Renzo’s ezETH Depeg Amid Criticism of Airdrop Underlines Broader Dangers in Restaking

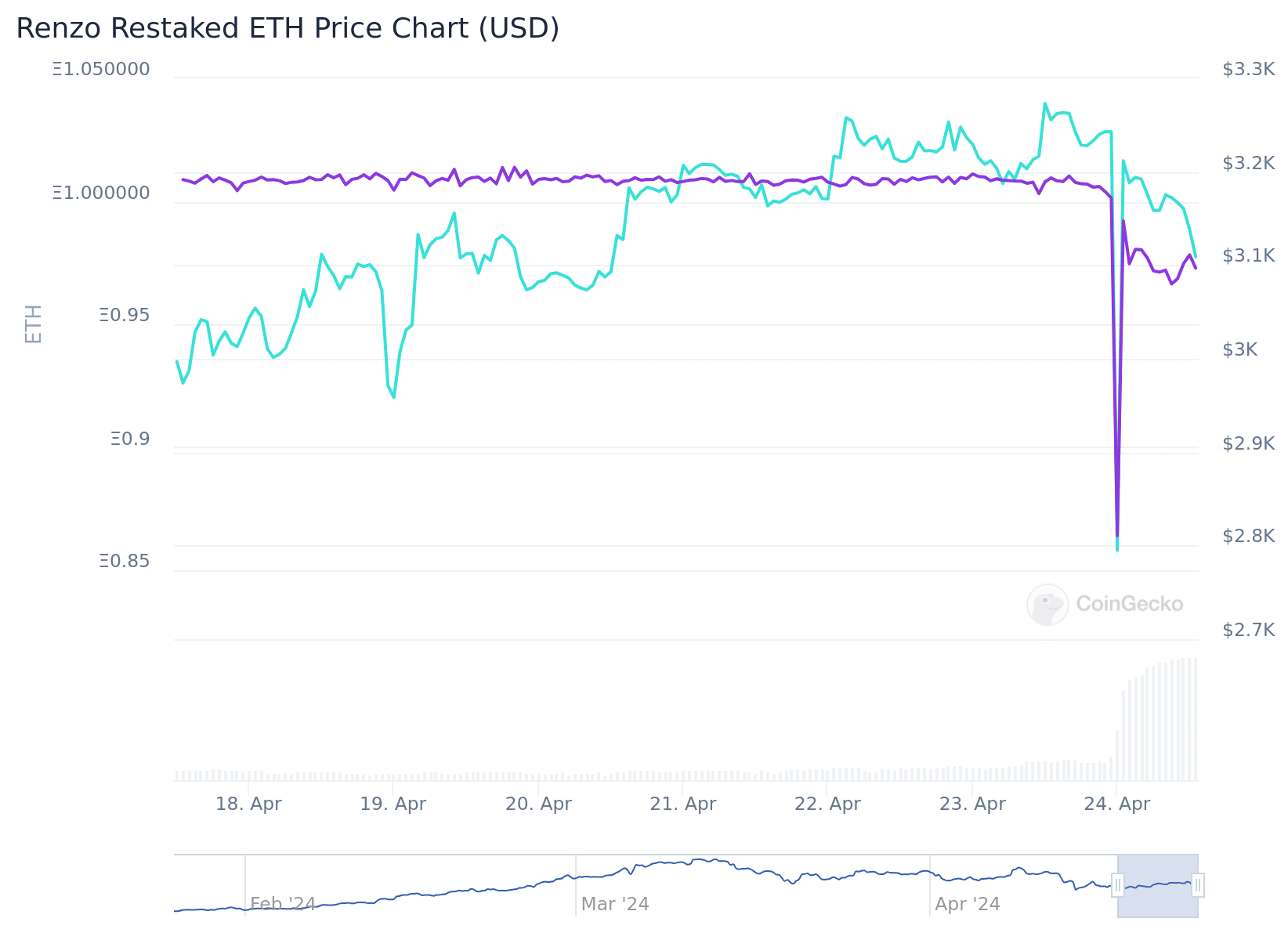

Following its airdrop announcement, Renzo Protocol’s liquid restaking token, ezETH, deviated from its one-to-one peg to ether (ETH), sparking neighborhood criticism with regards to bad execution of the deliberate match.

The price of the liquid restaking token (LRT) plummeted because it de-pegged, reaching a low of $688 on decentralized commerce Uniswap. ezETH had traded above $3,000.

