MicroStrategy Has Nothing on Satoshi

November 30, 2021 / Unchained Day by day / Laura Shin

Day by day Bits ✍️✍️✍️

-

Twitter CEO Jack Dorsey is stepping down and shall be changed by CTO Parag Agrawal.

-

Digital asset funds experienced a $306 million influx for the week ending November 26.

-

Hivemind Captial Companions, a VC fund headed by a former Citi exec, equipped a $1.5 billion fund to take a position in blockchain and digital asset ecosystems.

-

The Federal Reserve Bank of Unique York launched a novel be taught soar to examine fintech skills, similar to CBDCs.

-

Invesco, an investment firm with $1.3 trillion in AUM, has partnered with CoinShares and can free up a European ETP backed by physical BTC.

-

Galaxy Digital is selling $500 million in exchangeable senior notes to steal cash to flee up enhance initiatives across its alternate traces.

-

Kelly Strategic Administration filed with the SEC for an ether futures ETF.

-

Artist Damien Hirst airdropped a series of 10,000 NFTs depicting the quilt art he created for Drake’s most modern album.

-

The Bank of Israel is accelerating its be taught on issuing a digital shekel; Tanzania plans to initiating a CBDC.

-

Kraken will list SHIB on November 30th.

-

Budweiser released a series of 1,936 Ethereum NFTs the day gone by.

-

Binance has resumed Dogecoin withdrawals after a 17-day lengthen.

-

AMC and Sony partnered to fall a line of NFTs as rewards for the come purchase of tickets to the upcoming Spider-Man “Now Manner Dwelling” film.

What Get You Meme?

What’s Poppin’?

MicroStrategy Stacks More Sats

The gadget company MicroStrategy equipped the purchase of seven,002 Bitcoin for roughly $414.4 million in cash at a median price of $59,187.

With its most modern purchase, MicroStrategy holds 121,044 bitcoins, or about .57% of the complete provision of Bitcoin. The firm’s Bitcoin used to be bought at an combination price of $3.57 billion — leaving MicroStrategy with a median BTC purchase price of correct beneath $30,000. At unusual costs, MicroStrategy has with regards to doubled its complete investment in BTC.

To place that quantity in standpoint…

- If MicroStrategy had been to take care of all 121,044 bitcoins in a single pockets, it could be the third-greatest BTC holder in existence, in conserving with recordsdata from BitInfoCharts.

- MicroStrategy holds nearly three times the amount of Bitcoin as Tesla, which owns 42,902 bitcoins and is the second-greatest public holder of BTC, in conserving with recordsdata from Buy Bitcoin Worldwide.

Notably, whereas MicroStrategy is a whale, its Bitcoin holdings quiet light in comparison to Bitcoin’s creator, Satoshi Nakamoto. Even after investing over $3 billion into Bitcoin, MicroStrategy barely holds 1/Tenth the amount of Bitcoin time and again associatedwith Satoshi, who seemingly mined roughy 1 million bitcoins support within the early days of the protocol.

While the gadget firm is up now now not lower than $3 billion on its Bitcoin investment, the interrogate quiet looms about what would happen if the price of bitcoin crashes in due course — as MicroStrategy’s beefy BTC wager is mostly fueled by purchases backed by $2 billion in loans. As reported by The Block, some observers speculate that if BTC had been to fall, as it is a ways identified to complete every as soon as rapidly, MicroStrategy would possibly well strive towards to repay its debt.

Suggested Reads

- I wrote two articles on what offers bitcoin and ETH price — beefy to section with inexperienced persons:

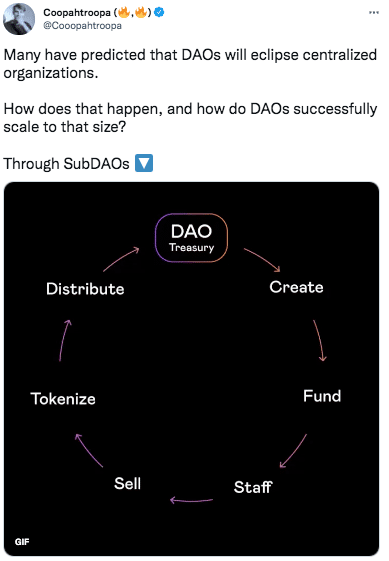

- Variant Fund’s Cooper Turley on scaling DAOs:

- Galaxy Digital on the price to mine a single Bitcoin:

On The Pod…

Will Solana Be the Execution Layer and Ethereum the Settlement Layer?

On Unchained, two co-founders of Solana Labs, Anatoly Yakovenko and Raj Gokal, dive deeply into the Solana ecosystem, discussing every part from the price of SOL to the Solana network outage to the competitors between Ethereum and Solana. Demonstrate highlights:

-

- why Raj thinks SOL’s market cap grew from $86 million to $68 billion in lower than a year

- Anatoly’s and Raj’s background and how they stumbled on themselves working collectively to construct Solana

- why Anatoly thinks Solana will seemingly be a standard-cause blockchain as a substitute of that specialize in gaming or excessive frequency procuring and selling

- Anatoly’s goal to keep Solana the famous billion-user blockchain

- why Raj thinks NFTs on Solana were so new

- why, within the opinion of Raj and Anatoly, Solana’s cause has shifted a ways off from excessive-frequency procuring and selling

- how NFTs would possibly well change ads

- why “every part is DeFi”

- how Solana Labs plans to allocate the unusual $314 million funding spherical it raised

- what lessons Anatoly realized from the 18-hour September network outage

- technically talking, what took station to construct off Solana’s network outage

- why Anatoly believes that outages, at this stage, aren’t necessarily a injurious thing

- whether “procuring and selling mercenaries” dominated at Solana Breakpoint

- why builders are angry about building on Solana

- how Solana and Ethereum review as execution and settlement layers

- why Raj doesn’t bask in framing competitors between Solana and Ethereum as a fight

- how Anatoly views the competitors between Ethereum and Solana

- whether the arrival of Neon Labs, which is bringing EVM to Solana, would possibly well lead to builders leaving Ethereum

- how NFTs and Phantom wallets are bringing in unique customers for Solana

- whether Raj and Anatoly would roll support Solana if something bask in Ethereum’s DAO hack had been to happen

- why Solana has the competitive advantage in throughput, in conserving with Anatoly

- what would happen if FTX cofounder and CEO Sam Bankman-Fried gave up on Solana

- their predictions for Solana 5 years from now

Book Update

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Sizable Cryptocurrency Craze, is now readily accessible for pre-allege now.

The e book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-allege it right this moment time!

You’re going to be in a station to purchase it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com