Tag Surge in Rocket Pool’s RPL Triggers $1.5 Million in Liquidations

A resolution of pockets addresses borrowing RPL were liquidated on Friday because the governance token for decentralized liquid staking provider Rocket Pool skyrocketed on Friday in gentle of moderately about a tokenomics proposals and earlier than Sunday’s Houston upgrade.

Records from TradingView reveals that the worth of RPL opened the day round $19 and almost doubled to $35.78 sooner than losing to hover near $24.

In accordance with a Rocket Pool community indicate, who goes by @Jasperthefriendlyghost.ETH, a pockets address swapped 199.11 WETH for 20,862 RPL, worth over $700,500. “This easy aquire prompted liquidations to begin up taking place,” Jasper wrote to Unchained over X, which capacity that the easy aquire pushed the worth up, making the collateral insufficient to duvet the elevated cost of the borrowed RPL.

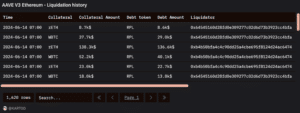

Friday saw 149 liquidations on Aave v3’s Ethereum markets, the 2nd most in a day over the final year, and a easy chunk of liquidations got here from pockets addresses borrowing RPL tokens with collateral in the derive of WBTC, WETH, wstETH, USDC, rETH, per a Dune Analytics dashboard created by recordsdata analyst Roman Zinovyev.

Houston Upgrade Anticipated Sunday

The liquidations attain as community individuals are presently serious about instructing the broader ecosystem about the upcoming Houston upgrade, anticipated to head continue to exist Sunday, besides moderately about a tokenomics proposals in the works. As acknowledged in the liquid staking provider’s documents, the Houston upgrade objectives to introduce “an extraordinarily onchain DAO to manipulate the [Rocket Pool] protocol.”

“That that you just must never predict what the market will dwell nonetheless it surely used to be cheap to ask the market to positively imprint in the upgrade, especially after a resolution of delays,” Jasper stated.

Dissenting, Charlie Mercado, a recordsdata scientist at blockchain analytics company Flipside Crypto stated, “Folk judge the Houston upgrade is a gargantuan deal, nonetheless I’m now no longer obvious it in fact is…It’s frosty, nonetheless it surely’s potentially now no longer the main driver of RPL volatility.”

The worth movement “could per chance even were a partner seeking to derive RPL for Houston [and] it could per chance perhaps perhaps even derive additionally been a speedy hunter who wished to place off liquidations,” wrote Jasper.

RPL Token to Salvage a Revamp?

Furthermore underway are a resolution of tokenomic proposals, which Jasper says, “must soundless aid RPL derive a more sustainable lengthy-term valuation.”

The tokenomics proposals, first created in March and presently soundless of their draft stage, goal to revamp the RPL token which has declined over 40% up to now year, in accordance with CoinGecko.

Points of this makeover consist of decreasing emissions, making it imaginable to jog a Rocket Pool node without RPL, and potentially organising a orderly contract that “holds ETH from protocol revenue and enables for RPL to be burned in switch for that protocol ETH.”

Rocket Pool has an entire locked cost of almost $4.2 billion, making it the ninth-perfect DeFi protocol, earlier than restaking protocol Renzo and synthetic dollar provider Ethena, recordsdata from DefiLlama reveals.

Source credit : unchainedcrypto.com