Quantity Hasten Up! But Why?

November 4, 2021 / Unchained Day after day / Laura Shin

Day after day Bits ✍️✍️✍️

-

The interagency “crypto plug” has concluded, says the performing US comptroller.

-

10% of China’s inhabitants has opened a digital yuan pockets.

-

A narrative from JPMorgan reveals that companies would possibly well place $100 billion in unhealthy-border prices if they were to exercise a CBDC.

-

Binance is pondering blacklisting addresses connected with the Squid Sport token.

-

Coinbase customers can now borrow $1 million utilizing bitcoin as collateral; Coinbase can be making an strive out a subscription carrier, Coinbase One, that would possibly well give customers access to aspects like zero-rate trading.

-

Bitcoin mining earnings for October used to be the second-highestever.

-

Crypto lender Celsius acquired GK8, a cybersecurity company, for $115 million.

-

The Commonwealth Financial institution of Australia will quickly provide retail potentialities crypto trading capabilities.

-

Records reveals that people from lower-profits jobs are quitting due to the performance of their crypto investments.

-

BitMEX claims it’s now carbon neutral.

-

Decrease trading volatility would possibly well mean the crypto market is maturing, in protecting with CoinDesk.

-

The EOS Foundation CEO acknowledged that “EOS, because it stands, is a failure” in a speech on Wednesday.

-

Bitcoin mining companies are experiencing delays in receiving instruments due to a world provide chain crisis.

-

A single SHIB holder moved $2.9 billion worth of tokens from their pockets the day before recently.

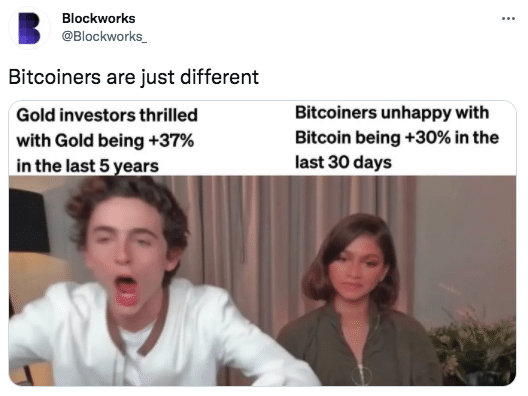

What Attain You Meme?

What’s Poppin’?

The Bull Proceed Spherical-up

The total cryptocurrency market is much less than a 5% lengthen from hitting $3 trillion, in protecting with files from Coin Gecko. For context, as an asset class, crypto used to be much less than $1 trillion on January 1, 2021. Bitcoin, Ethereum, Solana, Polkadot, Shiba Inu, and Terra, or 60% of the atomize 10 tokens by market cap (non-stablecoins), own reached a new all-time excessive in the closing 30 days.

With such an exuberant market, it appears like recently would possibly well be an very just correct time to grab a uncover support and strive to digest the slither of events which own led to essentially the most stylish crypto bull plug.

Bitcoin Futures ETF

The bull market acquired a novel wind when the ProShares’ Bitcoin Approach (BITO), the first SEC-permitted US bitcoin (futures) ETF, began trading on Tuesday, October Nineteenth. Bloomberg’s Eric Balchunas reported that the ETF held over $1 billion after just correct two days of trading, changing into the second-quickest ETF to hit such a landmark — outpacing $GLD. Particularly, Bitcoin hit its all-time excessive, $67,276.79, on BITO’s second day of trading,

While now not a situation bitcoin ETF, the ProShares’ managed futures ETF used to be the first such product to be permitted by the SEC. Ensuing from this truth, Valkyrie and VanEck also launched futures-essentially based mostly ETFs.

Meta Is Upright for the Metaverse

Fb rebranded to Meta closing Friday to be succesful of rebrand the social media huge as a metaverse company. While grand of Meta’s focal point appears to be on augmented and digital actuality merchandise, CEO Model Zuckerberg did hint at NFTs, or digital items, playing a hefty role in Meta’s imaginative and prescient.