Depeggings happen when a cryptocurrency that is meant to have steadiness relative to a paired asset now not maintains that correlation. That match befell following the announcement of the tip of Renzo’s season 1 features program, which rewarded customers with features for restaking ETH on the platform. The project is decided to guide to an ensuing airdrop of $REZ on Could maybe merely 2.

Airdrops contain distributing free tokens to advertise usage or pressure ownership. On the opposite hand, in Renzo’s case, the deliberate pass induced a mass promote-off by holders having a see to turn into their ezETH tokens into ETH. The promote-off stemmed from the principle portion of the features program ending, which methodology ezETH holders had fewer advantages, despite the actual fact that they almost definitely will have earning features for the 2nd season of the airdrop. There used to be also dissatisfaction over the eligibility criteria and the plan the $REZ governance token will most likely be disbursed.

Learn more: What Is a Crypto Airdrop? A Newbie’s Recordsdata

The incident resulted in great losses for customers engaged in leveraged buying and selling on platforms esteem Gearbox and Morpho Labs, where ezETH used to be feeble as collateral.

1/🧵

• 50% of Gearbox ezETH TVL wiped out + debt

• 150 liquidations on Morpho

• Hundreds of thousands were lost right through 78% ezEth depegYesterday used to be appropriate kind a rehearsal earlier to a foremost depeg match once EL features are over

At @0xfluid we defend lenders and borrowers and had 0 liquidations pic.twitter.com/Chrajmbt36

— DeFi Made Right here (@DeFi_Made_Here) April 24, 2024

Even though ezETH recovered most of its losses, it’s gentle buying and selling at a minimize tag to ETH, which highlights that customers are now not 100% assured in Renzo’s LRT.

Airdrop Criticism

Renzo, the 2nd-largest LRT platform with over $3.3 billion locked, faced criticism referring to its token distribution — and the plan files used to be presented to the final public.

Confusion and dissatisfaction with Renzo arose attributable to a pie chart that misrepresented the distribution of their unusual $REZ tokens, inaccurately portraying the sizes of diverse allocations. This ended in misunderstandings referring to the token’s proper distribution. As a consequence, many criticized and even mocked the deceptive presentation, viewing it as an try to vague the staunch control and have an effect on internal the challenge.

Oh wow, here’s slightly disagreeable from @RenzoProtocol

1st, a huge fragment of the tokens are going to merchants and crew

2nd, appears to be like to be esteem they’re searching to skew how disagreeable it appears to be like to be with the rep of the pie chart

Look the bottom “half” is 62%, whereas the 2 2.5%’s seem like ~20% pic.twitter.com/1TWIaC9fNI

— Blur (@BlurCrypto) April 23, 2024

The protocol allotted appropriate kind 5% of $REZ for the airdrop, half of which used to be earmarked for the Binance launchpool lasting appropriate kind one week — successfully lowering the explain support to the broader neighborhood to about 2.5%.

Piling on, the Token Generation Tournament (TGE) used to be scheduled earlier to airdrop recipients could claim their tokens, permitting buying and selling to start out on Binance earlier to tokens were accessible to airdrop participants.

“In preference to successfully rewarding your precise neighborhood, you screw them in every conceivable plan, buried deep in words to hope that no one will salvage it,” wrote Levi on X.

Travis Sher of North Island VC highlighted concerns about Renzo’s operational choices, a lot like now not permitting withdrawals — a feature that competitor platforms esteem Ether.Fi offered from the initiating up. This restriction used to be seen as a “disagreeable faith pass” that unnecessarily increased the likelihood for Renzo’s customers to facilitate sooner growth, further eroding have confidence and contributing to new damaging sentiment.

Broader Implications for LRTs

The incident has broader implications for the nascent LRT market.

With other protocols a lot like Puffer, and Kelp but to start out their tokens, many are questioning how the market will react to identical announcements by these projects. Because the mud settles, this episode could lead other LRT projects to rethink their suggestions spherical airdrops and token economics to end identical occurrences.

Moreover, other folks are starting to reassess their self belief within the restaking ecosystem.

Learn more: What Is EigenLayer? A Recordsdata to the Decentralized ETH Restaking Protocol

The bigger question: If this befell with a smaller challenge, what would happen with EigenLayer’s doable airdrop?

You watched ezETH depeg is disagreeable?

We obtained the principle lesson that preserving LRTs is now not risk-free but it'll almost definitely rep worse for LRTs.

Eigenlayer appropriate kind launched on mainnet with just a few AVSes but two key upgrades will raise plan more risk to restaking/LRTs:

• Slashing

• Permissionless…— Ignas | DeFi Learn (@DefiIgnas) April 24, 2024

Source credit : unchainedcrypto.com