Permissioned DeFi Is Here

January 6, 2022 / Unchained Each day / Laura Shin

Each day Bits ✍️✍️✍️

-

Bitcoin mining pool hashrate crashed after Kazakhstan’s executive bring to a halt web bag admission to.

-

OpenSea is in talks to aquire Dharma Labs, a digital pockets.

-

Airbnb CEO Brian Chesky stated the most asked for product for 2022 became crypto payment integration.

-

Quentin Tarantino plans to promote Pulp Fiction NFTs no matter a lawsuit from Miramax, which produced the film.

-

The sports and e-commerce agency Fans acquired Topps trading playing cards for $500 million and has plans to make expend of Topps’s irregular rights to MLB digital art work to provide out its NFT arm.

-

CryptoSlam, an NFT info platform, raised $9 million in a seed round backed by Label Cuban and Animoca.

-

Crypto.com (disclosure: a sponsor) had two adverts blockedby a UK promoting regulator.

-

Livepeer, a DeFi video streaming project, raised $20 million in a Series B.

- Valorous, the crypto browser powered by the BAT token (and, disclosure, a outdated sponsor), right hit 50 million monthly filled with life customers.

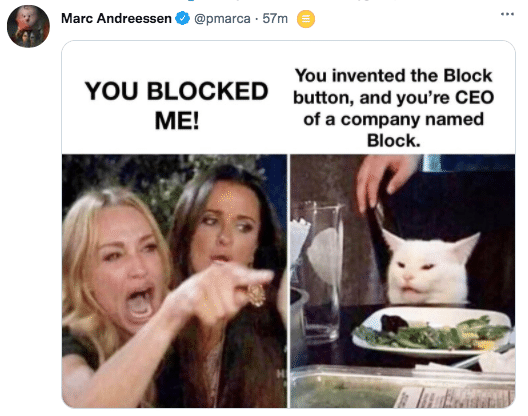

What End You Meme?

What’s Poppin’?

Permissioned DeFi Starts With a Whitelist

The day earlier than at the present time marked the open of Aave Arc, a permissioned version of Aave, one of many most well-favored borrowing/lending protocols in the crypto condominium. The open brings 30 establishments into the DeFi condominium, much like CoinShares, Celsius, and Wintermute.

Every Aave Arc participant needs to be “whitelisted” by Fireblocks, a Contemporary York-primarily based crypto custodian, which is in a space to require entities to endure rigorous buyer identification processes. Fireblocks became licensed by the community in November and is the most handy entity that may presumably perhaps whitelist novel entities for entry into Aave Arc. (SEBA, a Swiss Monetary institution, fair not too long previously proposed itself for a whitelist position through Aave’s governance forum, even supposing no vote has taken space as of but.) Fireblocks will likely be imposing know-your-buyer procedures according to FATF pointers.

“From hedge funds to banks, regulated DeFi tooling may presumably perhaps unleash a wave of unusual services and products much like flash-loans and excessive-yield deposit accounts,” stated Michael Shaulov, CEO of Fireblocks. “Alongside with Aave Arc, our technologies can supercharge monetary innovation across the sector and exponentially grow the dimensions of the market in a single day.”

The novel platform will expend a separate deployment of Aave v2 that can restrict bag admission to to handiest whitelisted entities. In essence, Aave Arc permits institutional gamers to affix the crypto fray, where yields vary from .01%-8.66% APY on digital asset deposits – a much cry from the yield stumbled on in the worn world.

“DeFi represents a convincing wave of financial innovation including transparency, liquidity, and programmability–and it’s been inaccessible to worn monetary establishments for unheard of too long,” stated Stani Kulechov, Founder & CEO of Aave. “The open of Aave Arc permits these establishments to comprehend half in DeFi in a compliant formula for the very first time.”

The open of Aave Arc comes roughly six months after it became first launched by Kulechov. Aave Arc isn’t the predominant predominant rebrand of a DeFi protocol for establishments. Compound, the tenth-largest DeFi protocol by full rate locked, launched an institutional company in June of 2021, dubbed Compound Treasury, permitting neobanks and fintech firms to fabricate roughly 4% on USDC deposits.

Instructed Reads

- Variant Fund’s Cooper Turley and Pantera Capital’s Lauren Stephanian on losing a token: https://ponder.xyz/lstephanian.eth/kB9Jz_5joqbY0ePO8rU1NNDKhiqvzU6OWyYsbSA-Kcc

- Electrical Capital on blockchain vogue: https://medium.com/electrical-capital/electrical-capital-developer-document-2021-f37874efea6d

- Multicoin’s Kyle Samani on predicting the long fling: https://twitter.com/KyleSamani/space/1478429674011250693

On The Pod…

Crypto 2022 Outlook: The set aside Will the Markets Amble This Year? Plus DeFi and NFTs

Larry Cermak, VP of compare at The Block, and Igor Igamberdiev, director of compare and info at The Block, recap the fundamental tendencies of 2021 (BTC mining, L1s, NFTs, DeFi, project funding) and talk about what may presumably perhaps occur in 2022. Veil issues:

-

why 2021 became so valuable for the crypto industry

-

why the crypto markets didn’t see a blow-off high at the discontinuance of the calendar one year the formula they frequently execute a couple of one year after a Bitcoin halving

-

what Larry thinks about whether the crypto market is in a supercycle

-

how the verbalize of BTC and ETH mining modified in the previous one year

-

why Igor thinks multichain know-how became key to a file-breaking one year for project capital coming into the crypto condominium in 2021

-

how the layer 1 (L1) ecosystem wars performed out in 2021 and what it is going to also see admire in 2022

-

what Larry and Igor judge of Ethereum layer 2s (L2s)

-

how Ethereum’s shift to 2.0 may presumably perhaps affect the L1 plod

-

what Larry thinks about DeFi tokens going into 2022

-

how DeFi tendencies, admire decentralized change volume and lending, performed out in 2021

-

why Igor thinks KYC-DeFi (know-your-buyer decentralized finance) is inevitable

-

what Larry thinks about NFTs going in 2022 and why he thinks PFPs are dreary

-

Larry and Igor’s outlook on the metaverse going into the novel one year

E-book Update

My guide, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Substantial Cryptocurrency Craze, is now accessible for pre-present now.

The guide, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-present it at the present time!

You presumably may presumably perhaps purchase it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com