Various of BTC HODLers at a File High

Also can 26, 2021 / Unchained Day-to-day / Laura Shin

Day-to-day Bits ✍️✍️✍️

-

The sequence of long-term BTC holders hit a file high

-

SEC Commissioner Hester Peirce said “crypto may per chance per chance per chance power [the SEC] to preserve out that modernization faster than we otherwise would function.”

-

1confirmation, a crypto VC firm, raised $125 million for its third fund (quit tuned for a podcast on this subsequent week)

-

GameStop is constructing out an NFT platform on Ethereum

-

Galaxy Digital announced the acquisition of asset administration firm Vision Hill Neighborhood

-

Wall Boulevard Bets Redditors are turning their consideration to crypto

-

Dfinity Foundation to present $220 million in funds to attract developers to the Web Computer, an Ethereum competitor

-

JPMorgan charges Coinbase as chubby; sets ticket goal at $371

-

China’s Inside Mongolia proposed eight contemporary measures to stop down crypto mining

- Issuance of a CBDC by the Federal Reserve would “presumably require extra authority,” per Vice Chairman for Supervision Randal Quarles on behalf of the Fed.

What Manufacture You Meme?

To boot to Quarles’s feedback on the Federal Reserve’s authority to undertaking a CBDC, he also confirmed the Fed, OCC, FDIC are taking off a cryptocurrency policy “race,” ethical as Michael Hsu, acting head of the OCC, proposed they would final week.

Sean Tuffy, head of market and regulatory intelligence at Citi, supplied up his diagnosis on what this kind of “race” would deem worship:

*Bonus advise material that comprises crypto’s favourite interviewer, Lily*

What’s Poppin’?

Layer 2 alternatives are poppin’.

The day earlier than this day, Shark Tank “shark,” Mavericks owner, and billionaire investor Stamp Cuban confirmed his investment in Polygon to CoinDesk. Polygon, previously identified as Matic, is a layer 2 protocol constructed on Ethereum as a draw to bundle a lot of scaling alternatives into one plump-stack application. Polygon describes itself as “Ethereum’s Web of Blockchains.”

One in all the significant disorders plaguing Ethereum within the interim is the postulate of scaling. In the mean time, Ethereum can handiest contend with around 15 transactions per second. For context, Visa handles roughly 2,000 transactions per second. Community bottlenecks resulting from Ethereum customers annoying extra block location than is accessible has resulted in high ETH fuel prices for customers.

Polygon and its token (MATIC) are ethical undoubtedly one of many alternatives to scaling Ethereum (be taught here, here, and here for a extra in-depth breakdown of layers 2s, sharding, and roll-ups).

At the same time as you had invested $100 in MATIC ethical one month within the past, you doubtlessly can now be the proud owner of roughly $372 — which will likely be honest correct ample for a 372% originate whereas the leisure of the market dipped around 10% over the the same time length.

Suggested Reads

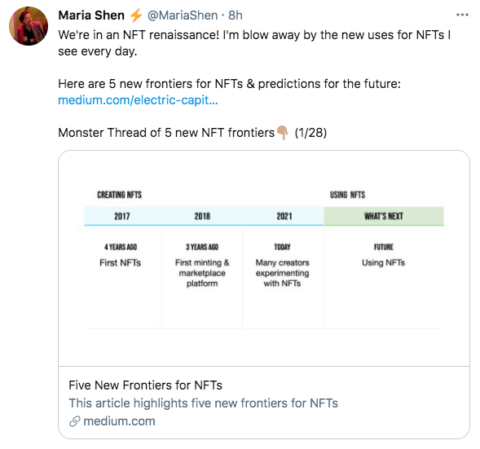

- 5 contemporary NFT expend cases which will pique your interest:

- An tutorial’s point of view on EIP-1559 (an absolute MUST be taught IMO):

- Vitalik on blockchain voting:

On The Pod…

How Solana and Binance Appealing Chain Also can Take Ethereum’s Lead

Kain Warwick, founder of Synthetix, and Kyle Samani, managing accomplice at Multicoin Capital, debate the merits of Ethereum, Solana, and Binance Appealing Chain. On this episode, they roar about:

-

why Ethereum is losing market half to Solana and BSC

-

whether or no longer decentralization issues and at what point decentralization becomes redundant

-

why they mediate Solana and Binance Appealing Chain must be taken seriously as competitors to EThereum

-

whether or no longer BSC or Solana is the higher long-term threat to Ethereum

-

the finest obstacle to Ethereum’s success (and it’s no longer fuel prices)

-

how Ethereum will navigate fragmented Layer 2 alternatives

-

Solana and its lack of developers

-

what differentiates DeFi from CeFi

-

why Solana has an edge on Ethereum by the utilization of composability

-

how Ethereum will onboard contemporary customers

-

why Kain is such an ardent backer of Ethereum

-

why both Kyle and Kain mediate EIP 1559 and the functionality for higher ETH prices is harmful for Ethereum

-

if Synthetix would ever take into consideration launching a defective-chain product

-

the viability of a multi-chain world

-

why Kyle believes the long poke holds a winner-take-most blockchain ecosystem

Book Update

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Good Cryptocurrency Craze, is now accessible for pre-remark now.

The e book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-remark it this day!

That you simply can also aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com