OHMG 😱 OHM Down 91% From ATH 📉

January 18, 2022 / Unchained On a typical foundation / Laura Shin

On a typical foundation Bits ✍️✍️✍️

-

OpenSea hit $3.5 billion in ETH gross sales volume for January, marking an all-time excessive easiest midway by the month.

-

Crypto.com (disclosure: a sponsor of my shows) briefly suspended withdrawals on its platform following “unauthorized process” being reported by just a few customers; PeckShield experiences that the switch lost $15 million in ETH.

-

Binance burned 1.68 million BNB tokens (worth roughly $800 million) in its most modern burn.

-

Spain issued a release defining new principles for crypto influencer posts.

-

Singapore’s Financial Authority informed crypto companies to discontinuance advertising merchandise to the public.

- Elliptic is increasing a new recordsdata product for institutional crypto traders.

On the current time in Crypto Adoption…

-

India’s Top Minister called for world cooperation on regulating cryptocurrency.

- Binance is partnering with Gulf Innova Company to device up a crypto switch in Thailand.

The $$$ Nook…

-

Mechanism Capital launched a $100 million play-to-establish gaming fund.

- Burnt Finance, an NFT auction protocol, raised $8 million in a Series A led by Animoca Producers.

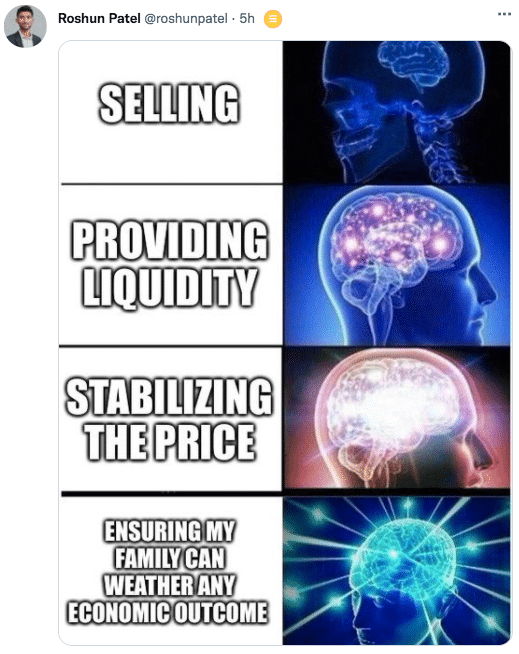

What Enact You Meme?

What’s Poppin’?

OHMy Goodness, OHM Token Label Is Falling

OHM, the native token of Olympus DAO, crashed to an all-time low of $104.68 the day earlier than this day, marking a 91% decline from its all-time excessive in April of 2021 and a decrease of 50%+ within the past seven days. Based totally on recordsdata from DeFi Llama, OlympusDAO’s complete worth locked also took a fundamental hit, lowering by over $1 billion for the rationale that originate of 2022.

Olympus DAO is a decentralized reserve forex protocol. Each and each OHM token is backed by a basket of property, like DAI or FRAX, within the Olympus treasury – giving each and each token a baseline worth that it goes to no longer topple below. Basically, the total point of OHM is to behave as a store of worth that is no longer tied to USD.

Extra OHM tokens can even be generated when customers bond other cryptos to the Olympus DAO treasury, like DAI, FRAX, or WBTC. This permits Olympus DAO to dangle its liquidity. To boot to to the issuance of OHM in line with its treasury, Olympus DAO permits OHM holders to stake OHM tokens in return for extra OHM tokens. As a result of the venture’s popularity, OHM has gradually traded a long way above the treasury of Olympus DAO, taking into consideration Olympus DAO to print extra OHM by ability of staking rewards as a procedure to dilute the worth of OHM help to something extra trusty. As of writing time, the protocol provides upwards of 3,500% APY. This has created a critically virtuous cycle within the past, as customers stake OHM to ascertain extra OHM, which they then stake any other time.

The realm, then any other time, comes when customers discontinuance staking their OHM and money out. When this occurs, the clear cycle of staking is stopped, and the worth of OHM can even be worn out quickly as believe within the machine decays. That is precisely what took place on Sunday evening, in line with crypto reporter Colin Wu:

Colin’s tweet is backed up by a transaction on Etherscan that shows roughly $10 million in OHM being traded for DAI on SushiSwap that evening. Based totally on Twitter interactions, evidently @shotta_sk can also honest have been the vendor. Based totally on the calculations of Freddie Raynolds, who appears to be like to be to be the indispensable to flag the transaction, the $11 million dump precipitated 25% slippage on OHM trades all the procedure by Ethereum and over $5 million in liquidations.

As of 9:12 pm ET, OHM is buying and selling at $120.03 and is down 15.7% over the past 24 hours.

Suggested Reads

-

Politico on Bitcoin and the midterms:

-

Ethereum Foundation’s Josh Stark on Ethereum in 2021:

-

Galaxy Digital on Bitcoin mining in 2021 and 2022:

On The Pod…

Is Binance Shipshape Chain Being Trudge ‘Be pleased the Venture of a Stoned Child?’ Two BSC Pros Answer

Binance Shipshape Chain is the third-biggest chain by TVL and its token, BNB, is the third-biggest token by market capitalization. On the opposite hand, there are questions about hacks, centralization, lack of developer give a boost to, and sketch MEV transactions. On Unchained, Gwendolyn Regina, funding director of the Binance Shipshape Chain Boost Fund, and Samy Karim, ecosystem coordinator at Binance Shipshape Chain, give a candid interview discussing BSC, from its wonderful voice in 2021 to about a of the hardest questions surrounding the chain. Issues lined encompass:

-

how and why BSC grew from 50,000 day to day energetic customers to about 7 million over the path of 2021

-

what differentiates Binance Chain and Binance Shipshape Chain

-

why Binance Shipshape Chain determined to assemble its blockchain with easiest 21 validators

-

how Gwen and Samy envision BSC fitting correct into a multichain future

-

what plans BSC has to scale its throughput

-

why blockchain gaming is so crucial to BSC and how this can employ its $1 billion voice fund to grow the gaming facet of the chain

-

how BSC’s relationship between Binance and BNB works

Within the 2nd half of the imprint, Sam and Gwendolyn respond to about a opinions, honest like:

-

is BSC no doubt innovating, or is it real a duplicate and paste blockchain of Ethereum?

-

-

why are there so many failed transactions on BSC?

-

how is BSC addressing the quite about a hacks on the blockchain?

-

why has BSC’s fragment of complete worth locked amongst neat contract blockchains fallen from 20% in Also can to 6%?

-

how is BSC attempting to help builders, who, in line with some extreme posts, are struggling to work with BSC?

-

why does it appear that some validators are entrance working without possibility?

-

does BSC have a future if Ethereum scales?

-

what does BSC have deliberate for 2022?

-

E book Update

My e-book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now accessible for pre-uncover now.

The e-book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-uncover it this day!

You would also buy it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com