Since Meta’s resolution, metaverse-essentially based mostly tokens own exploded in reputation. The Metaverse Index from Index Coop, a DeFi protocol offering tokenized indices, rose 76% correct by the final seven days on the backs of tokens like $SAND, $ILV, $MANA, $AXS, and $ENJ.

Solana — An NFT Pump?

Solana’s native token, $SOL, reached a new all-time excessive the day before recently, breaking across $240 for the first time. In the previous week, $SOL climbed into the atomize five of tokens by market capitalization, flipping Cardano’s $ADA. Solana now has a market cap over $70 billion.

While the clarification for Solana’s jump in label is more difficult to pinpoint, Messari’s Mason Nystrom noted that Solana’s NFT ecosystem has seen “ambitious exclaim,” with total secondary sales reaching $500 million in the previous three months.

The Ethereum Supply Shift

Ethereum hit a new all-time excessive the day before recently above $4,600.

Why? Effectively, as lined on Fb Bulletin, Ethereum changed its provide schedule in August by imposing Ethereum Development Proposal 1559 (EIP-1559), which resulted in a mechanism that burned ETH when community seek data from will enhance over a undeniable stage.

Per files from The Block, Ethereum has actually begun burning more ETH than it considerations. Since October twenty sixth, Ethereum’s earn issuance is roughly destructive 8,900 ETH, or -$3.96 billion. If truth be told, Ethereum is changing correct into a deflationary asset, making ETH more and more scarce with day to day of destructive issuance.

Suggested Reads

- @CroissantEth on NFT exercise conditions:

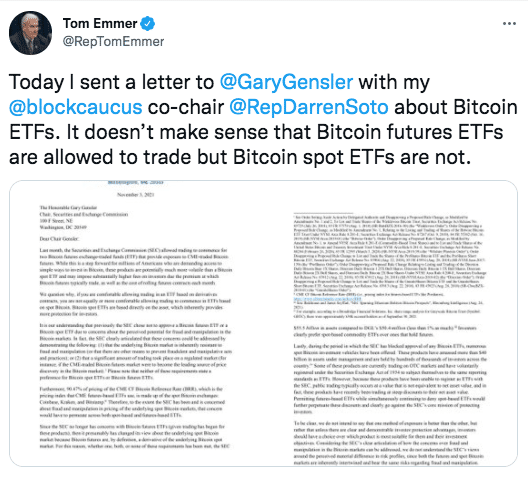

- Handbook Tom Emmer and Handbook Darren Soto on why it doesn’t influence sense for bitcoin futures ETFs to be traded whereas bitcoin situation ETFs are now not:

- Spartan Group’s Jason Choi on getting prosperous in crypto:

On The Pod…

Tor Bair of Secret on Why Non-public Dapper Contracts Are Crucial

Secret Network is a privateness-first, permissionless layer 1 blockchain built for computational privateness. Tor Bair, founder of Secret Foundation, a developer of Secret Network, discusses what makes Secret Network odd, alongside with dapper contract privateness, interior most metadata for NFTs, and how regulators would possibly well just quiet take care of privateness tech in blockchain. Display highlights:

- how Tor fell down the crypto rabbit gap

- what the Secret Network is and how it’s bringing privateness to blockchain

- why public blockchains are problematic

- what makes Secret Network diverse from Monero or Zcash

- how Secret Network works from a technical viewpoint

- what assemble of capabilities Secret Network can strengthen that public blockchains can now not

- why blockchain vote casting is liable to be a terrifying realizing (for now)

- what attack vectors exist regarding Secret Network

- how Secret Network nodes work and why there are most effective 50 of them

- how Secret Network fixes miner extractable worth (MEV)

- what DeFi capabilities are imaginable on Secret Network

- how NFTs on Secret Network are diverse from public blockchain NFTs

- how regulators would possibly well just quiet take care of Secret Network

Guide Replace

My e-book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Mountainous Cryptocurrency Craze, is now on hand for pre-disclose now.

The e-book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-disclose it recently!

You can aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com