Accurate-World Asset Sector Led by Ondo Finance Is Most attention-grabbing-Performing Month-to-Date

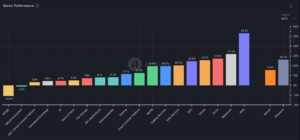

Whereas memecoins non-public taken to take into accounta good chunk of the crypto users’ mindshare, staunch-world resources non-public been essentially the most productive-performing sector in the crypto ecosystem month-to-date.

Per data from blockchain analytics firm Artemis, the absolutely diluted market cap of the particular-world resources sector restful of the governance tokens of three tasks – Ondo Finance, Clearpool, and Maple Finance – has increased Fifty three.5% since Might perhaps perhaps perhaps perhaps also 1 outdated to the next sectors: memecoins, decentralized finance, and oracles.

“On the total, traders are bullish [on] RWA publish ETH ETF approval as they give conception to what that unlocks,” wrote co-founder of crypto investment firm Modular Capital, Vincent Jow, in a yelp message to Unchained on X.

On the opposite hand, since Artemis’ chart is weighted by absolutely diluted market capitalization, RWA’s efficiency month-to-date is “heavily skewed by one token,” namely Ondo Finance’s governance token ONDO.

The three tasks in Artemis’ RWA sector non-public a blended absolutely diluted valuation (FDV) of $12.2 billion and Ondo Finance is in charge for 97% of the sphere with an FDV of nearly $11.9 billion. Clearpool’s FDV stands at nearly $187 million while Maple’s FDV is roughly $147 million.

ONDO has risen over 54% in Might perhaps perhaps perhaps perhaps also to alternate at $1.20 at presstime. CPOOL, the governance token for Clearpool that would be staked, has increased 25% to cruise round 19 cents, while Maple Finance’s governance token MPL has jumped 24% to $14.67 in the same time frame, per CoinGecko.

Be taught Extra: What Is Accurate-World Asset (RWA) Tokenization? A Newbie’s Recordsdata

“Ondo also has a fairly small circulating market cap vs. absolutely diluted in utter that also skews the amount,” Modular Capital’s Jow added. A protocol’s market cap is the replacement of tokens for the time being circulating multiplied by the stamp of a single token, while a challenge’s FDV is the theoretical market cap of the challenge if all tokens had been circulating in the market.

The circulating market caps of Maple and Clearpool’s governance tokens are 78% and 60% of their FDV, respectively. In inequity, ONDO’s market cap, which sits at $1.7 billion, makes up lower than 14.5% of its FDV.

In phrases of full stamp locked, Ondo Finance stays essentially the most neatly-most neatly-liked parking field of the three tasks as crypto users non-public locked $470 million in full stamp into Ondo Finance, $4.6 million into Clearpool, and $1 million in Maple Finance, data from DefiLlama presentations.

Whereas Clearpool and Maple Finance’s TVL non-public remained fairly genuine and non-public no longer considered gargantuan boost in Might perhaps perhaps perhaps perhaps also, Ondo’s TVL has grown by $117.85 million month-to-date from $352.67 million.

Ondo Finance’s Characteristic in the RWA Sector

Ondo Finance is a tokenized staunch-world asset platform that has two flagship products: USDY for folk and OUSG for folks that meet explicit “certified purchaser” requirements. Per Ondo Finance’s documents USDY “is a tokenized tag secured by immediate-term US Treasuries and bank request deposits,” designed to behave as a stablecoin with US buck-denominated yield, while OUSG “affords liquid publicity to immediate-term US Treasuries with 24/7 tokenized subscriptions and redemptions.”

Ondo propelling the RWA sector to develop into essentially the most productive-performing sector in Might perhaps perhaps perhaps perhaps also, in accordance with Artemis, comes as Ondo Finance applied earlier this month to Arbitrum’s Stable Treasury Endowment Program which targets to diversify 35 million ARB tokens into genuine staunch-world resources backed by Treasury bills and money market devices.

Ondo Finance will most definitely be linked to BlackRock’s BUIDL Fund, which has a $473 million market cap. Per its documents, a “indispensable majority” of Ondo’s OUSG portfolio is for the time being in BlackRock’s BUIDL Fund.” Additionally, data from blockchain explorer Etherscan presentations that Ondo Finance holds 10.5% of BUIDL.

CoinDesk reported in March 2024 Ondo became shifting $95 million of its resources backing the OUSG token from BlackRock’s iShares Treasury Bond ETF to Blackrock’s tokenized BUIDL fund.

“The efficiency of the RWA home is critically to be anticipated,” wrote Jim Hwang, COO at Firinne Capital, in a text message to Unchained. “We’re initiating to search staunch world and onchain finance merging which opens up the functionality for every domains.”

Source credit : unchainedcrypto.com