Most Ethereum Staking Swimming pools Are The insist of Appropriate One Execution Client, Doubtlessly Growing Risks to the Community

Most Ethereum staking swimming pools insist factual one execution consumer: Amble Ethereum (Geth). As a consequence, some Ethereum enthusiasts like publicly inspired of us to remain away from utilizing Geth for their validator tasks thanks to the aptitude dangers of over-counting on one consumer.

Extra than four-fifths of all validators, which would per chance per chance per chance be to blame of proposing and validating new blocks of transactions to the Ethereum blockchain, insist execution consumer Geth, according to info offered by the crypto analytics web situation clientdiversity.org, which covers about 60% of the total Ethereum community.

Ethereum customers are software implementations of us can acquire to dawdle the Ethereum community. In say to invent its tasks, a single validator on the total runs two customers concurrently to address varied parts of Ethereum — the consensus aspect and the execution aspect.

Nethermind, the 2nd-largest execution consumer for Ethereum running on about 8% of validators encountered a bug yesterday, Ethereum core developer Łukasz Rozmej acknowledged on X. The bug, which has since been resolved, has sparked a conversation just a few hypothetical bug impacting Geth.

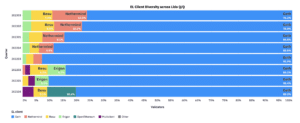

Whereas the consensus aspect has seen its consumer selection enhance, execution consumer selection on Ethereum is ragged. Particularly, the next Ethereum staking swimming pools and carrier platforms — per execution-selection.info — likely insist Geth as their finest execution consumer for their validator tasks: Allnodes, Ankr, Blox Staking, Binance, Bitcoin Suisse, Bitfinex, Coinbase, Kraken, and Stakefish.

As smartly as, Lido, the largest liquid staking platform with bigger than 9 million ETH staked, has linked over three-quarters of its validators to Geth as smartly.

A ‘Supermajority Client’

Vitalik Buterin, Ethereum’s co-founder, designed Ethereum to work on varied software customers, no longer factual one, so that a bug affecting a single consumer wouldn’t adversely affect your total blockchain.

On the opposite hand, Geth is taken into account a “supermajority consumer.” As such, validators that dawdle Geth just like the functionality to finalize the Ethereum blockchain without agreement from validators running varied software customers, comparable to Nethermind, Besu, and Erigon. This has the aptitude for disastrous outcomes comparable to a community split, loss of funds, and reputational damage to Ethereum.

“Must Amble-Ethereum, likely to be the majority execution consumer after the Merge, originate an invalid block, it could per chance per chance per chance in finding finalized and thus cause the catastrophic failure described in scenario 3,” wrote Ethereum researcher Dankrad Feist in a 2022 blog post. Scenario three entails a hypothetical utter the keep a consumer with bigger than two-thirds of the stake has a bug in its software and entails an invalid block to the Ethereum blockchain.

Validators running a minority consumer would finest lose a little amount of rewards for having a bug, whereas the associated rate of getting a bug for validators running a supermajority consumer could per chance be huge.

“Counterintuitively: staking with a minority consumer bears considerably much less risk – these stricken by the contemporary Nethermind bug hardly ever misplaced the rewards of one to 2 days. Being on the contaminated aspect as piece of a majority, alternatively, can lead to significant loss of stake,” wrote co-founding father of Gnosis Chain Martin Köppelmann on X on Monday.

Within the meantime, Lefteris Karapetsas, the founding father of portfolio tracker Rotkiapp, great on X that “In case of a supermajority Ethereum consumer bug that outcomes in total loss of the stake of these stakers for the time being this would per chance burn > ~20% of the total ETH provide.”

Lido did not at the moment reply to Unchained’s search info from for comment.

On Monday night, Coinbase announced on X its purpose of in conjunction with an further execution consumer in its validator infrastructure, after the Ethereum community expressed concerns about Coinbase’s single consumer staking steup revolving around Geth.

The biggest publicly traded crypto replace in the U.S. acknowledged it relied fully on Geth for validation because of the it used to be the appropriate execution consumer that met the firm’s technical requirements. However Coinbase acknowledged it is begin to replace.

“Though we’ve evaluated execution customers since 2020, none like met Coinbase Cloud’s requirements up to now,” wrote Coinbase on X. “Many varied operators on the community like reached the the same conclusion, which is piece of the clarification why 84% of Ethereum validators dawdle Geth. On the opposite hand, the tide is turning.”

Coinbase is for the time being assessing different execution customers, and acknowledged it could per chance per chance per chance share their subsequent steps by the close of February.

UPDATE (January 23, 2:00 pm. ET): Up up to now with crucial functions of Coinbase’s announcement.

Source credit : unchainedcrypto.com