Bother-Hungry Investors Possess Already Locked $650M in Paradigm-Backed Layer-2 Blast

Crypto merchants are eagerly risking their sources for seemingly rewards by Blast, an unfinished Ethereum layer-2 blockchain that would not but enjoy an operational testnet.

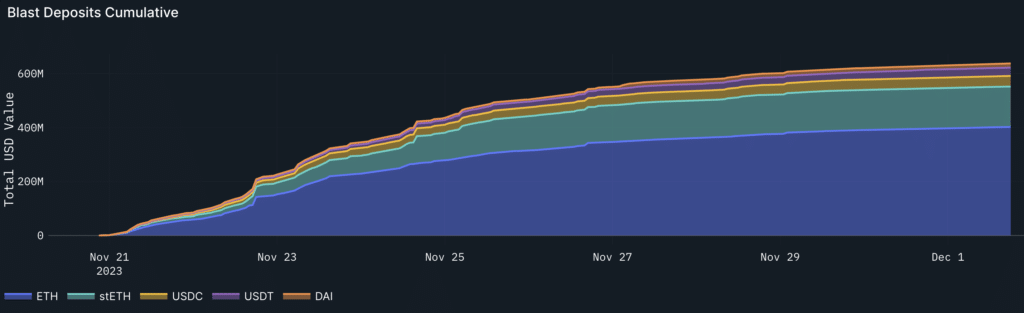

Blast, which aims to present yield to its depositors and promises an airdrop, crossed $650 million in total value locked in its second week as the Crypto Apprehension and Greed Index, a statistical quantity outmoded to gauge most modern market sentiment, has been at a level not viewed since Nov. 2021 when BTC changed into near its all-time high.

Each and each are signs that the crypto ecosystem is getting hungrier for threat.

Within the 2 weeks since Blast’s neat contract started accepting deposits, total value locked (TVL) on Blast not most effective competitors layer-1 blockchains like Avalanche and Solana, every having more than $650 million in locked value, per DefiLlama, but has also surpassed older layer-2 rollups like zkSync Generation, Mantle, and Coinbase’s Harmful.

Learn more: The Slicing Block Discusses Blast and Also Talks to a DeFi Hack Negotiator

Layer-2 rollups are separate blockchains constructed on top of Ethereum that aim to tempo up transactions cases and nick encourage charges by bundling up transactions and settling them on the second-largest blockchain by market capitalization.

The aforementioned protocols enjoy all launched their mainnet, while Blast has but to unveil its testnet. Virotechnics, an anon Milady NFT holder and Blast depositor, said to Unchained by Telegram, “The tempo with which it achieved an excess of $600M TVL is spectacular. It’s catching up with Solana at a violent payment, nearly toe-to-toe & there isn’t even an L2 blockchain to make exhaust of but.”

“An interpretation of the sources deposited so a ways would be that many people dwell up for a bull flee mid-time length,” wrote Nansen study analyst Niklas Polk in a file. “Given the anticipated bull flee, many could be cosy locking ETH for a few months and getting extra yield on top of the 4% for staking.”

Heavy Focus

In accordance with Unchained prognosis of Nansen data, the tip six depositors story for approximately $101.5 million in deposits, representing 15.6% of Blast’s TVL, while the tip 50 depositors designate up roughly 26.7% of total deposits, $173.2 million, highlighting how rapid paunchy whales – in crypto parlance – are ready to shore up liquidity in gape for additonal yield.

Even supposing the tip 50 depositors are liable for a foremost fragment of Blast, the massive majority of the more than 68,000 uncommon depositors are likely to be not whales as roughly 70% of Blast depositors enjoy dedicated not up to $1,000.

“Have to you would be given the need between 5% APY on ETH or maybe design more by an airdrop I feel some americans are willing to grab the security/rug threat to score a elevated return,” Paul Vaden, a core contributor for perpetuals protocol Lyra, advised Unchained over Telegram.

Virotechnics also said to Unchained of Blast’s upward push, “If merchants/merchants are willing to lock their ETH except February & grab part in speculative sport-theory systems like BLAST is providing — it indicators that they’re increasingly more willing to grab on threat. Many are to envision what the BLAST ecosystem will amount to, how mighty TVL this could per chance enjoy after the airdrop, and whether or not any uncommon DeFi alternatives will emerge on the chain early on. I feel many are with me in this speculation.”

Apprehension and Greed Index

Blast uses its deposits to generate yield, which “is passed encourage to Blast users routinely,” from Lido’s ETH staking and proper-world asset protocols like Maker, its internet set says. To incentivize more deposits, Blast said this could per chance airdrop tokens to developers in January and depositors in Might maybe also. Per Nansen, Blast is the fourth-largest holder of stETH, Lido’s token that represents the blended value of a user’s initial amount of staked ether plus gathered pastime.

The Crypto Apprehension and Greed Index sits at 71 as of Friday, leaping from 27 within the starting set of January, that design market sentiment is currently within the “greed” stage, suggesting a bullish attitude among crypto merchants, per data from different.me.

Paradigm, the crypto investment firm that invested into the layer-2 rollup, and Blast founder Tieshun “Pacman” Roquerre failed to return a quiz for comment by presstime. In accordance with its internet set, Blast raised funds from Identical old Crypto, eGirl Capital and Larry Cermak, the CEO of crypto publication The Block.

CORRECTION (Dec. 1 8:Forty five UTC): A previous version of this account inaccurately acknowledged that Blast will airdrop tokens to its depositors in January. It plans to airdrop tokens to developers in January and depositors in Might maybe also.

Source credit : unchainedcrypto.com