christoff and Co., focus on how the crypto replace has conducted in Washington and the device in which it might well well better educate more regulators and politicians in regards to the skills. Note highlights:

-

Niki and Chris’s background

-

how Niki and Chris would grade the performance of crypto companies in Washington

-

what parallels Chris can device between crypto in the 2020s and FAANG in the mid-90s

-

whether having a plethora of crypto policy teams helps or hurts crypto in Washington

-

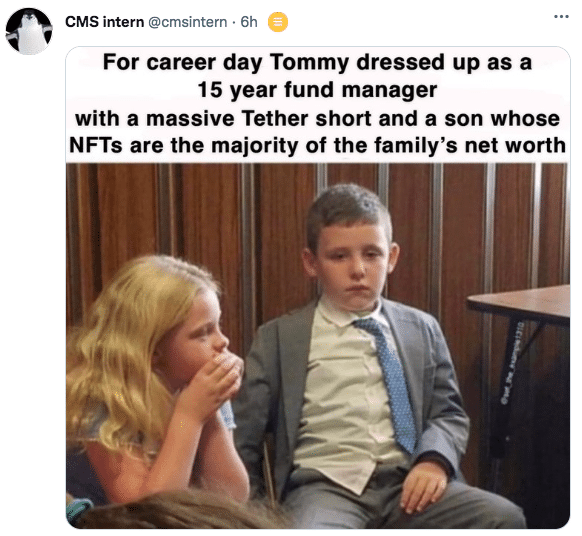

whether calling politicians and regulators names and making memes of them helps or hurts the crypto replace

-

an efficient manner crypto companies can advised lawmakers and regulators to prioritize crypto policy

-

why it would also be strategically smarter to strive to persuade incumbents to adopt pro-crypto policy over supporting challengers

-

why Chris thinks crypto might well also be a bipartisan subject

-

what Chris and Niki bear in mind the indisputable reality that Democratic candidates bought more donations from of us working in the crypto replace than Republicans did

-

the three forms of crypto customers that are helpful to political candidates

-

what Niki and Chris would repeat Senator Elizabeth Warren about crypto in the event that they had been to meet along with her at present time

-

what attain crypto might well need on midterms

-

why the terminology native to crypto might well also get to replace

Ebook Update

My e-book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Huge Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now on hand!

You ought to buy it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com