Robinhood’s Q2 Earnings Account for It’s Now a Crypto Company

August 19, 2021 / Unchained Day by day / Laura Shin

Day by day Bits ✍️✍️✍️

- Traipse Financial institution shut down Compass Mining’s bank accounts, in step with Compass Mining CEO Whit Gibbs.

- Facebook’s financial lead, David Marcus, argues for crypto wallet, Novi, to be allowed to pass to market.

- The operator at the again of Helix, a bitcoin mixing service, pleaded responsible to laundering $300M+.

- Binance employed Greg Monahan, a feeble IRS authentic, to head its world cash laundering group; this can furthermore note for registration with the central bank of the Netherlands after being issued a warning for running illegally.

- Coinbase is keeping $4.4B in earnings case of a “crypto winter.”

- MobileCoin, a privateness-primarily based cryptocurrency mission, raised $66M in a Sequence B.

- At some stage in final month’s Federal Delivery Market Committee assembly, regulators cited “diverse potential dangers to financial steadiness collectively with the hazards connected with expanded exercise of cryptocurrencies.”

- United Wholesale Mortgage, the 2nd-finest US mortgage lender, plans to win crypto as price by EOY 2021.

- Iris Vitality, a BTC mining company, submitted a proposal to the SEC to pass public by process of Nasdaq.

- Avalanche launched a liquidity mining incentive program to entice DeFi functions to its platform.

- Spinesmith Holdings, a minute biotech company, is converting its steadiness to BTC

What Enact You Meme?

What’s Poppin’?

Crypto trading on Robinhood is poppin’.

The funding app handsome accomplished its first quarter as a publicly-traded company. Consistent with Robinhood’s earnings list, evidently crypto trading had an outsized affect on the corporate’s backside line, as evidenced by the proven fact that 60% of Robinhood customers traded in crypto in Q2.

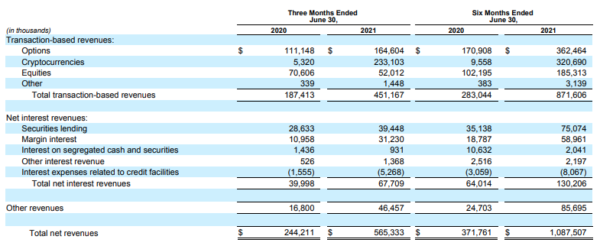

At $565M, earnings bigger than doubled since Q4 2021. The huge majority of Robinhood’s earnings, roughly 80%, is tied to transaction fees extracted from merchants buying/promoting alternatives, cryptocurrencies, equities, and other funding merchandise.

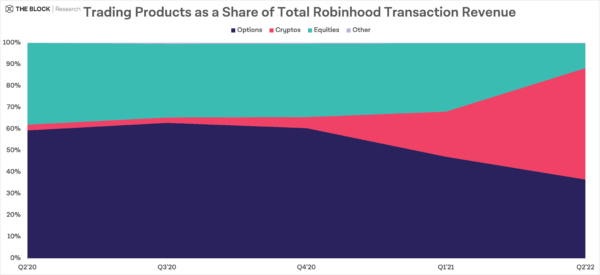

As you may perchance well maybe well also look in the chart above, of that 80% introduced in by process of transaction earnings, cryptocurrency trading accounted for bigger than half of that profits — which formula that 41% of Robinhood’s total earnings is the negate consequence of crypto trading. The company’s filing furthermore talked about that Dogecoin trading was the crypto of assorted for customers, noting, “62% of our cryptocurrency transaction-primarily based earnings was attributable to transactions in Dogecoin.”

Robinhood’s reliance on crypto trading seems to be to be increasing. In Q4 2020, crypto trading handiest accounted for 2% of the corporate’s earnings. In Q1 2021, handiest 17% of the funding app’s total earnings was derived from crypto trading. To set that in level of view, crypto trading earnings on Robinhood grew over 4,000% since Q4 2020.

Supply: The Block

At publishing time, $HOOD is trading at $forty five.43, down 9% on the week.

Beneficial Reads

- CoinShares on DeFi:

- Sam Sun, a study partner at Paradigm, on how he chanced on and helped patch a vulnerability that set over 109k ETH (~$350M) at likelihood.

- Chainalysis on crypto adoption (up 880% in the final year):

On The Pod…

On-Chain Analytics Account for ETH Accumulation Is Larger Than That of BTC

NFTs are the debate of the metaverse, EIP 1559 handsome went dwell, and DeFi stats are rebounding. On Unchained, Fredrik Haga, cofounder and CEO at Dune Analytics, along with Richard Chen, general partner at 1confirmation, focus on about the booming Ethereum ecosystem throughout the lens of on-chain files, diving into NFTs, DeFi, ETH, and their favourite layer 2s. Account for highlights:

- why Ethereum is on this form of pronounced upswing

- why on-chain metrics consequence in superior files reporting

- thoughts-blowing OpenSea statistics

- why NFTs are so hot in the meantime

- how Richard explains NFTs to normies

- whether the NFT market is sustainable

- what makes an NFT tumble pop and why profile pics (PFPs) subject

- how Polygon NFTs overview to Ethereum NFTs

- the main driving drive at the again of DeFi utilization

- how Richard measures the total amount of DeFi customers

- what brings new customers into DeFi

- what DEX trends Fredrik is preserving his seek on

- why structured merchandise are vital to DeFi’s persevered success

- how Ethereum is doing for the explanation that London exhausting fork

- why NFT drops are indulge in 2017 ICOs

- what metric shows ETH adoption outpacing BTC adoption among establishments

- which layer 2 solutions are Fredrik and Richard

- why Richard considers Binance Clear Chain a centralized blockchain

- why Fredrik likes what Solana is constructing

- Richard and Fredrik’s predictions for the NFTs, DeFi, and ETH going forward

E book Substitute

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Tall Cryptocurrency Craze, is now available for pre-characterize now.

The e book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-characterize it this day!

It’s doubtless you’ll well maybe well presumably aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com