Costs Down; Hacks Up

December 6, 2021 / Unchained Each day / Laura Shin

Each day Bits ✍️✍️✍️

-

BitMart, a centralized cryptocurrency replace, misplaced at the least $150 million to a hack this weekend; CoinDesk locations the number at $196 million.

-

Final week’s $115 million BadgerDAO hack affected the centralized crypto lender Celsius.

-

JPMorgan gave away NFTs at an event final week.

-

Ritholtz Wealth Management and WisdomTree launched a brand unusual crypto index fund.

-

Nexus Mutual’s insurance will doubtless not quilt the BadgerDAO attack.

-

A Solana bug was as soon as patched earlier than attackers can also defend shut $27 million an hour.

-

FTX is reportedly searching out out $1.5 billion in funding at a $32 billion valuation; FTX released a regulatory wishlist outlining ten key principles for crypto market law.

-

LUNA hit an ATH over $70 on Saturday.

- Coinbase voted in establish on of airdropping more tokens in the most up-to-date ENS governance vote.

What Form You Meme?

What’s Poppin’?

Let’s Talk Concerning the Dip

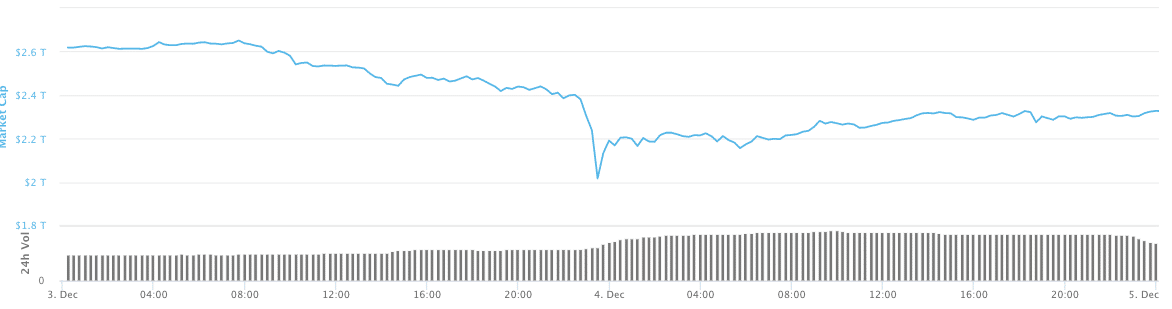

At 5:00 am UTC on Friday, the total crypto market cap traded at $2.63 trillion. A few hours later, at 23:34 UTC, the market crashed to $2.12 trillion — marking a 19% dip in not as much as 24 hours. For the rationale that initial dive, the total market cap has inched upwards to $2.28 trillion.

Bitcoin fell over $10,000 on Friday to a low of $45,032, fixed with data from CoinMarketCap. Ethereum fell almost about $1,000 on Friday, too, hitting $3,632. Nearly every token in the pinnacle 25 by market cap is down over the seven days spanning 11/28-12/5, with many, fancy Polkadot (DOT), Avalanche (AVAX), and Crypto.com (CRO; and, disclosure, a sponsor of my reveals), falling greater than 20%.

The two exceptions to the brutal market performance are Terra (LUNA), which is up 33.7% over the timeframe above, and Polygon (MATIC), which is up 21.2%.

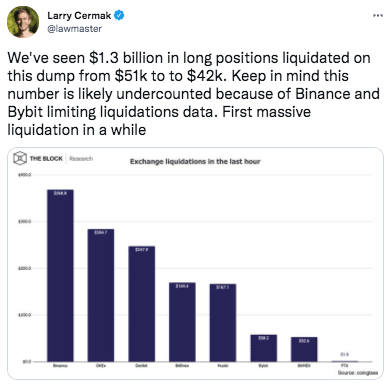

Files from Coinglass reveals that over $2.5 billion rate of positions had been liquidated on December 3. In line with The Block’s Larry Cermak, the market shatter saw over $1 billion in long positions liquidated accurate on account of Bitcoin’s transfer from $51,000 to $42,000. Total commence interest in derivatives also crashed roughly $5 billion in not as much as a single hour, talked about Cermak.

The Block’s Frank Chaparro stories that buying and selling executives factor in colossal institutional selling brought in regards to the shatter. Chaparro cites one executive announcing that a single institution sold greater than $500 million in BTC on Friday morning, which resulted in the “aggressive liquidations” discussed above.

To boot to to the well-known selling, Alex Kruger, economist and crypto seller, pointed to low liquidity stipulations on account of it being a “weekend night,” besides to the mass of crypto natives partying at Art Basel in Miami, as causes for the shatter. Kruger went on to predict that Friday’s dip must soon “point out revert” after Friday’s FOMC meeting on the 15th.

Alameda’s Sam Trabucco seconded Kruger’s concept that low liquidity was as soon as the major offender for the dip. He wrote on Twitter, “on various exchanges, BTC received sub-$30k for a second! And that was as soon as as a result of of how exiguous liquidity sits on the guide in some unspecified time in the future of stylish-off-hours. The initial liquidations had been the the same dimension as typical however the bids they had been getting market-ordered into had been thinner, causing: 1) more rate affect and a pair of) more liquidations, since the prices received REALLY low in diverse conditions (these two results feed off of each other).”

While the dip was as soon as execrable news for these liquidated, it also left the opportunity to aquire the dip — as El Salvador did, scooping up 150 further coins at a sub $50K rate.

Prompt Reads

- Kinjal Shah on web3 reads:

- The Generalist on MetaMask:

- Grant Tree’s Daniel Tenner on making it:

On The Pod…

How Ryan Zurrer Ended Up Spending the Most on a Single NFT Art work

Ryan Zurrer, founding father of Dialectic, a crypto wealth multi-family space of enterprise, discusses his most up-to-date $29 million aquire of Beeple’s Human One and his trip at Art Basel in Miami, along along with his thoughts on the NFT dwelling typically. Account for highlights:

-

-

-

what Human One is and why Ryan bought it

-

how Ryan and Beeple’s non-public relationship factored into the aquire of Human One

-

why Human One is major to the metaverse

-

how Ryan defied the percentages in buying Human One

-

how Miami’s Art Basel convention missed out by not capitalizing adequate on NFTs

-

what Ryan thinks in regards to the NFT replace being described as a bubble

-

how Ryan makes utilize of “proof-of-art work” to set up which NFTs to aquire

-

Ryan’s trip visiting Beeple’s art work studio/campus

-

where Ryan thinks NFTs will proceed from here, and why he is so bullish on tune NFTs in remark

-

-

Ebook Update

My guide, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Enormous Cryptocurrency Craze, is now on hand for pre-uncover now.

The guide, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-uncover it this day!

It’s good to also aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com